Digging metals out of the ground is the antithesis of sustainability and the circular economy. Yet it must be done to transition to a sustainable, low carbon world. Recycling can somewhat shift the sector away from a linear economy, for example recycled copper accounts for one-fifth of total copper demand, but it won’t get us to the supply needed to align our energy system with the Paris Agreement.

In such a ‘sustainability’ challenged sector, how should investors assess ESG risks and how might a sustainability focused investor justify a position in the sector?

ESG risks that may immediately spring to mind likely include carbon emissions (it is an energy intensive industry) and environmental problems including water, waste and tailing dam risks. However, often the greatest risks are under the social and governance banners; health and safety, community relations, labour, human rights, resource nationalism, bribery and corruption. It should be a central case study in any ESG 101 course!

Justification

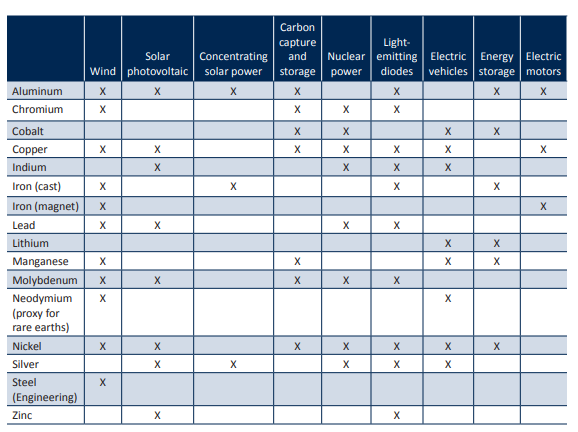

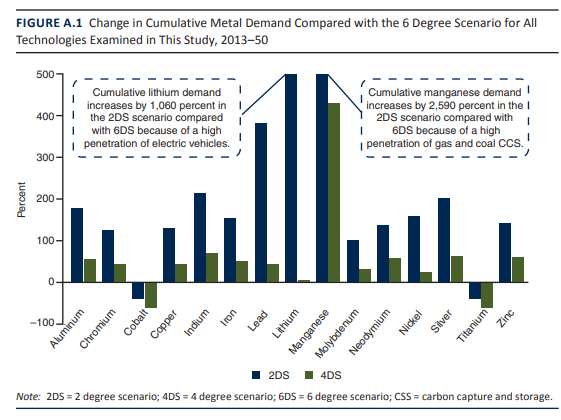

If focused on supporting the energy transition and wondering what metals might be acceptable for a sustainable mandate, it is key to understand the role that various metals play. The World Bank published a report in 2017 that is a very useful guide for this exercise. Figure 1 illustrates where each metal is used within wind, solar, carbon capture and storage, nuclear power, electric vehicles, energy storage and electric motors. Figure 2 gives a feel for the change in demand in these metals to reach a 2-degree scenario. Copper is much mentioned as a leading transition metal, driven by demand from electric vehicles (EVs), the electricity grid and renewables. It also benefits from low carbon intensity of production. Lithium is the preferred material in EV batteries, while it is estimated that committed supply and capacity expansions account for only 15% of demand growth between 2020 to 2050 required to support EV rollout. Many other transition metals are required, as illustrated.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

Assessment

If an investor is comfortable with the metal, the other risks mentioned should be fully assessed. Top level mining companies should be in compliance with global norms, such as the UN Global Compact and UN Guiding Principles on Business and Human Rights as well as the OECD Guidelines for Multinational Enterprises. Behaviour and ethical standards in this sector are more fundamental to managing risk than most sectors.

Understanding exposure to and assessment of other risks may lean on the Sustainability Accounting Standards Board (SASB) Materiality Map, an individual company’s own assessment, along with ESG rating agencies, broker research and non-profit organisations. The collapse in 2019 of a tailings dam in Brumadinho, Brazil, killing at least 259 people, prompted the Church of England Pensions Board and the Swedish National Pension Funds’ Council on Ethics to launch the Global Tailings Portal. The collaboration aims to improve disclosure, safety and risk management, while investors can access the data on individual mining companies for free. Other non-profit organisations aim to inform investors on further risks, including the World Benchmarking Alliance’s CHRB index on human rights.

Company disclosures, particularly for large cap stocks, are improving and allow for assessment on emissions, health and safety, and water management.

On greenhouse gases, some mining companies are only waking up to their scope 3 emissions, they trail the energy sector on taking responsibility and on setting meaningful targets.

Engagement

In September BHP reiterated a 30% cut in scope 1 and 2 emissions by 2030, while enhancing their scope 3 net zero by 2050 target, the latter heavily caveated. Glass Lewis have recommended that shareholders vote against the company’s plans at this year’s AGM. ISS have demonstrated how difficult these decisions are, by recommending both for and against… depending on how concerned you are as a shareholder about sustainability!

In early October the Fortescue Metals Group upped the ante on peers by declaring it would be net zero on scope 3 by 2040.

Rio Tinto responded later in October with updated scope 1 and 2 emission targets, raising ambitions from 15% to a 50% cut in absolute emissions by 2030. They announced a significant capital expenditure plan to meet the aggressive new target. On scope 3 the company is focused on reducing carbon intensity of steelmaking and reducing emissions from shipping. Again, like BHP, somewhat fudging on scope 3.

This is a sector where shareholders should be deeply engaged with company management and very open to collaboration with other shareholders to ensure good behaviour and to demand proper transition plans.

Remain involved

Like the energy sector, this is a race to net zero in materials. In a resource sector, be it fossil fuels or materials, it is sometimes not enough to be above average, a company must be seen to be leading, to be best in class, so as to attract capital from less receptive, more climate-change aware investors.

In the end, the portfolio manager must decide if the risks are worth taking. Starting with an attractive valuation, attributes such as: strong corporate governance; a large cap stock with a strong balance sheet; diversified by region, while avoiding conflict areas; with a portfolio containing a large exposure to transition metals, will help to mitigate risks and offer the potential for attractive returns.

Sometimes it may feel easier to pass, but therein lies the opportunity for an investor as many others will take that pass. It is also the irony of the energy transition, which requires companies to keep digging and sustainable investors to keep supporting them, to get to the end goal of a decarbonised energy system.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

Unless otherwise stated, all opinions within this document are those of the RWC UK Value & Income team, as at 27th October 2021.