In 2022, Convertible Bonds (CBs) experienced difficulties which we now believe are broadly reversing. Analysing the drivers of recent strong performance in the asset class, we are encouraged by these dynamics. We think convertible bonds can play a helpful role in a portfolio, potentially providing strong tailwinds to returns. Here are 6 reasons why:

Effects of the interest rate environment

Rates have been rising since the second quarter of 2022, however the landscape has now changed, with rates now looking to stabilise:

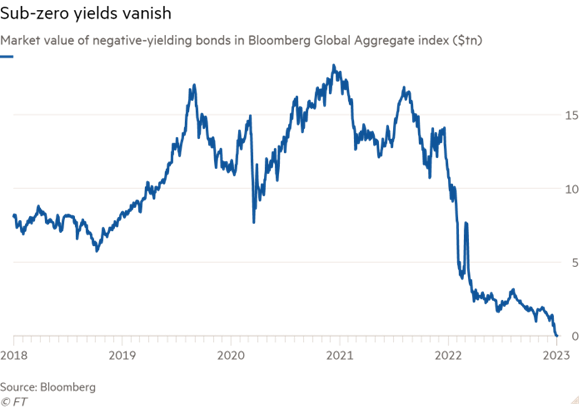

• Negative yielding debt appears to be a thing of the past

Source: Bloomberg, as at 31st December 2022

Past performance is not a guide to future results. The information shown above is for illustrative purposes.

• The bond component of CBs has upside from duration if inflation subsides and the monetary cycle becomes dovish, while remaining low in absolute terms if rates move higher (albeit in a more measured pace vs 2022)

• In stark contrast to last year, we believe the correlation between stocks and bonds will revert to being negative, becoming a tailwind to risk-adjusted returns for the equity option and fixed-income profile provided by a convertible bond

Convertible universe has improved – yields are back

• New issuance dynamics are favourable from the issuer perspective due to coupon savings to companies vs straight debt, potentially providing a better alternative to equity issuance

• New issues are carrying coupons of 3% on average (observed across December 2022 and January 2023 thus far ) which is a stark change from a decade of zero to negative yields, providing a second source of return along with equity optionality [1]

• We are already seeing a pick-up in issuance (c. $6bn across December 2022 and January 2023 thus far ) and expect it to continue

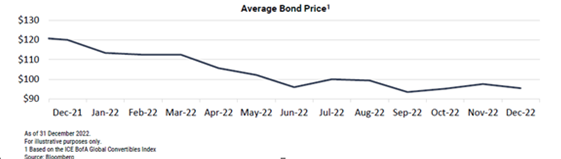

Source: Bloomberg, as at 31st December 2022

Past performance is not a guide to future results. The information shown above is for illustrative purposes.

• The secondary market is now also offering positive yields and convexity, with many CBs now in the balanced, mid-delta range and trading at or below par [2]

Equity exposure

• After a difficult 2022 for equities – which impacted CBs – we think that 2023 is likely to remain volatile, given the higher interest rate environment

• During volatile periods, convertible bonds tend to participate and protect well vs equities. Given our view of equities decorrelating with fixed income and a rate environment which is less hawkish, we feel that capital preservation will be strong with bond floors offering significant benefit

Exposure to growth sectors

• Growth stock valuations have arguably normalised and can be seen as attractive entry points for the next up cycle. A high percentage of the growth universe is well capitalised and with relatively low credit risk. Growth was a sectoral headwind during 2022, but we have seen strong performance during the first month of the 2023

• Many of these convertibles from growth-focused issuers are now offering a very balanced profile and, in most cases, provide positive yields. If growth continues to perform well, convertibles can offer a good way to capture risk-adjusted returns, given the positive yield dynamic and proximity to floor provided by these convertible bonds

• There is a paid-to- wait dynamic for much longer-term optionality, which makes investing in the sector via convertibles particularly attractive

Valuations

• We are starting to see some attractive valuations across the asset class, after systemic cheapening during 2022, partly due to spreads widening and some outflows from the asset class

• We believe the CB valuation environment offers not only great timing to participate but an enhanced risk/reward dynamic, due to the proximity to bond floors combined with a good level of participation if equities were to rally

Idiosyncratic

• Given increased volatility and dislocations across markets, we are seeing a significant increase in the number of issuer buy-backs and expect M&A activity to continue

• Takeover ratchets are a particularly appealing feature of the asset class for example Cellnex Telecom which is currently rumoured to be potentially subject to a take-private offer. We hold the 2026 maturity 1.5% convertible bond; based on a takeover at a 30% premium 3 months out, the current takeover premium would be in the region of 50% [3]

Sources:

[1] Bloomberg, Redwheel as at 24th January 2023

[2] Bloomberg, as at 24th January 2023

[3] Bloomberg, Redwheel as at 24th January 2023

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.