Economic reform programmes are creating new and sustainable sources of value across overlooked emerging markets. In our insights series, Harnessing reform as a catalyst for growth [1], we focus on markets where meaningful improvements in transparency, market liberalization and governance are paving the way for economic transformation.

In this context, Vietnam and Mexico stand out. Both demonstrate dynamic reform momentum and rapidly evolving market structures that underpin a differentiated investment opportunity for global investors.

Vietnam: Record highs fuelled by reform

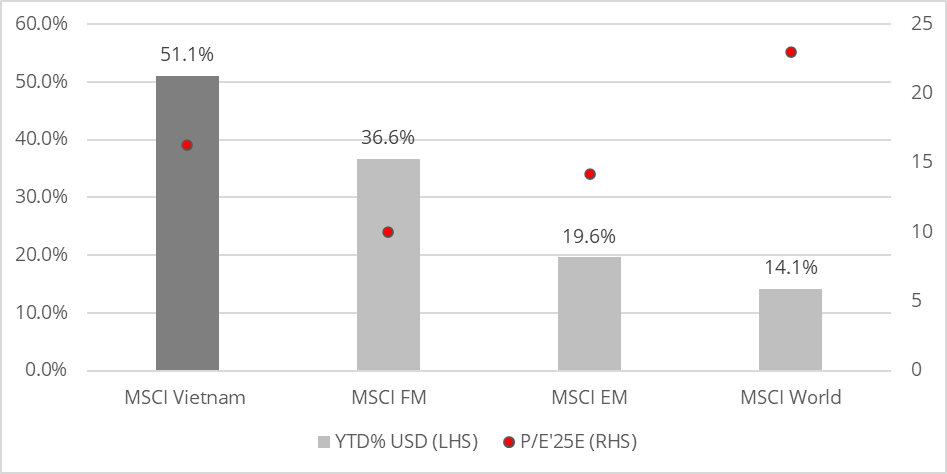

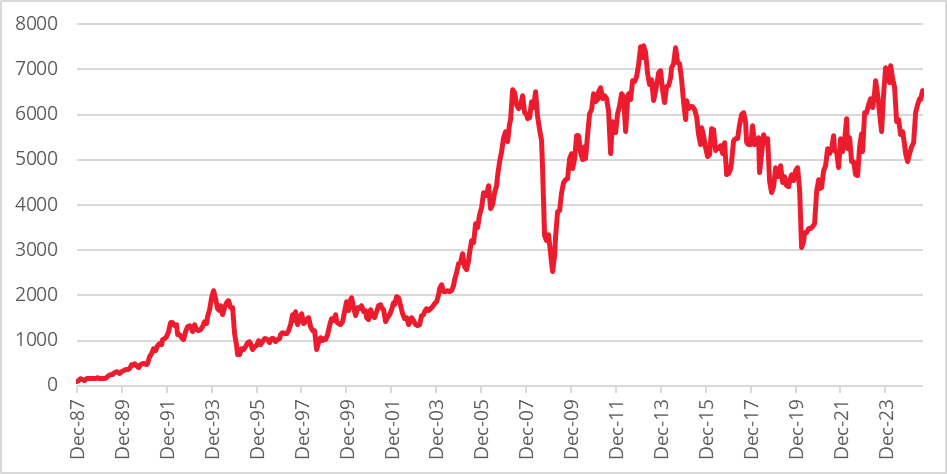

Vietnam’s financial markets have delivered exceptional results in 2025, with the MSCI Vietnam Index rising 51.1% year-to-date by the end of August [2], outstripping both the MSCI Frontier Market Index and most Asian peers. The rally reflected not just investor optimism but also the vigour of national reform and renewal as the country marks its 80th National Day of Independence. Redwheel’s Emerging Market Equity strategy increased its Vietnam allocation in 2025 to 2.8%. The Redwheel Next Generation and Frontier strategies also maintain a high Vietnamese exposure at 10%.

Structural advantages and nearshoring

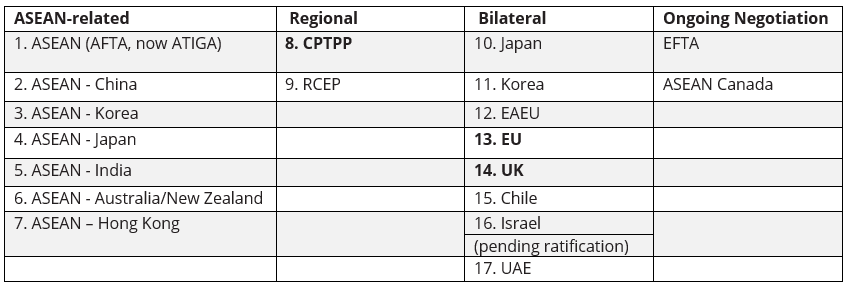

Vietnam has emerged as a global hub for nearshoring and supply chain diversification, capitalizing on its political stability, youthful workforce, and strategic proximity to China. An expanding network of free trade agreements (FTAs) has underpinned rising foreign direct investment (FDI).

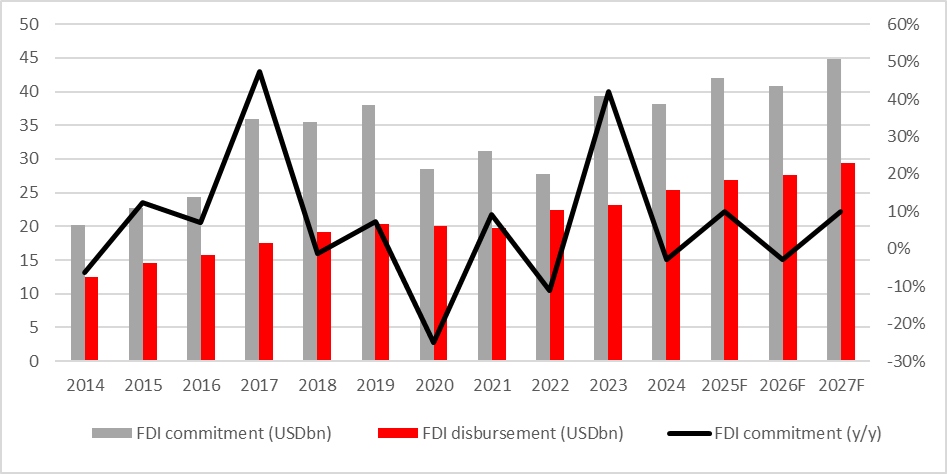

This has resulted in new FDI commitments of $38.2 billion by the end of 2024 (see Chart 3), a figure that has kept expanding in the first half of 2025 despite uncertainty around US tariff policy. Vietnam’s exports to the US amount to 25% of GDP and c.30% of total exports, making it one of the most vulnerable countries to trade levies [3]. However, Vietnam’s competitiveness endures as similar levies are now broadly applied to other manufacturing countries.

Chart 3: Vietnam FDI commitments and disbursements

Doi Moi 2.0: Domestic Reforms are accelerating

The appointment of To Lam as General Secretary in August 2024 has ushered in a new era of change for Vietnam, anchored by an ambitious “Era of National Rising” ahead of the 14th Party Congress in 2026. By 2030, the government aims for upper middle-income status with GDP per capita above $5,000 and intends to shift GDP growth onto an 8% trajectory through major investment in infrastructure and public goods.

The reform framework emphasizes innovation and business competitiveness, targeting a 30% reduction in business costs and enhanced regulatory efficiency to place Vietnam among the ASEAN region’s top three investment destinations within two to three years. There is also a 2045 vision to reach high-income, developed-country status.[4]

Policy decisions are aligned to stimulate growth

Interest rates remain low and public debt is modest at 34% of GDP [5], offering substantial fiscal latitude to increase public investment.

Resolution 68, announced in May 2025, officially puts private companies at the centre of Vietnam’s economy for the first time. This reform ensures equal treatment with state-owned firms, lays out a credible path for SOE privatization, and aims to support large domestic conglomerates.

Land law reform and provincial consolidation have created a more responsive environment for infrastructure investment. A massive infrastructure stimulus programme, ten percent of the nation’s GDP is in motion, directing funding to over 250 core transport and housing projects valued at $49 billion [6].

Exceptional liquidity and market participation

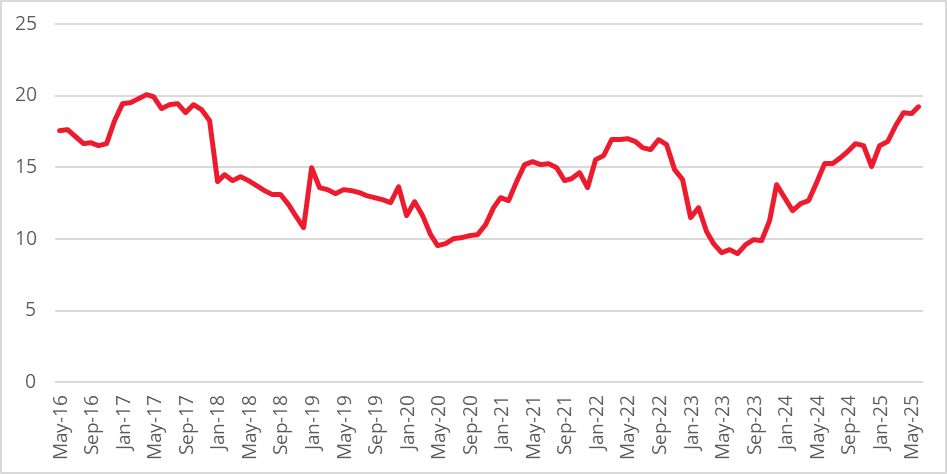

These reforms are already evident in Vietnam’s market structure. The Ho Chi Minh Stock Exchange has seen record daily trading volumes and surging margin lending, highlighting growing retail participation and increasing investor confidence. Despite these gains, market cap-to-GDP ratios remain below historical peaks, and valuations are attractive at 13x earnings versus a high of 17x in prior cycles [7].

Capital market modernization is also accelerating. The new Securities Law (effective 2025), deployment of upgraded trading infrastructure, and steps toward FTSE emerging market status highlight Vietnam’s intent to attract a larger pool of foreign portfolio investors.

Reshoring and consumer spending

Several sectors stand to benefit disproportionately from these changes. We believe that Vietnam’s leading steel producer, Hoa Phat Group, is positioned to leverage growing FDI and infrastructure investments and is on track to make the country self-sufficient in hot-rolled coil production. Consumer-focused firms like leading mall developer Vincom Retail are capitalizing on the real estate recovery, while Masan Group runs at the forefront of modern grocery and consumer goods distribution as retail formalization accelerates.

Financial inclusion

In banking, institutions such as Techcombank and Military Bank have seen resilient loan growth behind stable net margins. The likely abolition of Vietnam’s credit quota system in 2026 will further align lending practices with international norms and support further asset growth.

Brokerage firms such as Saigon Securities are reaping rewards from regulatory upgrades and infrastructure enhancements outlined above that have made 2025 a defining year for capital markets.

Taken together, Vietnam’s commitment to reform, robust FDI flows, and active capital market modernization provide a powerful case for continued re-rating and sustainable growth.

Mexico: Resilience and reform amid political uncertainty

Mexico’s equity market has staged a powerful recovery in 2025, with the MSCI Mexico index up 35.2% through to August, reversing last year’s losses and buoyed by strength in the peso, which gained 12% against the dollar over the period. Redwheel’s Emerging Market Equity strategy remains overweight Mexico, with a 2.4% allocation versus the MSCI Emerging Markets index’s 2% benchmark. Additionally, Redwheel’s Next Generation Emerging Markets strategy has an exposure of 5.3%.

Policy and economic resilience

The significant challenges that the country faced at the outset of 2025 have not materialized as expected. Judicial reform, a Trump presidency and the imposition of tariffs have had less of an impact on financial markets than initially expected; nonetheless, equity multiples remain below historical averages, reflecting weaker consumer and business confidence.

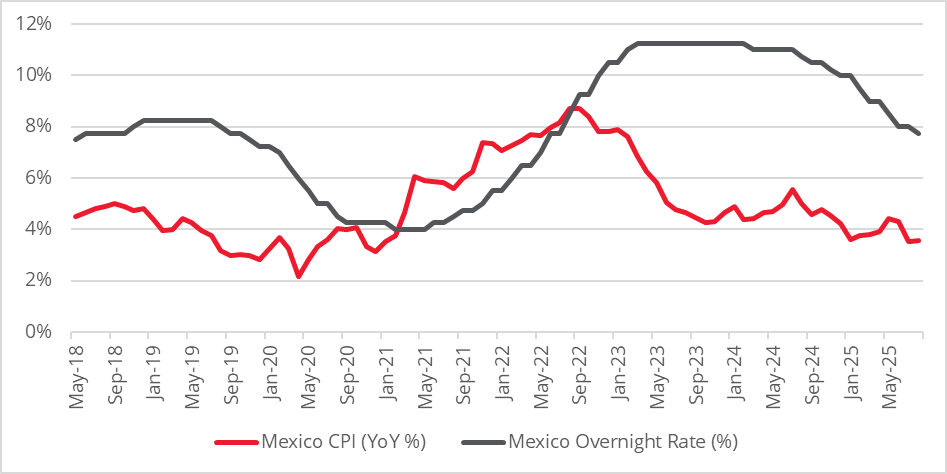

Inflation has remained under control, providing room for Banxico to ease the official overnight rate from 10.0% to 7.75% during the year – see Chart 7. Lower interest rates have supported the economy while private credit continues to grow at around 3-4% in real terms. Although overall GDP growth remains weak at 0.5% for 2025, we believe that the economy will continue to recover into 2026 with our estimates suggesting that real growth will reach 1.8% next year.

Nearshoring and trade dynamics

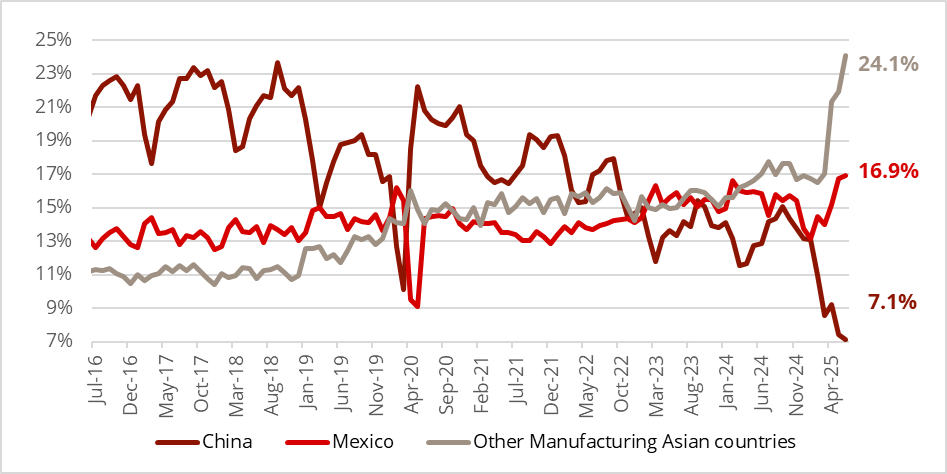

One of the key themes that continues to benefit Mexico is nearshoring. Mexico’s share of US imports is almost 17% – see Chart 8, growing substantially from the level of 13% seen almost a decade ago at the expense of China. This highlights the importance of Mexico as a manufacturing base adjacent to the USA during this period of trade tariffs.

Mexico’s largest export categories are automobiles, auto parts and heavy machinery [8]. Exports to the US continue to grow and Mexico will likely benefit from this as manufacturing supply chains move away from China due to tariffs. Moreover, the wage gap between Mexico and China has widened over the past two decades [9], further incentivizing a shift of manufacturing to Mexico. Demand for Mexican goods should also be stimulated by upcoming reductions in the US Fed Funds rate, which are expected to begin in autumn this year.

FDI and the investment outlook

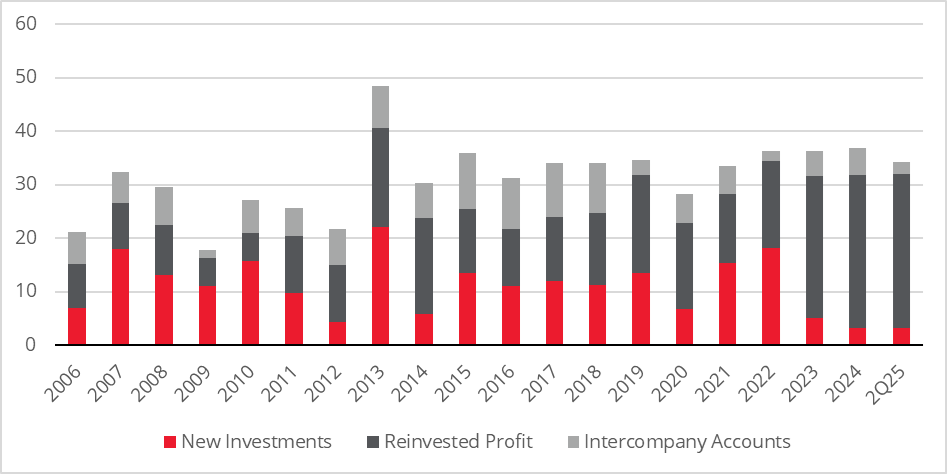

The outlook for FDI remains positive. Over the coming years, Mexico could receive around $121 billion from 308 nearshoring-related investments announced since the start of 2023 [10]. Although tariff-related uncertainty has delayed some projects, there have been few cancellations and FDI is stable, in our view.

Financial inclusion and credit expansion

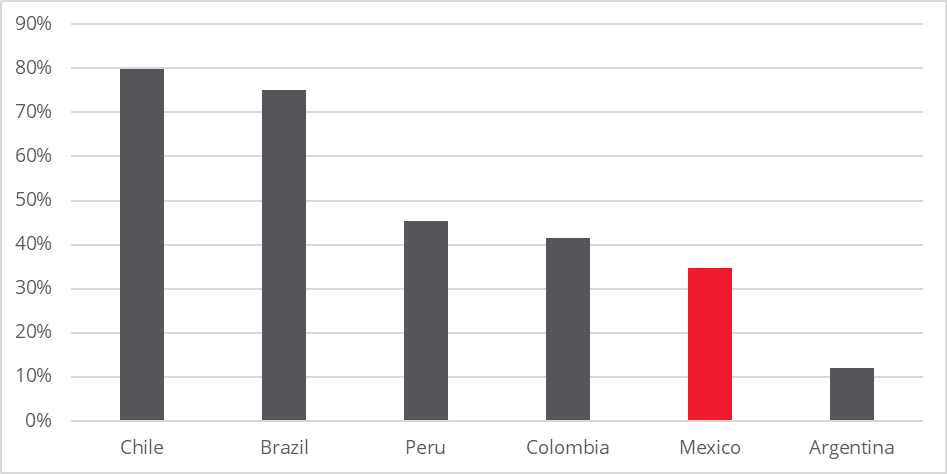

Yet, Mexico remains under-penetrated in terms of credit to GDP. Private credit to GDP is around 34% – see Chart 10, which is low compared to other countries in Latin America. The size of the informal economy suggests that it will be difficult for the credit penetration in Mexico to converge with countries such as Brazil and Chile. However, we expect mid-to-high single digit CAGR over the coming few years, which should lead to compounded earnings growth for banks and fintech companies operating in the country.

Despite lingering caution, the convergence of resilient credit expansion, stable FDI trends, currency strength, and moderating inflation creates a solid investment thesis in our view, underpinned by key growth drivers: ongoing reforms and Mexico’s established role in North American trade.

Conclusion

Vietnam and Mexico stand at the forefront of emerging market reform, each using bold policy shifts to unlock new investment opportunities. For global investors, we believe they offer differentiated, resilient exposures underlining why reform-driven markets remain essential for the next wave of sustainable, long-term portfolio growth.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

Sources:

[1] See Harnessing reform as a catalyst for growth: South Korea and South Africa, August 2025

[2] All sources are Bloomberg and Redwheel as at 31 August, 2025 unless otherwise indicated.

[3] Vietnam National Statistics office, Centre for WTO and International Trade, Redwheel, December 2024

[6] NationThailand.com, August 2025

[7] Bloomberg and Redwheel, 31 August 2025

[8] US Census Bureau, May 2025

[9] Mexico National Bureau of Statistics, CEIC, Trading Economics and Redwheel, June 2025

[10] Ministry of Economy, Santander research, 31 March, 2025