The word “discipline” will have different meanings for different people. Many may think of the military, with a high-ranking officer bellowing orders at a set of new recruits. Others may think of the discipline that is constantly being instilled in a young child by its parents and teachers. In the world of investment, the word is used in a slightly different context – but in all situations discipline exists to keep us safe.

As a team, our investment disciplines are extremely important to us – they guide everything we do. They start and end with our buy and sell discipline but include other forms of safety net at every stage of our investment process. Here we talk through why discipline matters and what it means to us.

Why discipline matters

The stock market is a fickle beast. Only over the long-term are its true performance characteristics fully revealed. Fundamentals determine substantially all equity market outcomes over long time periods, with the full power of the dividend unleashed in all its might.

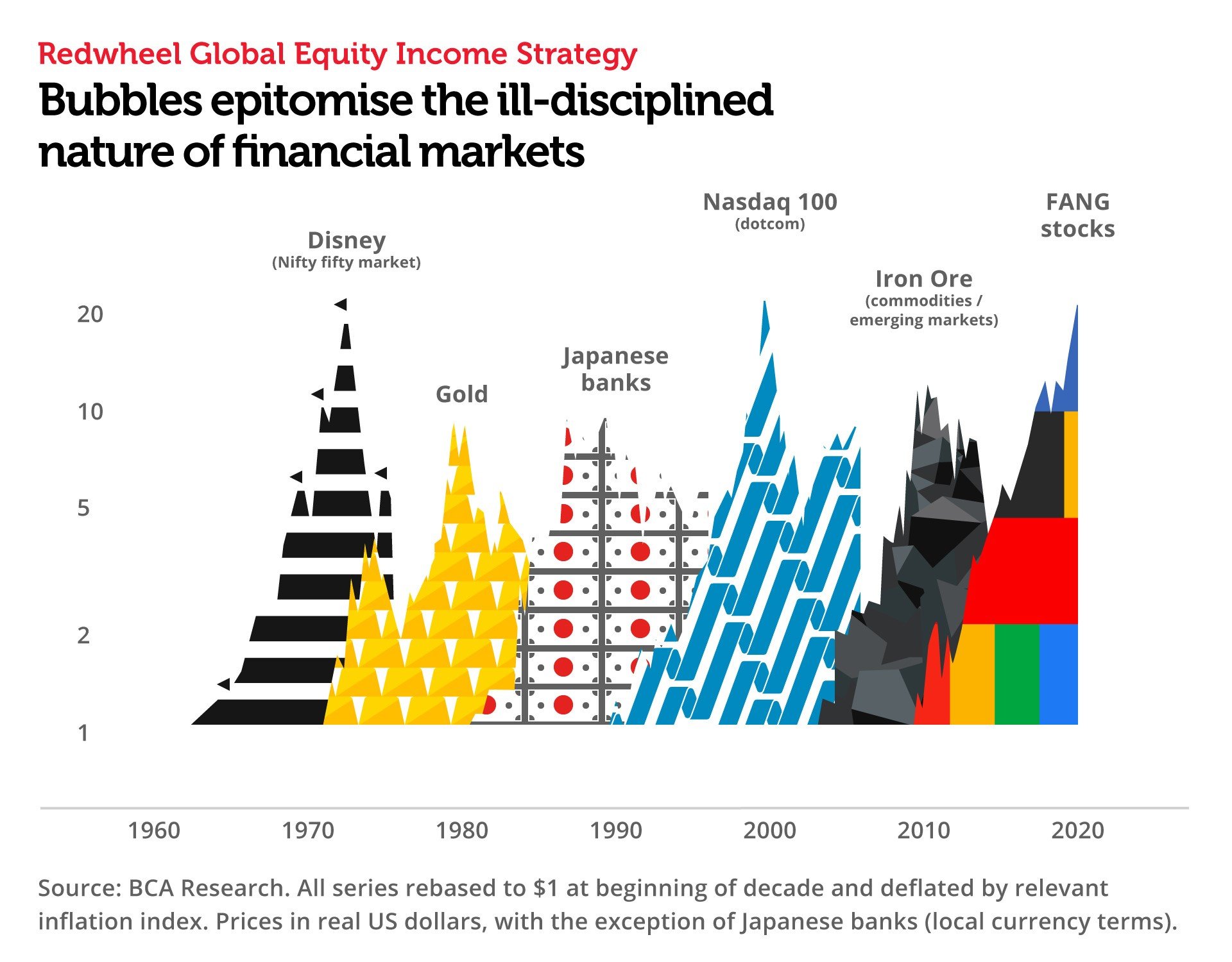

In the short-term, however, fundamentals can be obscured by other forces. Fashions come and go, and forces such as sentiment, momentum and other so-called “animal spirits” can buffet stock markets in all sorts of different directions over short time periods. Indeed, the history of financial markets amply demonstrates that these factors can sometimes persist for several years, driving a wedge between share prices and fundamentals, and ultimately inflating asset price bubbles.

Bubbles epitomise the ill-disciplined nature of financial markets. Many investors are prone to emotional responses that can be difficult to resist: the fear of missing out; the comfort of the herd; the allure of seemingly easy gains; and the desire to believe arguably in the four most dangerous words in investment, “this time it’s different”. These may all be understandable responses to what investors see happening in markets, but generally the only way to avoid these regular investment pitfalls is to stick resolutely to a robust and disciplined approach.

Discipline in the Redwheel Global Equity Income Strategy

- Buy discipline: we only buy stocks when they yield at least 25% more than the global market – this instils a strong valuation discipline into our approach and ensures the portfolio will consistently compound a superior income return for its investors

- Dividend sustainability: our investment analysis focuses on a company’s ability to generate cash and sustain its dividend to investors, now and in the future – this discipline helps us to focus on companies that are able to suffer, to try and avoid dividend cuts which can result in a permanent loss of capital

- Valuation margin of safety: we have a disciplined approach to cashflow-based valuation analysis – this helps us avoid overpaying for stocks and looks to limit downside even when the future turns sour

- Sticking to our sphere of competence: the three characteristics above only tend to be found when a company is surrounded by controversy – our process has a narrow focus on five different buckets of controversy (as explained here) into which all investments must fit – this helps us to avoid being drawn into situations that are statistically unfavourable and instead looks to increase our statistical chance of success via repetition of a disciplined process

- Reliance on fact-based evidence: we work hard to ensure that any investment rationale is supported by fact-based evidence rather than opinion – this helps to remove emotional bias and creates a culture that allows for agreement, ownership, criticism and learning

- Scenario analysis: we model a company’s expected cashflows over a five-year horizon in a range of potential scenarios – this results in a ‘fan’ of outcomes which must be asymmetrically skewed to the upside, thereby leaning the probability of success in favour of our clients, helping to mitigate the inherently probabilistic nature of investment and enabling each investment idea to be compared on a like for like basis

- Portfolio construction: the repetition of our approach forms the knowledge base from which we can understand the relative risk and reward of each investment – this informs a robust portfolio construction process, with more capital deployed to the strongest, safest and most liquid ideas

- Monitoring progress: The progress of an investment thesis is monitored through a series of pre-determined ‘flags’ – these allow us to dispassionately assess a company’s operational performance in isolation from its share price

- Sell discipline: we must sell stocks when they yield less than the global market – this encourages appropriate decision-making and protects the investment process from emotional biases, such as falling in love with a stock.

Conclusion

In all walks of life, discipline is designed to keep us safe. Despite this, history shows that discipline is not as common in financial markets as you might expect.

Our investment disciplines, however, are absolutely vital. Without them we have nothing to guide us, and we would be as prone as anyone else to the regular pitfalls of investing. There can be no exceptions to these disciplines, which are the starting point and basis of our entire process.

Of course, nothing can eradicate risk from the world of investment altogether. The enduring relationship between risk and return means that the former must be embraced in order to deliver the latter. Our disciplines, however, are designed to help keep us – and our investors – away from common pitfalls, and to lean the statistics in our favour, while in pursuit of an attractive long-term return.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.