“These are not the investments your portfolio manager chooses for the Fund. A wildly fluctuating dollar selling for 40 or 50 or 60 cents will always remain more attractive – and far less risky. As for my loneliness at the lunch table, it has always been a maxim of mine that while capital raising may be a popularity contest, intelligent investment is quite the opposite. One must therefore take some pride in such a universal lack of appeal.”

Although it now seems to be an old-fashioned notion, buying a share in a company used to be considered as an act of buying ownership of a future stream of income from a business. A sound investment strategy was thought to be one that tried to pay less than the net present value of that income stream in order to provide the investor with a reasonable return and a margin of safety. Today, investing for many seems to be focused on paying significantly more than the intrinsic value of a business in the hope that they can sell it on to ‘a greater fool’ at an even higher price. As the Robinhood traders in Gamestop have just discovered, however, that can go badly wrong when the music stops, and you are left holding a share priced at significantly more than it is worth with no-one willing to buy it from you.

It should be self-evident that there is an inverse correlation between the price you pay for that future stream of income and the return you get on it. To keep matters simple, let’s use just one income payment of £1 in five years’ time. If you pay 33p for it today, your return is 25% p.a. If you pay 75p your return is 6% p.a. and if you pay £1.1 your return is -2% p.a.

One thing that should jump out from this is that lower interest rates do not make that stream of income more valuable. There is no change in the £1 that you receive in five years’ time. When you hear people say that high share prices are “justified by lower interest rates”, what they are really saying is that the very low return expected from buying shares at high valuations looks acceptable relative to the very low return that you could get from owning bonds at very low yields. It does not mean you should expect the long run average return from equities if you buy them at high valuations, in fact you should probably expect to earn considerably less.

Valuing equities would be simple if we had just one payment and we knew with certainty its value in five years’ time but of course that is not the case. Whilst assumptions have to be made about future growth rates and terminal values, it is worth remembering that your returns as an equity investor come from income, plus growth, plus any change in valuation during your holding period. If you buy a stock on a 5% dividend yield, that grows its dividend at 3% and get no rerating, your return is 8%.

Conversely, if you buy a stock on a 1.5% dividend yield, even if it grows at 4% p.a. your return is 5.5% p.a. but if it just de-rated to 2% at the end of the five year period, your return is zero, i.e. that small de-rating is enough to wipe out all of the five years of 5.5%.

There are two lessons from this; 1) Investors often underestimate the extent to which their returns can be harmed by de-rating and 2)Re-rating is not a sustainable source of returns, once a share has rerated from a 4% yield to a 1% yield, there isn’t that much farther to go.

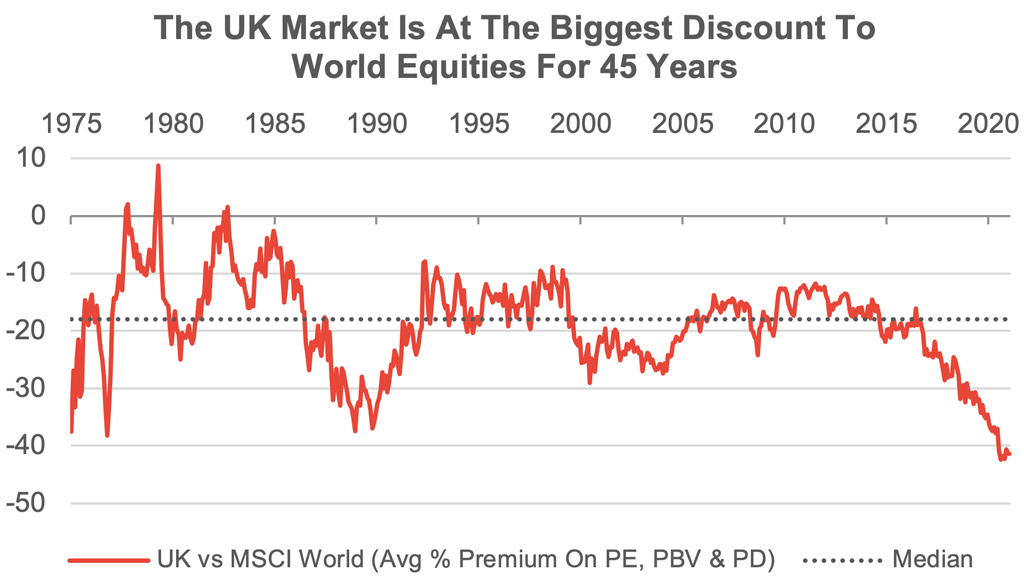

- Switching out of the UK to US equities or global equities

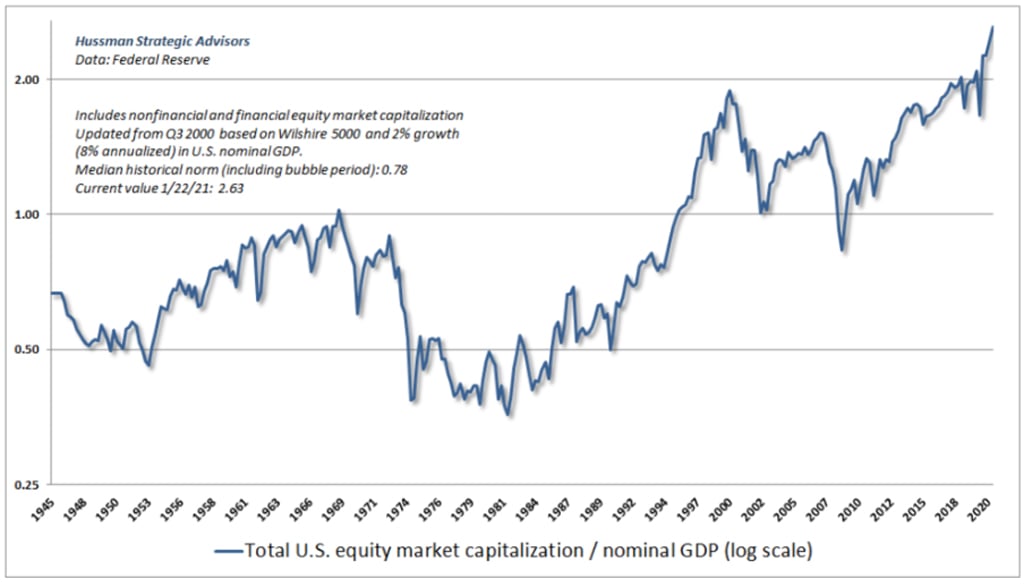

Source: The Speculative V by John Hussman, January 2020.

Source: RWC Partners, 31st December 2020.

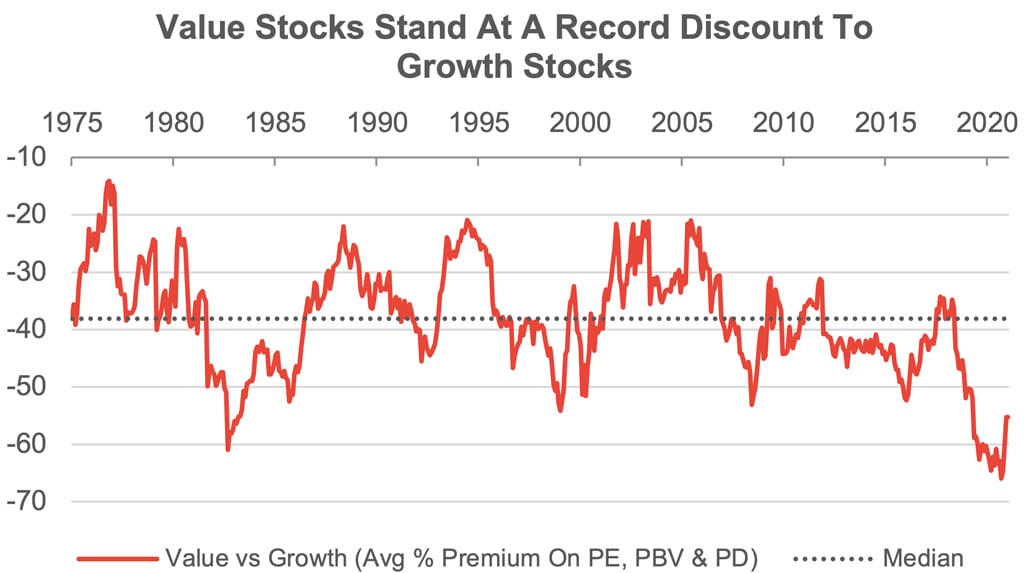

2. Switching out of Value into Growth funds[5].

Source:RWC Partners, 31st December 2020.

Conclusion

[1] https://acquirersmultiple.com/2018/08/michael-burry-risk-is-not-defined-by-volatility/

[2] Equity funds were the best-selling asset class in December 2020 with £2.5bn in net retail sales, buoyed by strong inflows into Global equity funds of £1.5bn. Funds investing in North America were the second most popular by region, taking in £504m.

[3] The Speculative V by John Hussman January 2020

[4] Superinvestors and the Art of Wordly Wisdom interview with John Hussman Jan 2021.

[5] ‘Meanwhile, the worst-selling Investment Association sector in December 2020 was UK Equity Income with an outflow of £501m, as the UK remained out of favour. Overall, UK funds saw net retail outflows of £845m’. Investment Week 4 Feb 2020.

[6] See, for instance, GMO, Research Affiliates or Hussman Advisors.

[7] See for instance ‘Do emotions overwhelm probability in decision making’ by Joe Wiggins April 2017.

The term “RWC” may include any one or more RWC branded entities including RWC Partners Limited and RWC Asset Management LLP, each of which is authorised and regulated by the UK Financial Conduct Authority and, in the case of RWC Asset Management LLP, the US Securities and Exchange Commission; RWC Asset Advisors (US) LLC, which is registered with the US Securities and Exchange Commission; and RWC Singapore (Pte) Limited, which is licensed as a Licensed Fund Management Company by the Monetary Authority of Singapore.

RWC may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. RWC seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by RWC are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

This document has been prepared for general information purposes only and has not been delivered for registration in any jurisdiction nor has its content been reviewed or approved by any regulatory authority in any jurisdiction. The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by RWC; or (iv) an offer to enter into any other transaction whatsoever (each a “Transaction”). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party.

RWC uses information from third party vendors, such as statistical and other data, that it believes to be reliable. However, the accuracy of this data, which may be used to calculate results or otherwise compile data that finds its way over time into RWC research data stored on its systems, is not guaranteed. If such information is not accurate, some of the conclusions reached or statements made may be adversely affected. RWC bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction. Any opinion expressed herein, which may be subjective in nature, may not be shared by all directors, officers, employees, or representatives of RWC and may be subject to change without notice. RWC is not liable for any decisions made or actions or inactions taken by you or others based on the contents of this document and neither RWC nor any of its directors, officers, employees, or representatives (including affiliates) accepts any liability whatsoever for any errors and/or omissions or for any direct, indirect, special, incidental, or consequential loss, damages, or expenses of any kind howsoever arising from the use of, or reliance on, any information contained herein.

Information contained in this document should not be viewed as indicative of future results. Past performance of any Transaction is not indicative of future results. The value of investments can go down as well as up. Certain assumptions and forward looking statements may have been made either for modelling purposes, to simplify the presentation and/or calculation of any projections or estimates contained herein and RWC does not represent that that any such assumptions or statements will reflect actual future events or that all assumptions have been considered or stated. Forward-looking statements are inherently uncertain, and changing factors such as those affecting the markets generally, or those affecting particular industries or issuers, may cause results to differ from those discussed. Accordingly, there can be no assurance that estimated returns or projections will be realised or that actual returns or performance results will not materially differ from those estimated herein. Some of the information contained in this document may be aggregated data of Transactions executed by RWC that has been compiled so as not to identify the underlying Transactions of any particular customer.

The information transmitted is intended only for the person or entity to which it has been given and may contain confidential and/or privileged material. In accepting receipt of the information transmitted you agree that you and/or your affiliates, partners, directors, officers and employees, as applicable, will keep all information strictly confidential. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information is prohibited. The information contained herein is confidential and is intended for the exclusive use of the intended recipient(s) to which this document has been provided. Any distribution or reproduction of this document is not authorised and is prohibited without the express written consent of RWC or any of its affiliates.

Changes in rates of exchange may cause the value of such investments to fluctuate. An investor may not be able to get back the amount invested and the loss on realisation may be very high and could result in a substantial or complete loss of the investment. In addition, an investor who realises their investment in a RWC-managed fund after a short period may not realise the amount originally invested as a result of charges made on the issue and/or redemption of such investment. The value of such interests for the purposes of purchases may differ from their value for the purpose of redemptions. No representations or warranties of any kind are intended or should be inferred with respect to the economic return from, or the tax consequences of, an investment in a RWC-managed fund. Current tax levels and reliefs may change. Depending on individual circumstances, this may affect investment returns. Nothing in this document constitutes advice on the merits of buying or selling a particular investment. This document expresses no views as to the suitability or appropriateness of the fund or any other investments described herein to the individual circumstances of any recipient.

AIFMD and Distribution in the European Economic Area (“EEA”)

The Alternative Fund Managers Directive (Directive 2011/61/EU) (“AIFMD”) is a regulatory regime which came into full effect in the EEA on 22 July 2014. RWC Asset Management LLP is an Alternative Investment Fund Manager (an “AIFM”) to certain funds managed by it (each an “AIF”). The AIFM is required to make available to investors certain prescribed information prior to their investment in an AIF. The majority of the prescribed information is contained in the latest Offering Document of the AIF. The remainder of the prescribed information is contained in the relevant AIF’s annual report and accounts. All of the information is provided in accordance with the AIFMD.

In relation to each member state of the EEA (each a “Member State”), this document may only be distributed and shares in a RWC fund (“Shares”) may only be offered and placed to the extent that (a) the relevant RWC fund is permitted to be marketed to professional investors in accordance with the AIFMD (as implemented into the local law/regulation of the relevant Member State); or (b) this document may otherwise be lawfully distributed and the Shares may lawfully offered or placed in that Member State (including at the initiative of the investor).

Information Required for Distribution of Foreign Collective Investment Schemes to Qualified Investors in Switzerland

The representative and paying agent of the RWC-managed funds in Switzerland (the “Representative in Switzerland”) is Société Générale, Paris, Zurich Branch, Talacker 50,

P.O. Box 5070, CH-8021 Zurich. In respect of the units of the RWC-managed funds distributed in Switzerland, the place of performance and jurisdiction is at the registered office of the Representative in Switzerland.