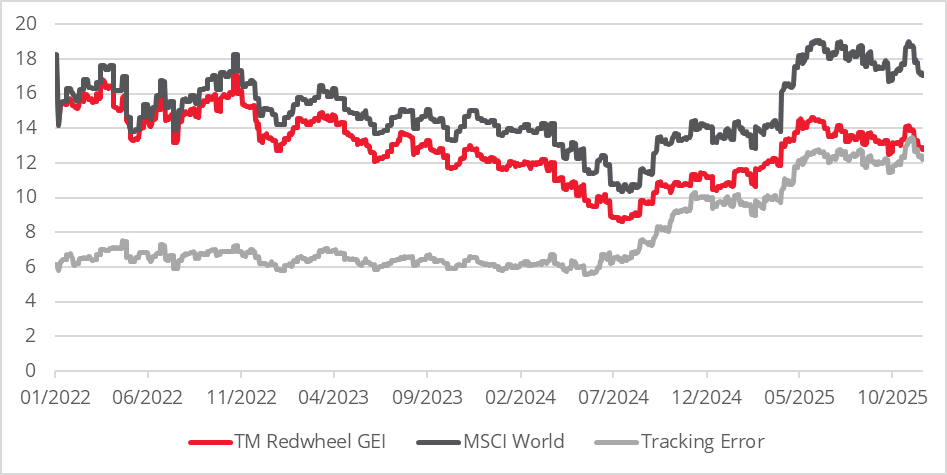

Disciplined, value-driven equity investors may be seeing a rise in tracking error – the measure of how much a portfolio’s returns diverge from its benchmark. While risk systems often flag tracking error as a negative, the true story can be more nuanced.

For a strategy committed to consistent, long-term returns and downside protection, an increase in tracking error may signal that it is doing exactly what it’s supposed to: providing diversification and risk management when it matters most.

Market concentration and volatility: The real culprits

Rising tracking error is often seen as a danger sign – but the real question is why it’s rising. Is increased volatility due to changes made by the portfolio manager, or is it because the broader market itself is becoming more volatile?

Recent years have seen a major shift in global equity markets, with returns becoming increasingly concentrated in a handful of highly valued technology giants. These “Magnificent 7” stocks have been responsible for much of the headline gains but are also driving volatility higher for the overall benchmark. Chart 1 clearly indicates an acceleration in Mag 7 outperformance in Q4 2024, a sharp deterioration during Q1 2025 followed by another period of acceleration in Q2 and Q3 2025.

Chart 1: Magnificent 7 relative to the MSCI World benchmark

Discipline can drive divergence

For disciplined equity income strategies, this market environment presents a challenge—but also a reaffirmation of core principles. Stringent buy or yield disciplines mean that these stocks fall outside the eligible universe for strategies like the Redwheel Global Equity Income strategy, which prioritises durable yields at a premium to market over short-term growth at any price.

This deliberate exclusion means tracking error rises—not due to risk-taking or a breach of discipline, but because the strategy refuses to compromise its standards even as the index becomes riskier. Investment discipline, not deliberate risk-taking, is behind the divergence from the benchmark.

Chart 2: : Volatility and tracking error – Redwheel Global Equity Income vs MSCI World index

However, most risk systems are not equipped to distinguish this nuance. Ironically, what flags as added risk within models may in fact reflect sensible, long-term risk management—particularly when index returns are being driven by a very narrow cadre of expensive and increasingly volatile stocks.

The power of consistency and downside protection

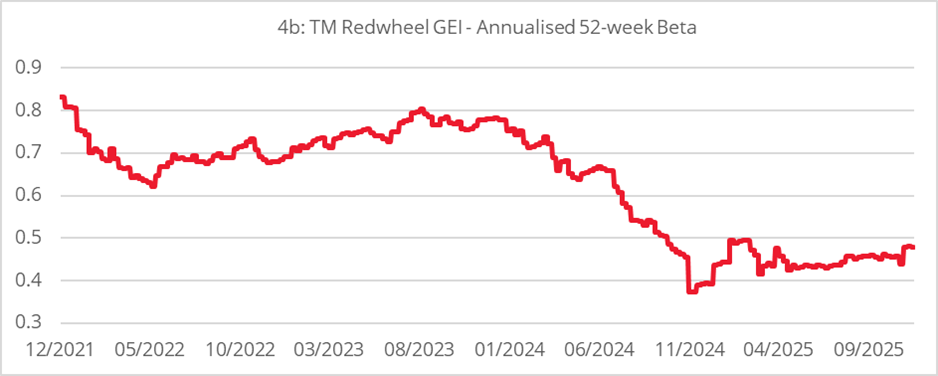

It’s in these conditions where the true benefit of a disciplined, income-oriented process comes to the fore. Over time, the power of compounding premium dividends, combined with a lower beta profile, can provide a pathway to more consistent, defensible returns. This effect is often amplified during periods of volatility when not losing money becomes mathematically more important than making money, even if the end results are positive. These strategies can therefore deliver their strongest outperformance when the broader index experiences increased volatility or a pullback.

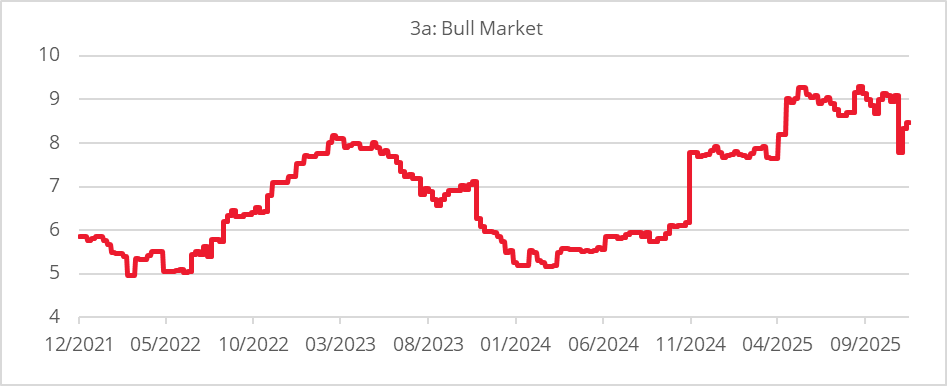

Chart 3 shows that, for Redwheel’s strategy, tracking error and the increase in tracking error are both greatest in bear market scenarios: rising from 4 to 11 in the bottom chart (bear market) vs. 5 to 9 in the top chart (bull market).

Charts 3a and 3b: Redwheel Global Equity Income strategy – tracking error in bull and bear markets

Increasing tracking error can therefore be less a sign of recklessness and more an indicator of smart, intentional risk allocation as volatility rises. The strategy’s smoothing effect on returns becomes paramount when compounding through more challenging cycles.

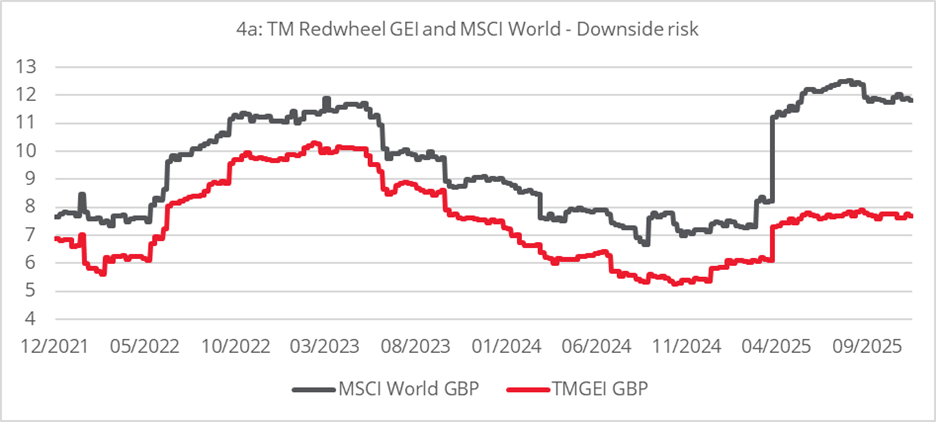

Chart 4 adds further support to this point, showing how downside risk is rising more for the benchmark than the strategy in combination with a declining beta.

Charts 4a and 4b: Redwheel Global Equity Income strategy – Downside risk and declining beta

Looking ahead

We see three possible scenarios from here:

- Markets continue to rise in a straight line, led by the same highly valued tech giants, with limited volatility

- Markets rise, but with far greater swings and reversals—a pattern already visible in 2025

- Markets correct, pulling back sharply from recent highs

Disciplined equity income strategies will naturally lag the index in the first scenario, when steady, low-volatility rallies favour concentrated, high-beta plays. But in the second and third scenarios—both of which now seem increasingly likely as volatility returns and concentration risks build—an approach grounded in yield, quality, and risk discipline is far more likely to deliver resilient, attractive returns for long-term investors.

Rethinking tracking error

Tracking error is often misunderstood as a pure risk metric, requiring a deeper analysis than those provided by risk systems. For strategies focused on quality and value, a rise in tracking error may be a mark of discipline, rather than deviation.

As market conditions shift from straight-line growth toward greater volatility or correction, the ability to hold course—delivering consistent returns uncorrelated to a concentrated index—will be essential for investors. Not all tracking error reflects risk to be feared; for resilient strategies, it may be a leading indicator that the manager is doing exactly what is needed for sustainable, long-term returns.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

Representative Portfolio

Portfolio characteristics, top ten holdings, sector allocation, country allocation, attribution, volatility, yield, dividend and ESG information are based on a representative portfolio, which is TM Redwheel Global Equity Income Fund.

Redwheel believes that precisely this account within the strategy most closely reflects the current portfolio management style for the Redwheel Global Equity Income Strategy. Portfolio holdings are subject to change without notice. The information shown is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.