Executive summary

- Health care valuations have not been this attractive since the financial crisis, in our view.

- The reasons for health care underperformance are explainable and likely to be transient.

- This creates a significant opportunity for investors because health care companies are expected to show higher earnings growth than the broader market in the short term and accelerating demographic changes set the sector up for long-term demand growth.

- We believe the companies that will benefit most, and that investors should seek, are those with solutions that have the most life changing impact on patients.

Historic lows belie strong fundamentals

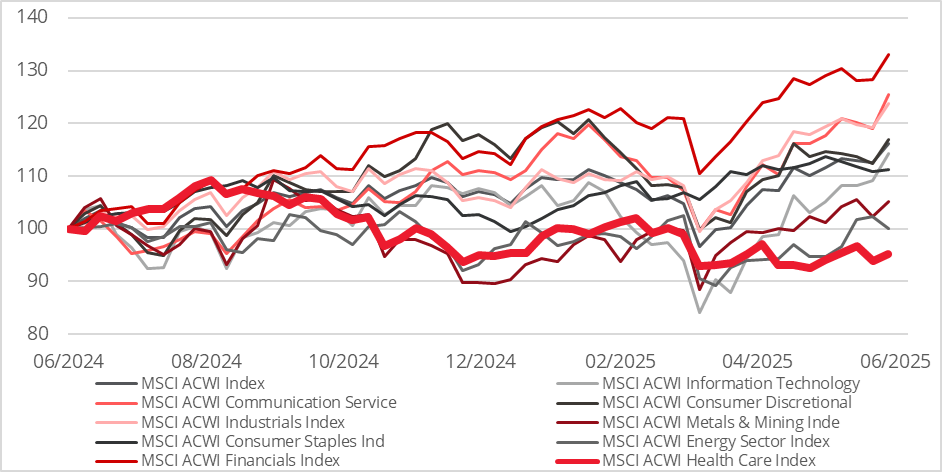

The health care sector has underperformed versus all key sectors and the broader market over the last year.

Chart 1: MSCI ACWI Health care – 1-year relative performance

Relative to the broader index, health care stock valuations are the most attractive they’ve been since the aftermath of the financial crisis – see Chart 2.

Chart 2: MSCI ACWI Health care – Relative P/E valuations since the GFC

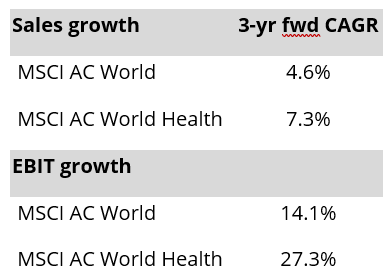

Health care stocks have become cheaper yet are expected to show higher aggregate revenue and profit growth than the broader market over the next three years.

Furthermore, the last time valuations were this cheap, health care went on to outperform the broader market in five of the next six years.

Why has health care underperformed?

We believe sector underperformance is the result of a confluence of three transient factors:

- Political risks: The new US administration has made some provocative moves. President Trump selected pharma-industry sceptic Robert F Kennedy Jr. as his Health Secretary, threatened pharma with industry specific tariffs and is attempting to introduce US price controls for pharmaceuticals.

- Higher US interest rates have negatively impacted sentiment for growth stocks such as biotech.

- High-profile, stock-specific concerns: Generalist investor interest in the sector may have taken a knock from the high-profile meltdowns of United Health and Novo Nordisk’s stock prices. Both stocks are down more than 50% from their high points over the last year. United Health, the world’s largest health insurer, saw its share price fall substantially after management downgraded its outlook for the company just as many investors were looking for “safe havens” from US tariff risks[1]

Similarly, Novo Nordisk has suffered from waning investor euphoria for the GLP-1 weight loss drug trend. As we saw in the tech sector when DeepSeek cast a gloom over the AI trade[2], when a high-profile trend stops working, it can temporarily cast negative sentiment over a whole sector.

What could get health care stocks performing again?

The number one thing the sector needs is clarity on the regulatory and policy environment in the US, and we think this will come with time. Markets hate uncertainty and tend to assume worst case outcomes, but we believe that key policy decisions will be less severe than expected, catalysing improved sentiment.

Many investors are nervous that Health Secretary RFK Jr. could delay or disrupt approvals of new drugs and medical devices for patients. However, the head of the US drug regulator, Martin Makary M.D. has very publicly stated he wants to speed up drug approvals. He wrote in a US medical journal that the US Food and Drug Administration (FDA) could conduct “rapid or instant reviews” versus traditional reviews that take about ten months[3].

So far, activity at the FDA has shown no signs of disruption. The FDA had approved 13 new drugs by the end of May 2025, similar to the 16 new drugs approved as the same point last year. We believe that as investors get comfortable with the new administration’s policy direction and see that the FDA continues to approve new treatments for patients, confidence in health care stocks will return.

Declining interest rates could also help the sector, particularly higher growth segments of the market, such as biotech. Declining rates could make the potential returns offered by biotech more attractive and encourage more mergers and acquisition activity by large cap pharma that needs to secure future revenue growth through new drug launches.

What’s the long-term outlook?

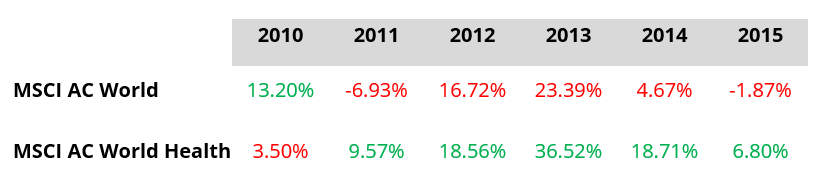

Investors should appreciate that the long-term demand drivers of health care remain. In particular, global populations are ageing and people typically consume more health care as they age. As a result, between now and 2050, health care spending is expected to grow faster than global GDP. Over time we believe this could drive above average returns in health care stocks and with valuations where they are today, investors could see significant returns if they focus on the right stocks.

Chart 3: Health care spending by country and age group in 2015

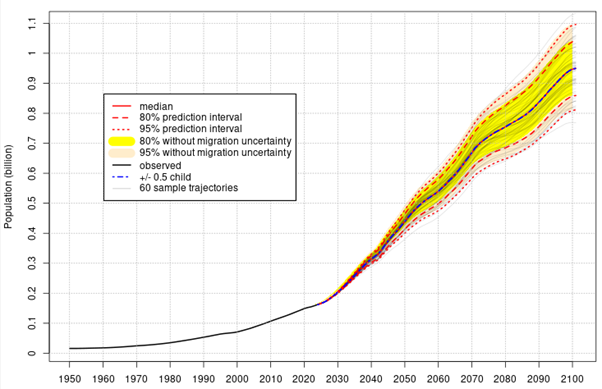

Chart 4: Projected global increase of people over 80 years

The most life changing solutions should experience the best growth

We believe that health care investors can gain greater exposure to long-term growth, more durable profit margins, and better insulation from political risks by focusing exclusively on the most life changing solutions for patients. Our conviction is that solutions with the greatest impact on patient outcomes are more likely to be commercially successful. Moreover, by aligning investments with what matters most to patients, investors can better shield themselves from political uncertainties as policymakers tend to prioritise policies that sustain or improve population health. In short, focusing on solutions that deliver more for patients should deliver more for investors.

In our Life Changing Treatments strategy we define solutions in one of three ways:

- Life changing drugs that are changing medical practice now or in the future.

- Health system strengthening solutions that improve patients’ access to health care, for example through better diagnosis.

- Life changing care solutions include medical devices, helping deliver care more efficiently and where the patient wants to receive it.

For us, Soleno Therapeutics’s recently approved drug, Vykat XR, for rare disease Prader-Willi Syndrome (PWS) is a prime example of a life changing drug. We believe clinical trial results show the drug offers a strong benefit/risk profile for patients. PWS has a devastating impact on patients and caregivers but had no approved treatments before this year. We think Vykat XR has a strong positive impact on a high unmet need, so we believe demand for the drug will be high and deliver results for patients and investors.

Similarly, we have previously written about the opportunity in blood tests for cancer. Despite medical advances, cancer continues to put a huge burden on patients and health systems, and a patient’s cancer may still progress despite a physician’s best efforts. Detecting progression earlier could transform outcomes for patients and evidence presented at the recent ASCO conference[4] showed blood-based testing could identify recurrence of cancer nine months before it shows up on traditional scans, allowing physicians to switch therapy and benefit patients sooner. We identify cancer diagnostic companies such as Guardant Health and Exact Sciences and pharma companies incorporating blood testing into clinical trials, such as AstraZeneca, as being well positioned to benefit in this space.

A compelling case for a rerating from here

In our opinion, health care valuations haven’t been this attractive since the financial crisis. The reasons for health care underperformance are explainable but likely to be transient. This creates a significant opportunity for investors because health care companies are expected to show higher earnings growth than the broader market in the short term and accelerating demographic changes set the sector up for long-term demand growth. We believe the companies that will benefit most, and that investors should seek, are those with solutions that have the most life changing impact on patients.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

Sources:

[1] Bloomberg Law, April 2025

[2] Reuters, January 2025

[4] 2025 ASCO (American Society of Clinical Oncology) Annual Meeting, 30 May to 3 June