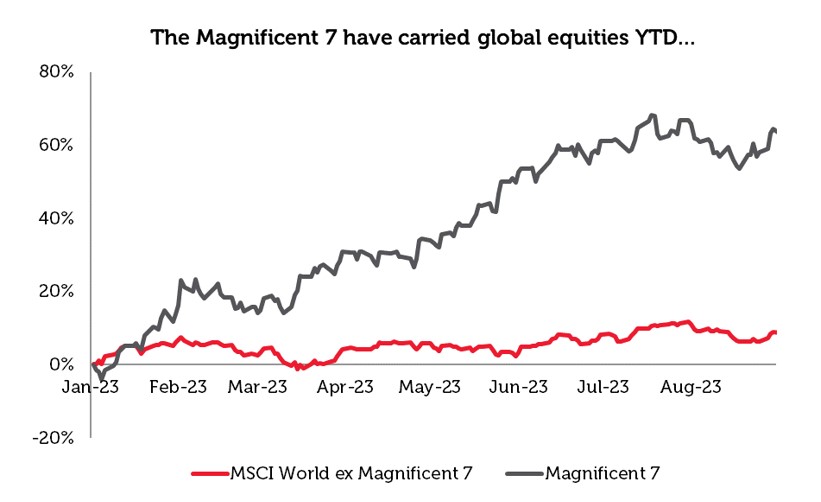

If you take a look at our portfolio, something may seem intriguing, maybe even somewhat ludicrous to some – there is no sign of any of the ‘Magnificent Seven’. This is no mistake, not a case of kicking ourselves that we did not catch the rally sooner; there is just no scope for holding these stocks at these valuations.

Markets have revelled in seemingly unwavering optimism, and despite some more recent hiccups, recession estimates keep edging out further and further and talks of a soft landing are still going strong. In our view, this is creating a potentially perilous and pavlovian response from investors to crowd into the same names – there are still cracks lurking beneath the surface: sticky inflation fuelling central bank hawkishness, Russia’s invasion of Ukraine, and China’s burgeoning economy currently seeming a distant memory, to name a few.

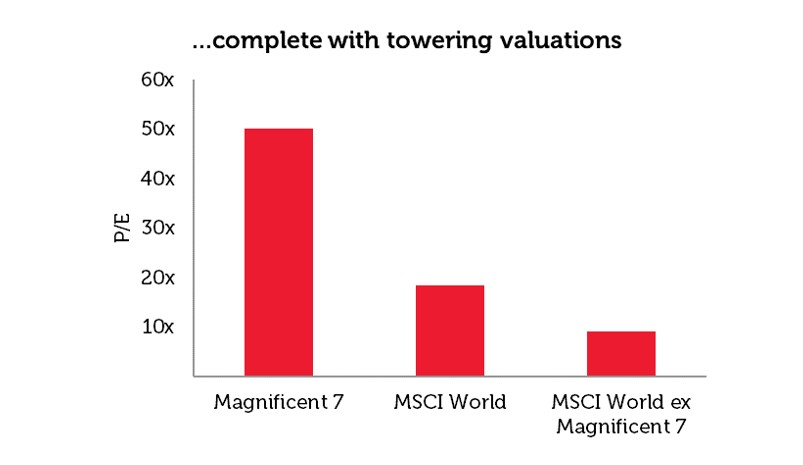

Despite the widely acknowledged shift away from an accommodative backdrop, markets are still leaning on a handful of stocks at valuations contingent upon interest rates falling to lows once more. When the crowd grows stronger and stronger, we believe that discipline becomes paramount in avoiding repeating the same mistakes. The Strategy’s inherent discipline in only purchasing stocks yielding at least 25% higher than the market prevents us from joining the crowd.

This has seen us marvel from the sidelines at markets becoming increasingly concentrated since Covid, including with a ‘one theme, one dream’ AI-fuelled vengeance more recently. Markets are certainly no strangers to concentration, having been led by an array of acronyms over the years: Nifty Fifty, GAMMA, FAANG, and even MCGXI over 20 years ago when it anchored the dot-com exuberance – although, clearly not as catchy.

But this time looks to be different – and not just because the pack comes complete with a name fit for a superhero dynasty as well as a Hollywood western. Even with recent stumbles, Apple continues to cement itself as the heaviest S&P 500 constituent of the past four decades [1,2], and the top five are still asserting unmatched dominance only rivalled by the 70s.[3,4]

The Magnificent Seven’s size remains truly magnificent: their collective market cap is around 40% of US GDP and around 10% of global GDP. Apple’s and Microsoft’s market caps wouldn’t look out of place among the G7, and Apple’s also swamps an average S&P 500 company’s by nearly 35x.[6]

Admittedly, this is different to the dot-com bubble – we don’t think this calls for the dreaded b-word just yet. At least the momentum centres around quality, profitable businesses far from hinging on pipedreams. Even so, we cannot ignore the increasingly lofty prices investors have been paying for these names that would already pose a significant obstacle to long-term returns. Investors have big expectations for how AI can elevate these businesses, and it could become a thorny issue for these names if they fail to live up to the hype.

Source: Redwheel, Factset, total returns in USD as at 31st August 2023. Past performance is not a guide to future results. No investment strategy or risk management technique can guarantee returns or eliminate risks.

Source: Redwheel, Bloomberg, as at 3rd September 2023. Past performance is not a guide to future results. No investment strategy or risk management technique can guarantee returns or eliminate risks.

Like the realisation that often dawns on every superhero, with great power comes great responsibility; for the Magnificent Seven, they can easily manage to carry the market when sentiment and central banks are conducive. Yet, with history often repeating itself, we have seen time and time again what can happen when this is not the case and when the ending is much less auspicious.

As sentiment still broadly remains elevated, it is easy to forget just what a valuation dictates: it is the expectation being placed upon a company in order to deliver a return to investors. As Scott McNealy, co-founder and former CEO of Sun Microsystems, noted in April 2002 following the burst of the dot-com bubble: “At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

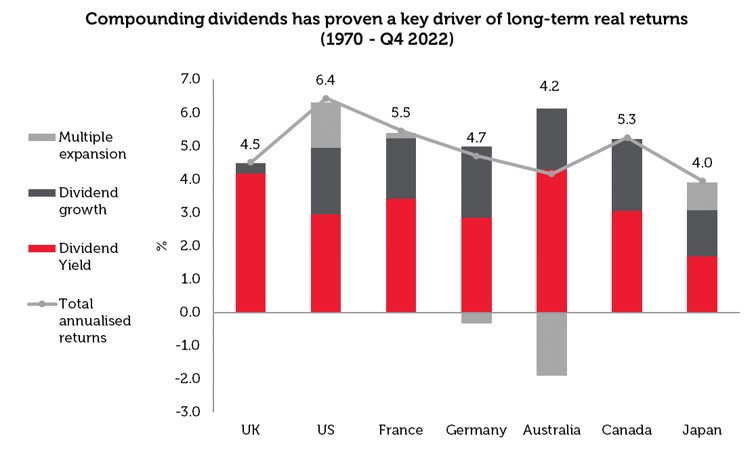

With the investment backdrop waving goodbye to an era of Quantitative Easing (QE) and zero interest rates, it’s time to dust off how to invest in a conventional market environment as cycles and volatility return. While it is probably too late to bet on the Magnificent Seven to reproduce these stellar returns, in our view, it is not too early to look beyond them. Clearly, navigating markets is likely to be trickier as easy money becomes less easy, yet greater steps can be taken to soften the impact by zooming out of these names and broadening exposure.

We believe quality, income-generating stocks could provide a powerful combination in this evolving market environment as well as greater balance to portfolios through their potential to produce attractive long-term returns due to having some all-weather characteristics. Although the below past results should not be relied upon, it is intuitive that dividends can help cushion dampened returns in down markets, and quality companies not only have robust balance sheets to support dividends, but can grow them over time, enhancing the compounding effect.

Source: SG Quantitative Research, total annualised real returns in local currency, as at Q4 2022. Past performance is not a guide to future results. No investment strategy or risk management technique can guarantee returns or eliminate risks.

Income investing is often associated with defensive-leaning areas such as staples, yet it doesn’t have to be completely distinct from growth-oriented areas; the portfolio also has exposure to these areas, though only to those stocks that have a premium yield underpinned by sustainable cash flows, thus possessing a greater ability to suffer. In the context of AI, think less Apple and its 0.5% dividend, and more TSMC with its 2.0% dividend. Compared to its closest Magnificent Seven relative, Nvidia, TSMC has a much more palatable valuation: it trades at a P/E of 16x, versus an eye-watering 114x for Nvidia (and 36x sales!) as at 6th September 2023.[7] We also look for a margin of safety in our investments; things can go wrong, especially with markets likely to be rate-sensitive amid higher rates.

Looking back, there have been various examples of how behavioural forces can impact markets, and how little attention is paid to them until it is often too late. Given the strength of higher multiple stocks in recent memory, it is interesting to see how the allure of joining the crowd, FOMO, as well as benchmark risk, are prompting allocations to growth more widely. This is important food for thought for investors – are philosophies being stuck to, or are fund investors having overlapping exposures as a result of style drift while a bumpier ride likely lies in store for growth?

Over the years, we have built up a bank of lessons to draw from, including avoiding parts of the market statistically difficult to repeatedly succeed in, which becomes particularly eminent as volatility increases. These narrow rallies are some of such cases, and there will rarely be scope for index behemoths to creep into the portfolio, due to our yield and valuation discipline. This may seem painful, but we believe it is a case of short-term pain, long-term gain; we are not looking to chase returns, but to cultivate them in a sustainable manner by harnessing the statistical power of dividends supported by quality business models. This leads to the Strategy having all-weather characteristics, and we believe the benefits of our approach over more relying on capital growth should become more apparent in the coming years amid the return to normality.

Sources:

[1] https://www.barrons.com/articles/apple-stock-price-sp500-weighting-51660238751

[2] Bloomberg

[3] https://www.indexologyblog.com/2023/01/09/celebrating-20-years-of-the-sp-500-equal-weight-index/

[4] Bloomberg

[5] The Magnificent Seven includes the following stocks: Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta

[6] US Bureau of Economic Analysis, World Bank, Bloomberg

[7] Morningstar

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.