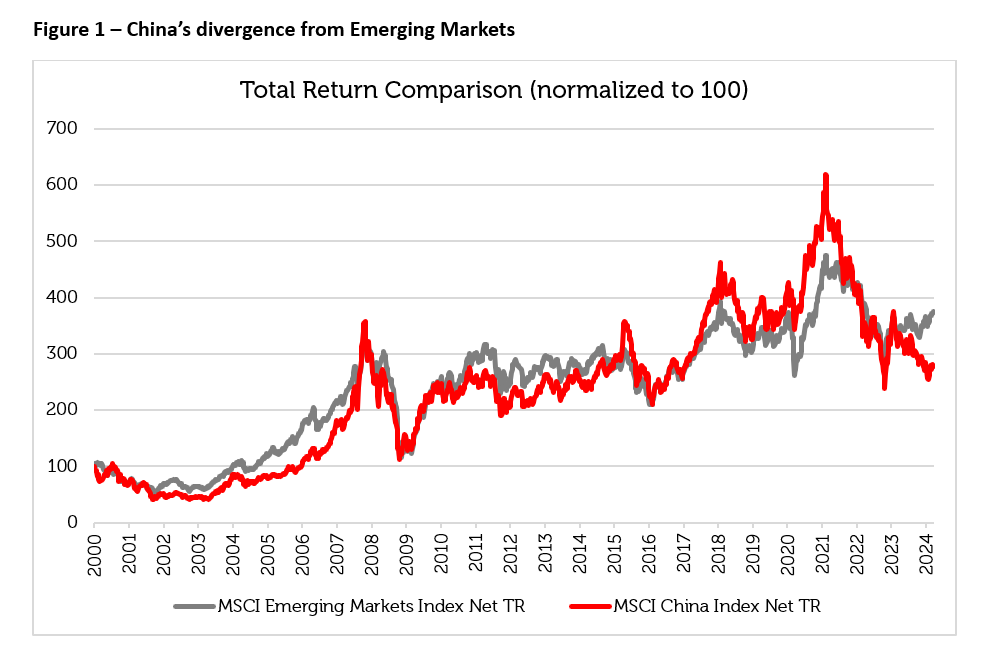

It seems that many investors have almost forgotten about China’s five-year bull run from February 2016 to February 2021, when the MSCI China Index gained over 100% in dollars, at a compound growth rate of over 15% per annum. The MSCI China technology sector posted even more impressive gains of over 30% per annum over the same period.

Since 2021, however, emerging markets in general – and China in particular – have been in the grip of a bear market. The reasons for the decline include the gradual withdrawal of fiscal stimulus and tightening of global monetary policy since the COVID-19 pandemic. China has also suffered from some of its own unique difficulties.

Causes of the bear market

Externally, the United States has imposed trade tariffs and technology restrictions that have curbed trade with China and reduced direct investment from the west. Domestically, China has imposed a variety of regulations on e-commerce, education, entertainment, finance and gaming companies with the aim of sharing wealth more equally between customers, shareholders and suppliers. These measures have hurt profitability for many listed companies. The drive to reduce dependence on debt in the property sector has reduced liquidity and slowed the growth in a key area of the Chinese economy. The decline in the rate of growth and profitability over the past three years has contributed to an equity bear market.

Source: Bloomberg, Redwheel as of 31 March 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

Depressed valuations

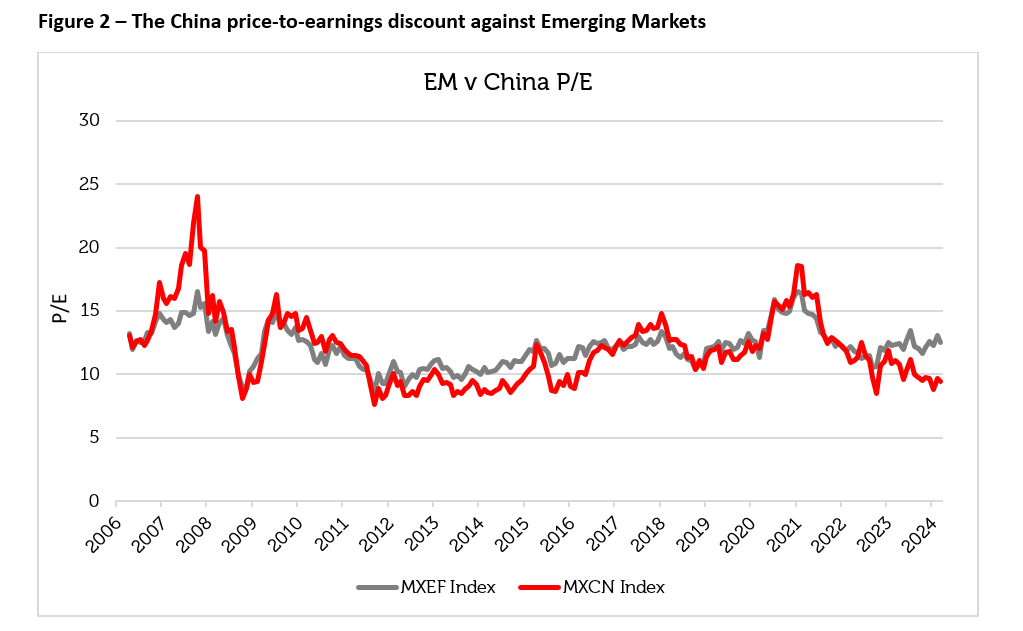

The fall in share prices since early 2021 means that MSCI China’s equity index is now attractively valued in both relative and absolute terms, in our view. From trading at a premium P/E ratio of over 20 in 2007, Chinese equities are now at a discount to the rest of EM with a valuation below 10 times forward earnings, close to the trough valuations of 2011 – 2015 from which the market subsequently recovered.

Source: Bloomberg, Redwheel as of 31 March 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results. No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

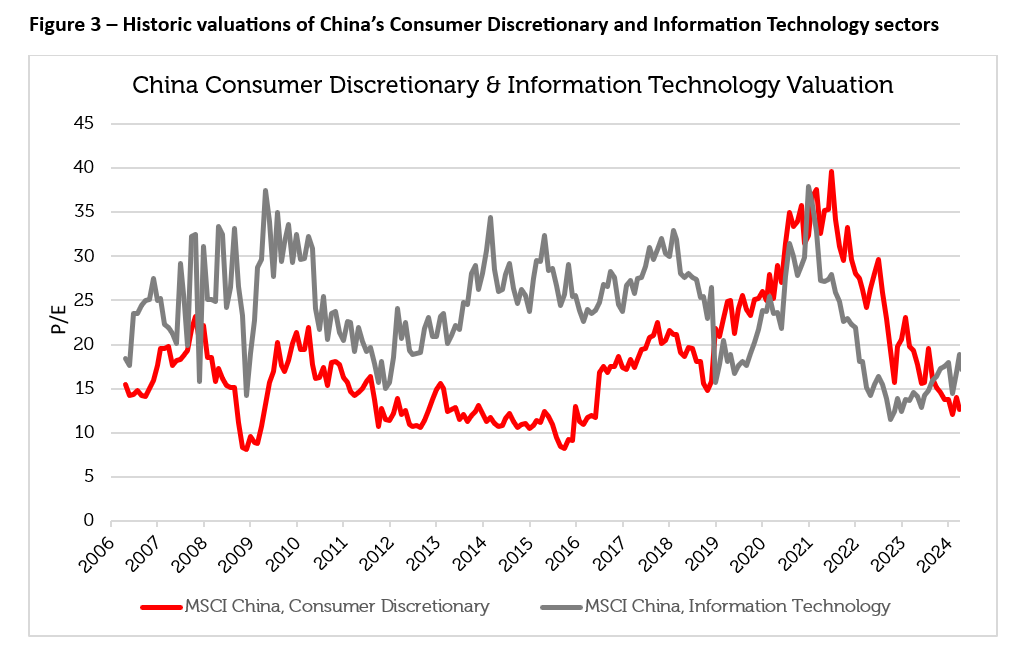

The Chinese equity market now has many attractively valued industry sectors. The Energy, Financial, Industrial and Real Estate sectors all trade on single-digit P/E multiples, with Real Estate and Financials showing dividend yields in the range of 7% – 8% (source: Bloomberg, Redwheel). High quality growth companies in the Consumer Discretionary and Technology sectors have on average experienced a halving of their valuations to levels seen only in periods of crisis, such as the Global Financial Crisis of 2008. Valuations have historically rebounded from these depressed levels.

Source: Bloomberg, Redwheel as of 31 March 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

China’s economic recovery and transformation

The Chinese equity market now requires patience for low valuations to result in better long run returns. The catalyst for the recovery might be new policy stimulus that the Chinese government has typically turned to during economic and financial downturns. First, on the monetary side, the People’s Bank of China has gradually reduced reserve requirements and interest rates to support aggregate demand. Second, specific actions have been designed to support the property market, including a reduction in down-payments, lowering mortgage rates and providing liquidity support to debt-constrained property developers. Third, the Chinese government explicitly wishes to boost domestic consumption in order to reduce reliance on exports and property development as the engines of growth. Policies were announced at the National People’s Congress (NPC) in March 2024 to promote higher sales of consumer durables, including the provision of credit, subsidies and trade-ins for automobiles and domestic appliances.

In the medium term, one of China’s goals is to redirect economic development towards the higher value-added manufacturing and technology sectors including electric vehicles, renewable energy production, smart appliances and services. The aim is to move away from fabricating low margin commodity products that China has relied on since joining the WTO in 2001, and towards a skills-based economy like Germany, which would raise both living standards and corporate profitability.

The successful implementation of short-term financial and monetary stimulus, together with long -term economic reform, would likely help China to narrow the current 30% valuation gap with the rest of Asia. Even now, we see Chinese companies demonstrating better profitability than the rest of the region. To illustrate, the MSCI China Index shows a higher Return on Equity (ROE) than the MSCI Asia ex-Japan Index, yet trades at a 30% P/E discount to the Asian index (Source: Bloomberg, Redwheel 26 April). In our view, economic renewal and stimulus should allow the equity market to re-rate as it has done from these levels in the past.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.