In recent years, the energy landscape has shifted dramatically, with electricity capturing an increasingly significant share of global energy consumption. This transition is driven by the rapid adoption of electric vehicles, heat pumps, induction stoves, and a growing array of electric industrial applications replacing traditional fossil fuel solutions. More recently, large data centres requiring considerable amounts of electricity have made headlines and we expect to see a noticeable impact on electricity consumption in the coming years, first in the US and then in Europe.

For investors, the implications are profound. Accelerating electricity demand is reshaping the energy sector, raising the prospect of a new kind of energy major. Traditional allocations that focus on fossil fuels risk missing this structural trend. We believe that investors will need to think differently about their energy exposure to capture the next era of growth.

From consumption to capitalisation: electricity is gaining ground

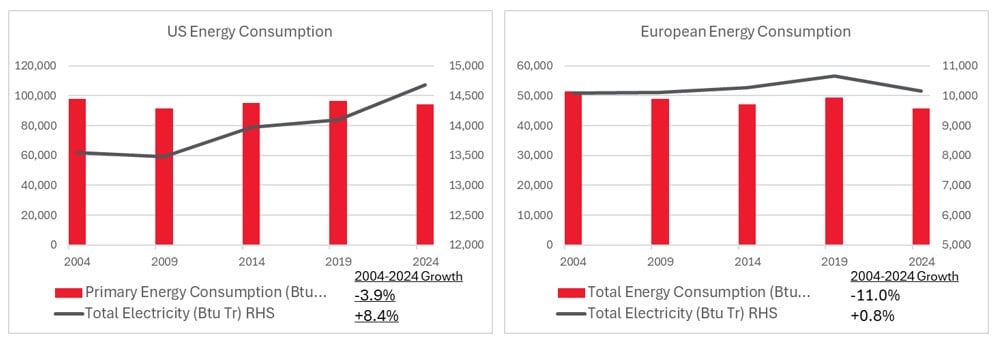

As illustrated in Chart 1, both the US and Europe have experienced a decline in total energy consumption over the past two decades—a testament to advances in energy efficiency. Notably, electricity demand has grown and consistently outperformed overall energy consumption.

Paradoxically, given the respective energy resources and political environments, we note the contrast between these regions. Since 2004, the US has seen robust electrification while Europe has recorded flattish electricity consumption due to a substantial reduction in the overall energy intensity of the European economy.

Chart 1: Energy and electricity consumption

Despite these differences, Europe remains ahead in electrification, with 22.2% of its energy sourced from electricity compared to 15.6% in the US [1]. However, the US is poised to close this gap, propelled by rapid expansion in energy-intensive data centres, onshoring and rising penetration of electric and hybrid vehicles from a low base.

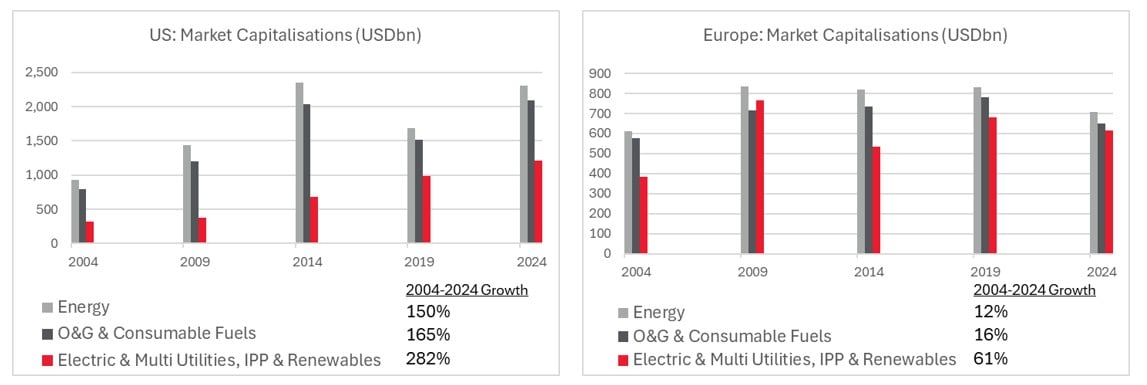

This evolving landscape is reflected in the financial markets. Over the same 20-year period, market capitalisation growth of traditional energy stocks—particularly oil and gas—has significantly lagged behind their electric peers, both in the US and Europe – Chart 2 below.

Chart 2: Market capitalisations by region and sub-sector

Importantly, as at the end of 2024, the market capitalisation of the electricity sector (defined as Electric and Multi utilities as well as independent power producers (IPP) and Renewables companies) is about half that of the energy sector in the US, which reflects the lower share of electrification. But Europe shows the direction of travel with higher electrification translating into the electricity sector capitalisation nearly on par with the energy complex. We can therefore expect the US electricity sector to see an increase in market capitalisation over the coming years.

Looking at the next decade, we expect the same trend to continue: a declining share of fossil fuels and a rising share of electricity in energy consumption. This should see electricity companies capture a larger share of market capitalisation in absolute terms and/or at the expense of energy companies. As such, we believe that investors should look at their overall energy allocation including fossil fuels but also electric utilities, IPPs and renewables developers/operators, and overweight the electricity bucket in their portfolios.

To put it another way, as the transition gathers pace, it is entirely plausible that the energy and electricity sectors will merge to become one single sector index, with significant implications for investors. Today, both are somewhat small at 3% and 2.3% of the S&P500, respectively [2]. Combined, they would naturally attract greater attention and higher flows, creating compelling alpha opportunities for both allocators and stock pickers. Portfolios tilted toward electricity-focused companies would be well positioned to capture this structural shift.

The dawn of electricity majors

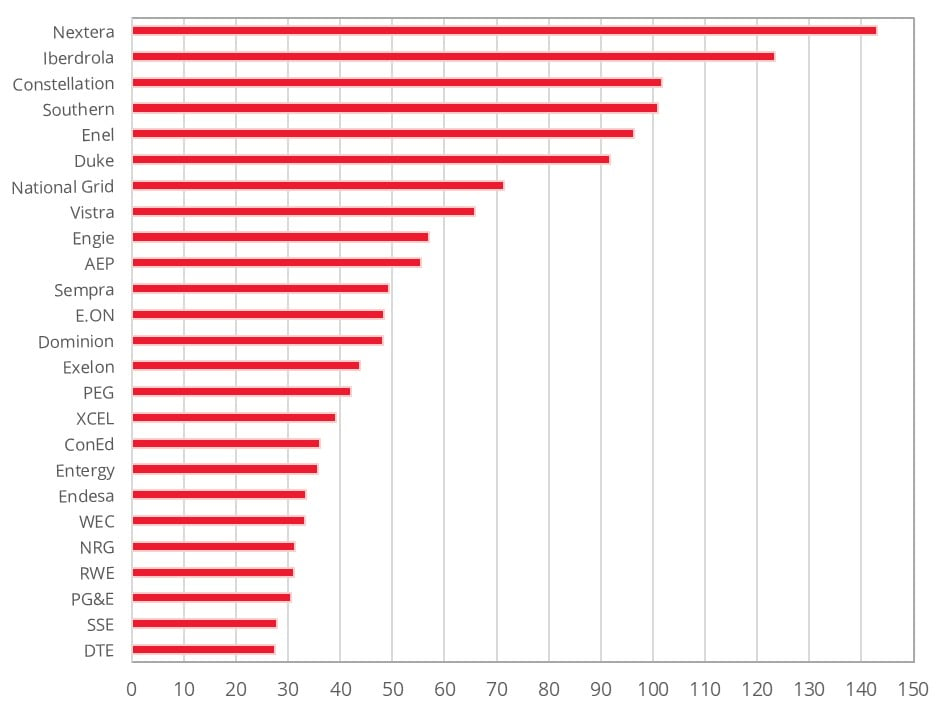

A closer look at sector performance from 2004 to 2024 reveals a telling dynamic: as US energy consumption declined, the five largest energy companies by market capitalisation grew at only half the pace of the sector, while the top five electricity companies outpaced their sector’s average [3]. This suggests that in a shrinking sector, large incumbents can act as a drag on investment performance, whereas in a growing sector, they become engines of growth.

Moreover, another notable trend is the higher concentration of market capitalisation within the energy sector: the top five companies account for 43% of the US total and 72% in Europe, compared to 37% and 47% respectively in the electricity sector. As of the end of 2024, only one electricity company in the US and Europe boasted a market cap above USD 100 billion, Nextera, versus five in the energy sector3. With electricity demand growth, recent M&A activity and ongoing consolidation, we expect the emergence of electricity majors—large, diversified leaders poised to define the next era of energy.

Historically, US energy companies have operated nationwide or globally and European energy companies, across the European continent and beyond, hence they had an easier route to develop into majors. However, for reasons of economic nationalism or regulation, electricity companies tended to operate at the state, multi-state or independent system operator (ISO) level in the US and country level in Europe. We believe that the migration to more intermittent sources of electricity (wind and solar) and the need for much greater resilience in electricity networks will accelerate the creation of nationwide and continentwide operators.

Nextera was a leader in that respect, starting with a best-in-class utility business in Florida and then creating the largest US renewables developer and operator. It is therefore no surprise that Nextera is the largest electricity company in the US (see Chart 3). More recently, Constellation has emerged as a US major on the back of the nuclear renaissance but also after announcing the acquisition of Calpine to extend and strengthen its presence in Western, Texas and Northeast markets. Southern and Duke also have a significant market cap. In Europe, Iberdrola and to a lesser extend Enel can be considered as majors given their mix of business and international reach.

Chart 3: Top 25 US and European electricity companies by market capitalisation

We believe that Dominion and E.ON have a high potential of becoming future regional majors with the likes of SSE, RWE, EDP, Brookfield and Engie likely to scale up over the next few years and become next-tier (regional) majors.

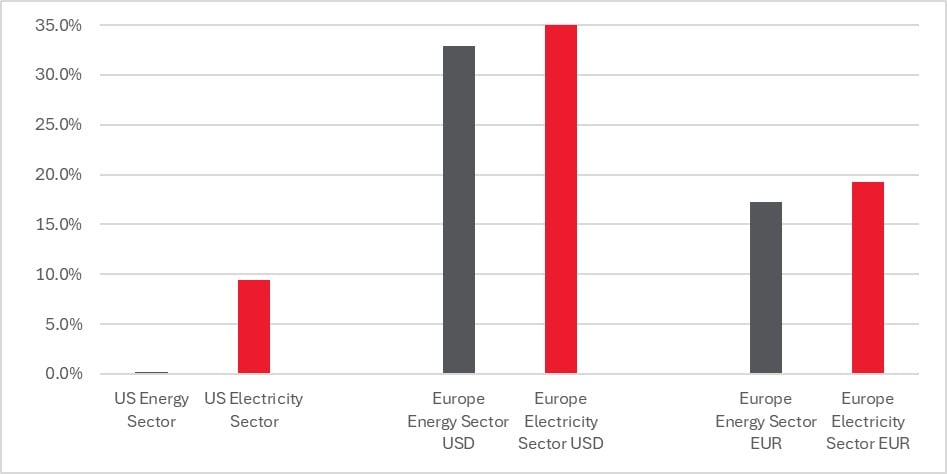

Advantage electricity so far in 2025

The electricity sector performed strongly in the first half of the year and outperformed the energy sector, both in the US and Europe (see Chart 4).

We believe that the strong trends in electrification, such as the high growth in electric and hybrid cars sales in Europe and numerous announcements of new electricity-hungry data centres by the hyperscalers in the US, have been and will remain key drivers of long-term investment performance. As such, the underlying case for electricity has been able to overcome regulatory uncertainties in a context of reasonably stable interest rates.

Chart 4: Energy vs electricity sector performance, H1 2025

Repositioning for an electric future

The electrification of energy is set to reshape the energy industry landscape. When investors think about their energy exposure, they should think about electricity companies as integral to that investment universe. And in that context, investors should prioritise electricity exposure, as underlying consumption growth and sector consolidation are likely to drive market capitalisation and foster the rise of new electricity majors and regional/next-tier majors.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

Sources:

[1] EIA, IEA. 2024

[2] Bloomberg, December 2024

[3] Bloomberg, December 2024