Regular returns to shareholders from equity investments are often known as “ordinary dividends”. This is a misnomer – there is nothing ordinary about dividends at all. In fact, they are extraordinary! Here’s why…

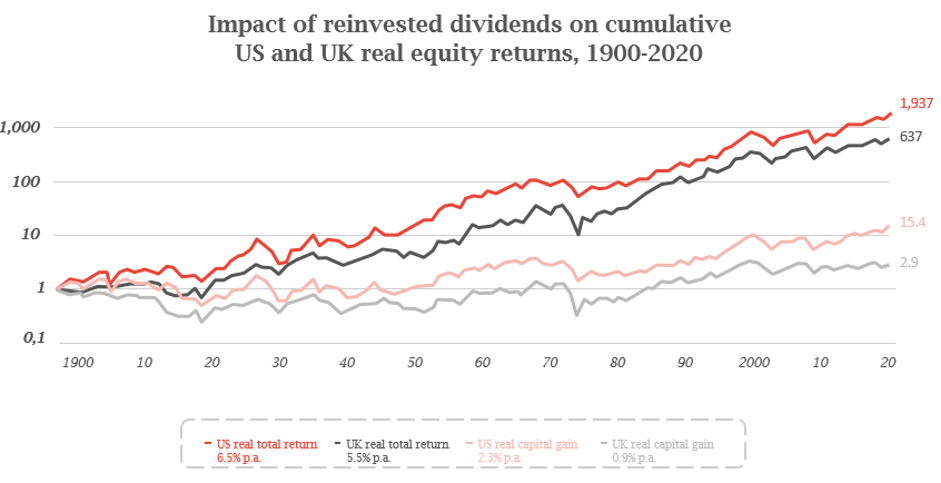

Powerful evidence, gathered over a very long period of time, demonstrates that dividends, and the reinvestment of dividends, represent the dominant source of long-term real returns in stock markets around the world. Even without the impact of dividends, equities have delivered an attractive historic long-term return. The light red line below illustrates that $1,000 invested in the US stock market in 1900, would now be worth in excess of $15,000 in real terms (i.e. after the erosive impact of inflation has been taken into account).

But if you include reinvested dividends in the calculation, the total return from US equities is simply staggering. The dark red line illustrates that, with dividends reinvested, $1,000 committed to US equities in 1900, would now be worth $193,700 in real terms.

Compounding a higher number

This is what Albert Einstein called “the eighth wonder of the world” – the power of compounding. Small amounts, reinvested year, after year, after year, turn into very substantial sums in the long run.

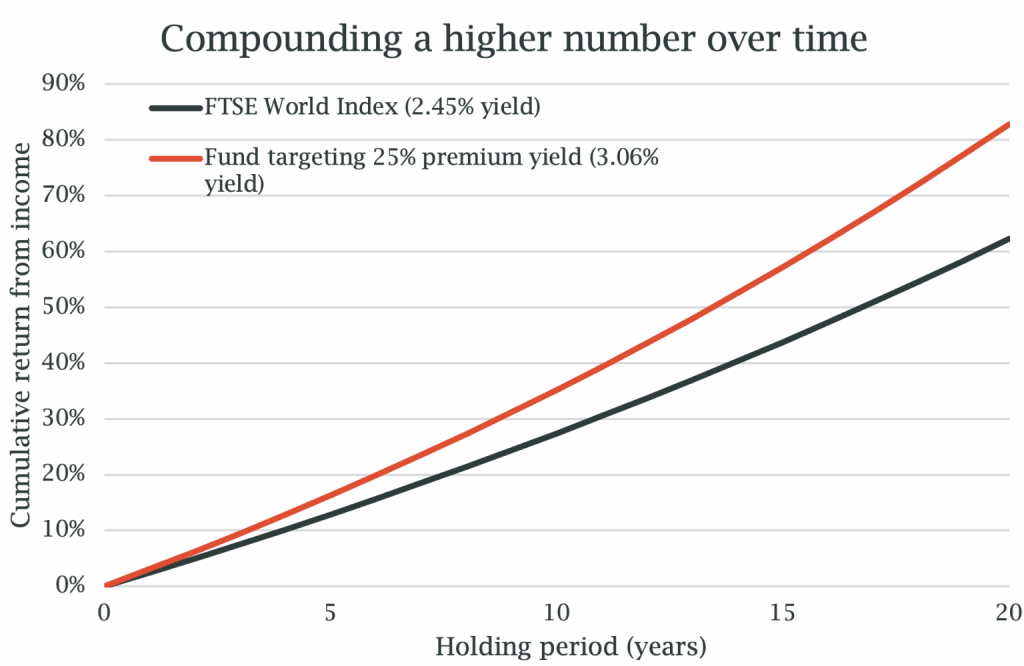

The investment approach we adopt for the RWC Global Equity Income Fund insists upon a premium yield. We will only invest in stocks if they yield at least 25% more than the yield of the global stock market. The power of compounding dividends through time dominates everything else in the world of investment – and our yield discipline ensure that our fund will be compounding a higher yield than the market.

For example, the average yield on the FTSE World Index over the last five years is 2.45%. Our yield discipline means we will only buy stocks that are yielding at least 25% more than this yield – so the minimum yield at which we would have bought stocks over the last five years is 3.06%. The additional return that we receive from this premium yield is important and, as the chart below demonstrates, over long periods of time, it can be very significant. All else being equal, if the index delivers a 2.45% yield annually, after five years investors would have seen a 12.9% return of their original investment from income alone. However, if a fund delivers a 3.06% yield annually, the return from income after five years would be 16.3% of their original investment.

The power of compounding means the difference between these two numbers grows more substantial over time. After ten years, the comparable numbers are 27.4% for the index, 35.2% for the fund. After 20 years, the income returns from the index and fund are 62.3% and 82.8% respectively.

It is important to point out that these numbers are theoretical and there are many variables which will combine to ensure that an actual investment experience never exactly replicates these returns. Indeed, there are other sources of return, such as dividend growth and valuation changes, which should mean that the long-term returns delivered by an equity portfolio are even more attractive.

However, the numbers should be helpful in demonstrating that consistently compounding a higher yield than the market, can have a profound effect on returns over longer time periods. This is what we mean by compounding a higher number over time, and by only buying stocks with a premium yield, it is exactly what we intend to do.

Dividends drive better behaviour

The discipline of a dividend improves future earnings growth

This research focused on US companies, but other studies have concluded that the same relationship holds true in other regions. In turn, this suggests that investors in a dividend strategy should not only receive an attractive yield, they should also be rewarded with superior long-term growth. Indeed, we regard the dividend as much more than just a component of the overall return delivered by a stock. The regular payment of a dividend also represents:

- Tangible evidence of a company’s profitability

- An alignment between management’s interests and those of its shareholders

A reflection of a management team’s confidence in its future - A sign that a company understands the importance of effective capital allocation and an appropriate balance sheet structure

For all of these reasons, we believe that the payment of a regular dividend is an important discipline for company management teams because it focuses their attention on effective and sustainable capital allocation.

A less volatile source of returns

As we have explored above, the dividend is highly prized by both shareholders and management teams. Neither party likes to see a dividend cut. As investors, we try to avoid them by focusing our research activities on the sustainability of a company’s cashflows, to ensure that the businesses we invest in have the ability to suffer without compromising their future dividend payments. And management teams try to avoid dividend cuts by investing in their business to deliver future growth without over-stretching themselves.

These disciplines are important, because they tend to make dividend income a less volatile source of returns. Dividends are a return on an investment in equities, so a fund that deploys a dividend-focused strategy will inevitably be exposed to the daily ups and downs of the stock market. However, it is unlikely to see the same degree of volatility as the broader market because the dividend itself is a much more stable source of returns.

The enduring appeal of dividends

Investors have sounded the alarm bell around the extreme valuations of technology stocks and other parts of the market that display classic ‘growth’ characteristics. Many people believe we are in bubble territory and have questioned the sustainability of share prices and earnings from the parts of the market that have driven returns in recent years.

Within equity markets, therefore, dividend-oriented strategies look less risky because they have not witnessed the same level of excitement and enthusiasm. Valuations, as a result, are much more attractive, and our yield discipline ensures we will only invest in stocks that offer a premium yield to the market.

We believe that by focusing our investment approach on the statistical power of dividends, we are explicitly targeting the dominant source of long-term real returns and naturally tilting the portfolio in favour of efficient capital allocation and long-term growth. This is the power of dividends and we aim to harness it on your behalf.

The term “RWC” may include any one or more RWC branded entities including RWC Partners Limited and RWC Asset Management LLP, each of which is authorised and regulated by the UK Financial Conduct Authority and, in the case of RWC Asset Management LLP, the US Securities and Exchange Commission; RWC Asset Advisors (US) LLC, which is registered with the US Securities and Exchange Commission; and RWC Singapore (Pte) Limited, which is licensed as a Licensed Fund Management Company by the Monetary Authority of Singapore.

RWC may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. RWC seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by RWC are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

This document has been prepared for general information purposes only and has not been delivered for registration in any jurisdiction nor has its content been reviewed or approved by any regulatory authority in any jurisdiction. The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by RWC; or (iv) an offer to enter into any other transaction whatsoever (each a “Transaction”). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party.

RWC uses information from third party vendors, such as statistical and other data, that it believes to be reliable. However, the accuracy of this data, which may be used to calculate results or otherwise compile data that finds its way over time into RWC research data stored on its systems, is not guaranteed. If such information is not accurate, some of the conclusions reached or statements made may be adversely affected. RWC bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction. Any opinion expressed herein, which may be subjective in nature, may not be shared by all directors, officers, employees, or representatives of RWC and may be subject to change without notice. RWC is not liable for any decisions made or actions or inactions taken by you or others based on the contents of this document and neither RWC nor any of its directors, officers, employees, or representatives (including affiliates) accepts any liability whatsoever for any errors and/or omissions or for any direct, indirect, special, incidental, or consequential loss, damages, or expenses of any kind howsoever arising from the use of, or reliance on, any information contained herein.

Information contained in this document should not be viewed as indicative of future results. Past performance of any Transaction is not indicative of future results. The value of investments can go down as well as up. Certain assumptions and forward looking statements may have been made either for modelling purposes, to simplify the presentation and/or calculation of any projections or estimates contained herein and RWC does not represent that that any such assumptions or statements will reflect actual future events or that all assumptions have been considered or stated. Forward-looking statements are inherently uncertain, and changing factors such as those affecting the markets generally, or those affecting particular industries or issuers, may cause results to differ from those discussed. Accordingly, there can be no assurance that estimated returns or projections will be realised or that actual returns or performance results will not materially differ from those estimated herein. Some of the information contained in this document may be aggregated data of Transactions executed by RWC that has been compiled so as not to identify the underlying Transactions of any particular customer.

The information transmitted is intended only for the person or entity to which it has been given and may contain confidential and/or privileged material. In accepting receipt of the information transmitted you agree that you and/or your affiliates, partners, directors, officers and employees, as applicable, will keep all information strictly confidential. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information is prohibited. The information contained herein is confidential and is intended for the exclusive use of the intended recipient(s) to which this document has been provided. Any distribution or reproduction of this document is not authorised and is prohibited without the express written consent of RWC or any of its affiliates.

Changes in rates of exchange may cause the value of such investments to fluctuate. An investor may not be able to get back the amount invested and the loss on realisation may be very high and could result in a substantial or complete loss of the investment. In addition, an investor who realises their investment in a RWC-managed fund after a short period may not realise the amount originally invested as a result of charges made on the issue and/or redemption of such investment. The value of such interests for the purposes of purchases may differ from their value for the purpose of redemptions. No representations or warranties of any kind are intended or should be inferred with respect to the economic return from, or the tax consequences of, an investment in a RWC-managed fund. Current tax levels and reliefs may change. Depending on individual circumstances, this may affect investment returns. Nothing in this document constitutes advice on the merits of buying or selling a particular investment. This document expresses no views as to the suitability or appropriateness of the fund or any other investments described herein to the individual circumstances of any recipient.

AIFMD and Distribution in the European Economic Area (“EEA”)

The Alternative Fund Managers Directive (Directive 2011/61/EU) (“AIFMD”) is a regulatory regime which came into full effect in the EEA on 22 July 2014. RWC Asset Management LLP is an Alternative Investment Fund Manager (an “AIFM”) to certain funds managed by it (each an “AIF”). The AIFM is required to make available to investors certain prescribed information prior to their investment in an AIF. The majority of the prescribed information is contained in the latest Offering Document of the AIF. The remainder of the prescribed information is contained in the relevant AIF’s annual report and accounts. All of the information is provided in accordance with the AIFMD.

In relation to each member state of the EEA (each a “Member State”), this document may only be distributed and shares in a RWC fund (“Shares”) may only be offered and placed to the extent that (a) the relevant RWC fund is permitted to be marketed to professional investors in accordance with the AIFMD (as implemented into the local law/regulation of the relevant Member State); or (b) this document may otherwise be lawfully distributed and the Shares may lawfully offered or placed in that Member State (including at the initiative of the investor).

Information Required for Distribution of Foreign Collective Investment Schemes to Qualified Investors in Switzerland

The representative and paying agent of the RWC-managed funds in Switzerland (the “Representative in Switzerland”) is Société Générale, Paris, Zurich Branch, Talacker 50,

P.O. Box 5070, CH-8021 Zurich. In respect of the units of the RWC-managed funds distributed in Switzerland, the place of performance and jurisdiction is at the registered office of the Representative in Switzerland.