One of the most powerful ways that a country can develop its internal resources and realise its true long-term potential is through the development of an urbanised working population. This requires investment in manufacturing capabilities to encourage labour away from its agrarian roots and towards a developed, salaried existence. Urbanisation drives consumption as local economies grow and consumers look to increase spending in property and durable goods such as cars and appliances.

China represents one of the most striking examples of this transformation. Its manufacturing capacity has grown exponentially over the last 25 years, creating enough jobs to lift 750 million people out of poverty and into urban life. Over the same time period its share of global manufacturing has risen from 4% in 2000 to an extraordinary 24% today.

Source: World Bank and the United Nations Statistics Division

China passes the baton

China’s economic success means that its labour prices have risen significantly over time and is no longer the cheapest manufacturing location on a global basis. Meanwhile, the imposition of trade tariffs has made China less competitive and the covid pandemic has shone a light on the problems that can arise from having supply chains too concentrated in one place.

As a result, the world is now starting to diversify away from its manufacturing reliance on China with new factories being built in other parts of the emerging world. Many companies are looking to new economies in which to expand their production centres for the next two decades. The countries that appear best placed to benefit from this diversification are the next generation emerging markets.

Countries that can demonstrate a benign political backdrop, along with attractive demographics and good infrastructure are seen as attractive destinations for investment. This has led to the next generation emerging markets of South-East Asia becoming popular alternatives for manufacturing investment, along with countries in Eastern Europe and North Africa such as Romania and Morocco.

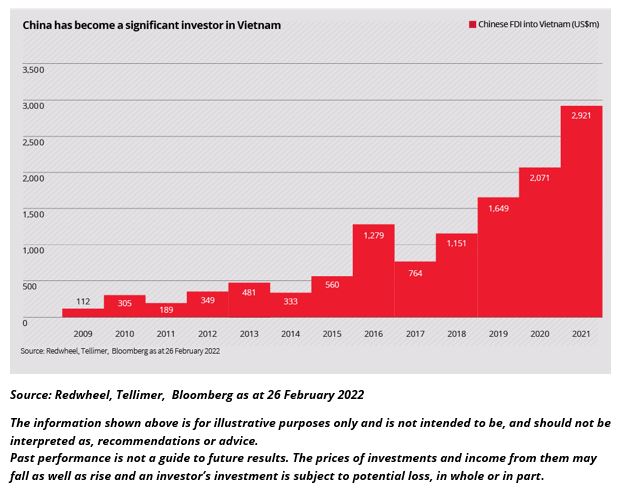

Importantly, it is not just Western companies that are embracing this trend. Chinese firms are often at the forefront of investment into these new manufacturing locations as they strive to remain cost-competitive on the international stage and fulfil a long-held desire to move up the economic value chain. Chinese investment into Vietnam has increased dramatically in recent years and it is also one of the biggest investors into the Bangladeshi textile industry.

Following the well-trodden path

Vietnam is an excellent case study of an economy currently on the well-trodden path of manufacturing growth. It has been attracting significant investment into labour-intensive manufacturing industries due to tax incentives, an inexpensive and young labour force and more recently, an effective strategy for handling the covid pandemic.

Over the last decade, the electronics giant Samsung has moved a large portion of its electronics manufacturing from South Korea and China to Vietnam. The company has invested almost $20bn in Vietnam and currently operates six factories along with a research and development centre in the country. Today, Vietnam accounts for nearly half of Samsung’s mobile phone production globally and in turn Samsung accounts for nearly a fifth of all Vietnam’s exports.

Source: Samsung Company Reports, Redwheel as at 31 March 2022

We believe that Vietnam has the potential to follow a similar path and replicate the success of what we saw in China twenty years ago. We can get exposure to this secular trend directly by investing in infrastructure and manufacturing companies or indirectly through companies benefitting from rising consumption, financial inclusion and property development.

For example, Hoa Phat Group is the largest steel manufacturer in Vietnam with a thirty percent market share. The company has seen robust sales growth as it has ramped up its Dung Quat expansion facility. This is now translating into meaningful cash flow improvements for the business and we see the company as a key beneficiary from continued inward investment in manufacturing infrastructure.

Source: Hoa Phat Group Company Reports and Bloomberg as at 31 March 2022

Another example of the on-going shift of manufacturing into next generation emerging markets is found in automobile production. Romania, the Czech Republic and Morocco now produce more passenger vehicles than more developed economies such as Italy. Companies such as Peugeot, Renault and Jaguar Land Rover have all shifted production to lower cost locations and we expect this trend to continue.

Chain reaction

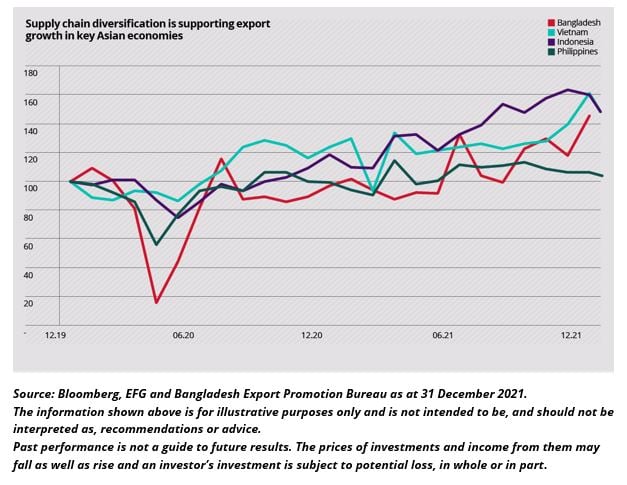

Strong inward investment in manufacturing capabilities has clear direct benefits, as highlighted by the export growth chart above. It can kickstart a positive virtuous circle by improving trade current accounts and government finances which in turn can stimulate further inward investment and employment.

Meanwhile, as workers receive higher wages and companies increase profits, domestic consumption will rise enabling a greater uptake of financial products. These are very powerful indirect benefits, which multiply the economic value of every incremental dollar of inward investment.

This multiplier effect leads to broader investment opportunities within these economies. Vincom Retail is the largest developer of shopping malls in Vietnam and we believe it looks exceptionally well-placed to continue to benefit from rising disposable incomes and an exponential increase in formal retail penetration in the country.

Back to the future

The Asian “Tiger” economies of Hong Kong, Singapore, South Korea and Thailand enjoyed rapid growth as they developed outsourced manufacturing and grew employment in the 1980s and 90s. China then took over the helm as the world’s low-cost manufacturer and underwent a similar industrial transformation, growing its manufacturing capacity exponentially since the early 2000s.

This is why we call the development of a manufacturing economy and an urbanised workforce a well-trodden path. We have seen it before and we should see it again. With the world looking to diversify its supply chains not only in search of lower cost manufacturing but also in an attempt to reduce its reliance on China, the next generation emerging market economies are in a good position to benefit.

Vietnam is at the forefront but other Asian economies such as Bangladesh, Indonesia and the Philippines, look well-positioned to attract continued inward investment as they develop strong manufacturing bases and further employment. Elsewhere in the world, Morocco, Kenya, Peru, Colombia, Romania and Hungary look similarly well placed.

The fact that so many of these economies are under-researched, misunderstood and frequently ignored by many investors adds to the long-term appeal for us as long-term investors. The combination of these factors has led to attractive valuations while economic growth remains higher than in other regions of the world. These factors make us confident about the prospect of continued success for the Redwheel Next Generation Emerging Markets Strategy.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.

Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.