You have been investing through a lot of market volatility since starting your career at the dawn of the ‘90s, what still surprises you about markets?

Repetition of the same mistakes.

As James Grant famously said: “Progress is cumulative in science and engineering, but cyclical in finance”.

What is different about this field compared to say science and engineering is how we learn: the latter often learn via compounding and more of a staircase approach, but with investors, we often learn cyclically (basically not at all), so it cannot be argued as much that we are facing new phenomena.

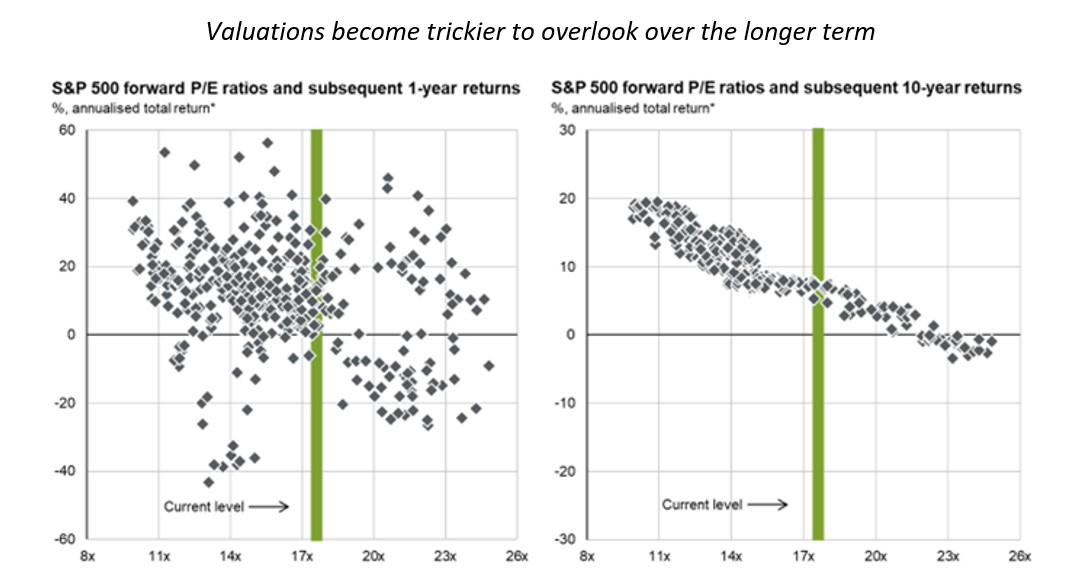

Currently we are still seeing a familiar disconnect between fundamentals and valuations, and a reluctance to detach from market darlings and the crowd. We work in an industry that often likes to shroud itself in complexity, and this can sometimes mean that investors forget the crux of what matters when it comes to achieving longer term gains.

My arty side contrasts this with painting a portrait: it forces you to think of the most important aspects that define a face to ensure that not only the face, but the emotion, comes to life on canvas. Valuation is typically a key feature that defines returns but often seems to barely feature in investors’ portraits.

Source: JP Morgan Asset Management as at 31/10/23. Monthly data points since 1988. Past performance is not a guide to future results.

With higher interest rates, what do you think this will mean for investors, and how do you think this will impact the Redwheel Global Equity Income Strategy?

Many central banks are holding rates higher to decisively break inflation. This could bring about recession, but investors are largely expecting a Fed pivot sooner than later, though this could reignite inflation.

In a recession, investors will likely need companies that can suffer, such as the defensive bond proxies often seen within consumer staples and health care. If inflation returns, this is where quality companies with pricing power should excel. No one can know for certain, but either way, with the departure from QE and ultra-low rates, valuation will likely no longer be as easily overlooked.

We believe this backdrop should be more conducive to allowing our Strategy – with its focus on quality companies purchased with a valuation discipline that have the ability to suffer and protect their dividends – to demonstrate its strengths in compounding income over capital gains to drive longer-term returns.

What should investors be asking their global equity income managers?

How does the strategy generate total return?

Given the easy money backdrop markets arguably enjoyed for over a decade, some equity income strategies have shifted more towards driving their total return through capital growth rather than compounding income – it can make it seem like equity income is yet another sector trying to do capital growth.

But this is particularly bizarre when put in the context of where we are now, at a time when the backdrop has returned to a more normal environment, one of cycles and volatility, meaning that over time capital growth is becoming harder to come by.

Investors use equity income strategies to deliver a differentiated return profile to that of a traditional (and now popular) growth approach. Investors need to discern whether their equity income manager does actually do something different or is simply playing the same game as their other managers.

It has been three years of the Strategy at Redwheel, what has the move been like?

The culture of a business matters dramatically – even more than we appreciated. We have been enjoying the freedom of responsibility at Redwheel, including from the extensive level of ownership over our Strategy, that deeply aligns our interests with clients, and extends to autonomy in how we leverage in-house resources, such as sustainability expertise, to enhance our investment activities.

With the Strategy, luck has lots to do with the early days of its journey. It was certainly an interesting time to start the Strategy at Redwheel amid the COVID-19 pandemic, but it has allowed the Strategy to demonstrate what it does; in that through it all, maintaining a focus on quality companies with the ability to suffer helps mitigate downside capture.

This has also meant that while a handful of names have dominated markets, our valuation discipline has limited our exposure, but we believe the return of cycles and volatility should see greater scrutiny on valuations and a realignment of what matters when it comes to generating returns for the longer term.

Managing the Strategy is a team effort – tell us about your partners in the Team

Right from university I was aware that I am no cleverer than others and the power of a team approach in solving a problem. My best friend and I were on the same course and each revised half and taught each other the other half so we didn’t have to individually revise in full. For me, teamwork is ultimately about the ability to trust and the ability to ask for help.

The Team has been built up over time as a team of generalists where we combine our own individual strengths and skills so that 1 x 4 is more than just 4. Whether that be eagle-eyed accounting dexterity, a proclivity to learn from others’ experiences, the ability to make sense out of nonsense, and a shared respect of our trusty biscuit tin.

Ultimately, trust and collaboration are the foundations of the Team: we all know we need each other and enable each other to be at our best.

As a big fan of quotes, what piece of borrowed wisdom has stayed with you?

This one quite literally stays with me – it has been a firm feature on my desk:

“The object of life is not to be on the side of the majority but to escape finding oneself in the ranks of the insane” – Marcus Aurelius

This, for me, sums up life, and when applied to investing, it’s not about needing to be contrarian simply for the sake of it; in order to make money, it’s about avoiding getting caught up in the herd at the wrong point in time. The herd can certainly be right, but when it comes to extremes, that’s when you have to be especially wary.

This is where having imbedded disciplines in the investment process can help, as no one is immune from making mistakes, but we have found that the yield and valuation disciplines in our Strategy have helped keep our focus on building returns for the longer term.

Outside of financial investments, what would you recommend as an investment?

A treat for yourself every day. It could be as simple as sitting for 10 minutes on a park bench, a slice of apple pie, a hug with a loved one, even going to bed early – or not! Ultimately, life often comes down to perspective, and this can help with keeping perspective, as well as with investing in trying to be optimistic.

“The optimist proclaims that we live in the best of all possible worlds, and the pessimistic fears this is true” – James Branch Cabell

Lastly, we couldn’t bring this to a close without a nod to any hidden talents: what would you be if you weren’t a portfolio manager?

A theatre set designer: although these days my arty side tends to be more confined to whimsical illustrations (i.e. doodles!) of market concepts, I am always blown away when I go to the theatre with what the set designers can create. It’s as if they combine art with magic!

Not that it’s time for a change – investing may not have as much charm, but it’s still an art with its own fair share of theatrics!

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.