Asia emerged out of Covid-19 stronger. Early signs of recovery were evident from rising industrial production and retail sales while mobility recovered close to pre-Covid levels in late 2020. We see this momentum accelerating throughout the rest of 2021 as the global economy recovers supported by re-openings and positive vaccine developments. Asia’s aggregate manufacturing rose to a five-month high, led by India and ASEAN where Covid restrictions eased further in the month of October and mobility has improved. Both production and new orders sub-indices drove the recovery in PMIs for these economies. Overall, six out of nine economies showed an improvement in their headline PMI vs. September 2021 and eight out of nine economies now have PMI readings in expansion territory. Production and new orders improved in six out of nine economies.

Going forward, South Korea and Taiwan should see a continued economic rebound led by export growth on the back of robust demand for technology hardware. For India, capex and productivity growth will take the lead as the key drivers of growth in this cycle, just as they did in 2003-07. This will allow strong rates of growth while keeping macro stability risks at bay. In the ASEAN region, we believe these economies will benefit from supply chain diversification away from China, robust FDI flows and the recovery of global travel. We have identified several themes within Asia ex China that will likely outperform including Technology Disruption, 5G, EM Travel and Supply Chain Diversification.

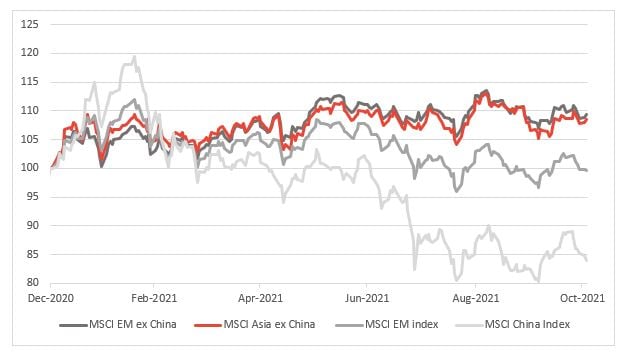

Chart 1: Asia ex China performance in line with MSCI EM ex China

The names shown above are for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

Technology Disruption

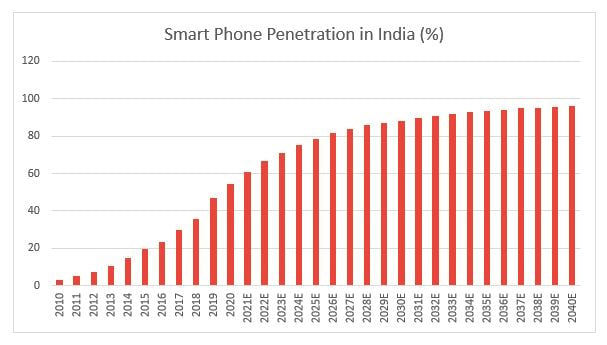

The rising penetration of internet connectivity and smartphones in emerging markets has led to solid demand for new phones and additional data. In India, Reliance’s telecom subsidiary, Jio, has garnered a large number of paying subscribers. Service quality perceptions continue to improve. Data demand appears to be sticky, and relatively less price sensitive. We expect Reliance to continue to benefit from the relatively low smart phone penetration in India. Additonally, as part of the company’s goal to achieve net zero emissions by 2035, Reliance should benefit from government incentives to promote domestic manufacturing capabilities of green energy.

Chart 2: Smart Phone Penetration in India

Estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

5G

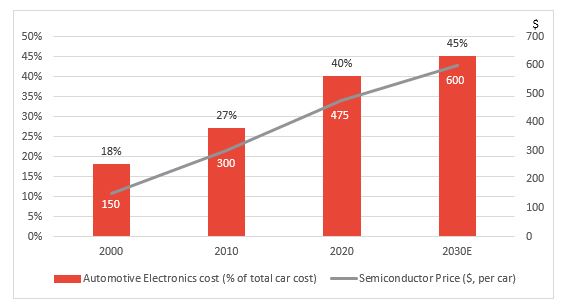

One trend that we are seeing is that the Covid-19 pandemic and the subsequent global economic recovery is driving supply tightness in many markets. As emerging markets are responsible for the manufacture, development and sale of commodities and equipment, they will be clear beneficiaries of current conditions. For instance, the rising penetration of internet connectivity, 5G smartphones and new auto technology has led to solid demand for technology hardware across the value chain. We expect this to drive revenue and margin growth for companies such as Mediatek and Taiwan Semiconductor Manufacturing.

Chart 3: Cost Contribution of Automotive Electronics and Semiconductor Content per Car

Estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

Supply Chain Diversification

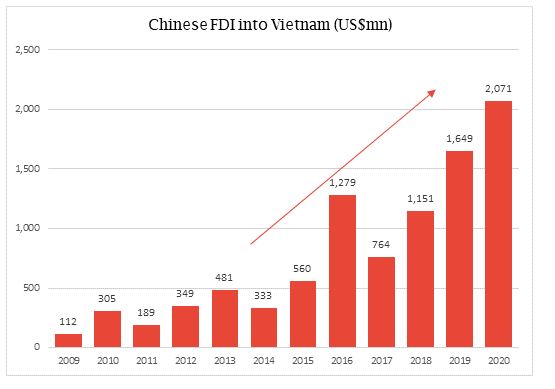

The diversification of supply chains was already underway pre-Covid following the Trump trade war in 2018. US imports from China dropped 17% ($88b) in 2019. Intra-Asia trade increased fourfold from 2000 to 2017 compared with growth in global trade of only 2.8 times. China’s share of exports in labour-intensive manufacturing has recently declined as production shifted to other markets. Lower labour costs and improved infrastructure have made South East Asia a leading alternative for outsourced manufacturing, especially Vietnam. Geo-political considerations such as US-China sanctions and ESG requirements will likely accelerate the diversification of the current Sino-centric supply chain. Furthermore, Covid-19 and the potential for pandemic-related supply-chain bottlenecks will be an additional risk to address via diversification.

Next Generation Asian economies have a chance to attract investment in labour-intensive manufacturing industries drawn by tax incentives, inexpensive and young labour forces and steady Covid-19 responses. Neutral geo-politics are a key draw for relocating firms while high industry utilization offers the potential for a quick relocation. Chinese firms are often at the forefront of FDI into these new manufacturing areas as they too want to remain cost-competitive.

Hoa Phat Group is the largest steel manufacturer in Vietnam with a market share of 32.5%. The company has seen robust sales volumes while it continues to ramp up the Dung Quat Steel complex expansion facility. We see the improvement in cash flow to translate through for the company in 2021 and 2022. Hoa Phat Group is set to be a key beneficiary from the increased demand for infrastructure needed to build out the manufacturing hubs.

Chart 4: New Factories of the World to Benefit from the Relocation from China

EM Travel

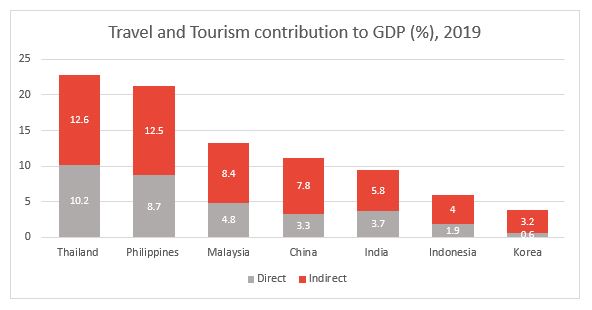

As the world continues to vaccinate its inhabitants, a recovery of travel will be a significant boost to the Asian economies that have a significant proportion of GDP from tourism. Additionally, indirect contribution from travel, which includes the impact on related industries such as food and beverage, retail and entertainment, can be double the direct contribution. We continue to see an uptick in international travel bookings, and this is expected to recover to pre-pandemic levels over the next few years.

IndiGo is an Indian low-cost airline. It is the largest airline in India by passengers carried and fleet size. The company is set to benefit from festival season demand, possibility of avoiding third wave altogether, government relaxations on capacity and fare regulations, and any pull back in commodity prices can be incremental catalysts.

Chart 5: Travel and Tourism as a contribution to GDP

The names shown above are for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

ASEAN Markets Remain Some of the Fastest Growing Countries in the World

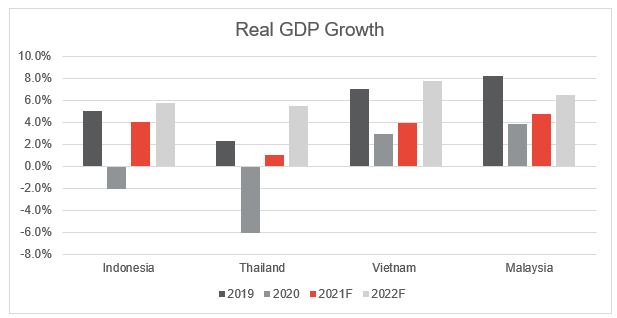

ASEAN markets are relatively under-researched compared to their larger emerging market peers in the region. At times, these markets are misunderstood and also ignored. A combination of these factors has led to attractive valuations while economic growth remains robust, and the demographics of this region remain favourable.GDP growth rates in ASEAN markets are significantly higher than in other regions. These superior growth rates are due to higher industrialisation, increasing exports and greater consumption resulting from favourable demographics. Countries such as Malaysia, Indonesia, and Vietnam are expected to post robust real GDP growth rates of 4-7% over the next five years, making them amongst the fastest growing globally[1].

[1] Source: RWC, IMF, Bloomberg as at 29 October 2021.

Chart 6: Robust GDP Growth of ASEAN markets

Estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

The names shown above are for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

Conclusion

Asia ex-China is investable, less levered to China growth and offers portfolio diversification benefits given its distinct differences from Chinese equities. It features attractive growth and valuation metrics but is under-owned by global investors, and thereby offers significant alpha opportunities.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

Forecasts and estimates are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

Unless otherwise stated, all opinions within this document are those of the RWC Emerging & Frontier Markets team as at 15th November 2021.