We believe the conditions are in place for the start of the next commodity “super-cycle”. The global drive to acknowledge and tackle the climate crisis will require a massive electrification and decarbonisation programme and should create significant demand for certain commodities for decades to come. Here we take a look at the potential winners and losers of the next commodity super-cycle, taking into account the lessons of history.

Mining is a notoriously cyclical industry due to its capital intensity and the length of time it takes to build new capacity. This means that if demand rises unexpectedly, prices can remain elevated for several years before additional supply can be brought into production. Conversely, if demand falters, mining companies can be forced to delay future investment ambitions well into the next cycle.

Occasionally, several factors combine to trigger a super-cycle which results in a sustained increase in the price of certain commodities for many years, sometimes more than a decade. These events tend to follow a prolonged period of sluggish demand and several years of lean capital expenditure within the mining industry.

The last commodity super-cycle occurred early in the new millennium which was driven by China’s infrastructure boom. After nearly twenty years of commodity price stagnation, this created an enormous rise in the demand for certain commodities such as oil, iron ore, copper and steel. The ensuing price rises in these commodities were beneficial to those economies that exported them; however, they also created substantial problems for consumers in other parts of the world. We see some parallels from history in today’s commodity markets, but it is important to recognise that every cycle also has its own unique characteristics and drivers. We believe this cycle will be driven by the green wave.

The green wave

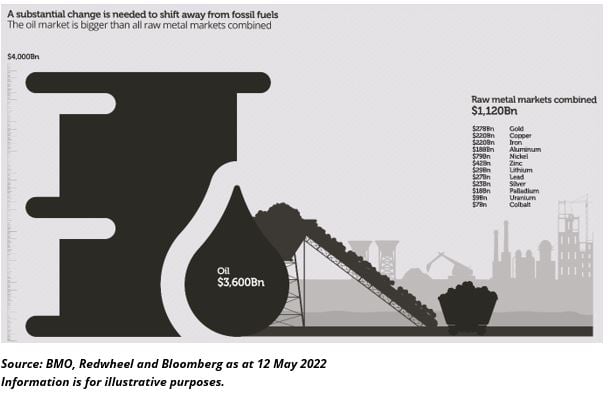

As we have seen at COP-26 and other major global environmental events in recent years, there is extraordinary global momentum behind the desire to do something about the climate crisis. We need to reduce our reliance on fossil fuels quickly and diversify away from an overly concentrated supply of energy before it is too late. Amongst other things, this should mean producing more energy renewably, through wind, solar power and hydrogen, and phasing out the combustion engine in favour of electric transportation.

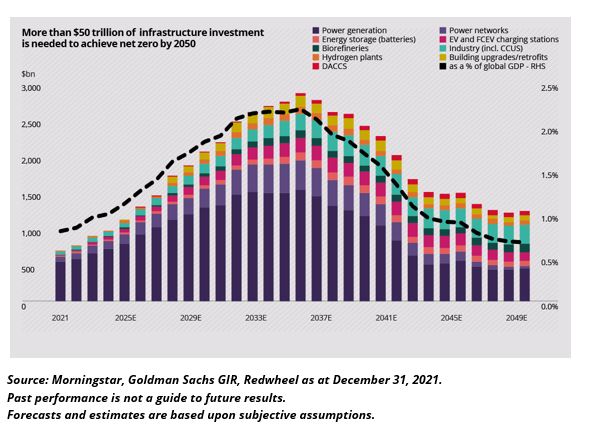

We need an estimated $56 trillion in incremental infrastructure investment to achieve net zero carbon emissions by 2050. Certain metals, such as copper, lithium and cobalt, are essential to the success of the decarbonisation drive. Importantly, the majority of these key commodities, which should drive the next super-cycle, are located in next generation emerging markets.

Copper

Copper has become the green metal that we should all be focusing on. A three-megawatt wind turbine can contain almost five tonnes of copper, and it is also a uniquely important material in our power networks. More than a third of the world’s copper reserves are found in two South American next generation emerging markets: Chile and Peru. Meanwhile, in Africa, DRC and Zambia are becoming increasingly important suppliers of copper.

Source: U.S. Geological Survey, Mineral Commodity Summaries as at January 2022

In Zambia, First Quantum Minerals operates one of the largest copper mines globally. The company is well-placed to benefit from an appreciation in the copper price over the next decade, owing to the combination of robust demand growth and subdued supply.

Lithium

The increasing adoption of electric vehicles is a distinct demand driver for lithium and several other metals. Chile and Argentina are two of the largest producers of lithium in the world. Lithium demand is expected to potentially grow by 20-25% per annum over the next few years and we expect lithium prices to be supported by this strong demand, coupled with the typical lag of five-to-seven years in bringing new mines into production.

Source: Redwheel as at May 2022

SQM operates one of the world’s largest lithium mines in Chile and is well positioned to take advantage of this price environment. The company should see robust production growth in the year ahead, while its projects are lower cost than many of its peers.

Winners and losers

There are always winners and losers in a commodity super-cycle. Individual companies such as First Quantum and SQM can benefit from the green wave which is already gathering momentum. However, net commodity exporting countries can also benefit from an improved fiscal position, higher government spending, more internal infrastructure investment and job creation. Conversely, higher inflation also creates substantial problems for consumers in other parts of the world which import key commodities. We are already seeing these effects play out. Russia’s invasion of Ukraine has served to intensify many of the supply deficits which were already in evidence.

Overall, we look to avoid countries which are exposed to challenging consumption dynamics which accompany higher commodity prices and rising inflation. Meanwhile, we focus on the net exporters of these commodities where the supply / demand imbalance suggests a positive future pricing environment.

Looking Ahead

Although the next commodity super-cycle should bear many of the same hallmarks of those that have preceded it, we believe it will be dominated by a different selection of commodities. Copper, lithium, cobalt and other metals which are essential to the decarbonisation mission are the key beneficiaries and they are largely found in the next generation emerging markets of South America, Africa and Asia. That is why we have identified commodities as one of the three key themes which the Redwheel Next Generation Emerging Markets strategy is looking to capture.

As this concludes our three-part series of the well-trodden path to growth, the attractiveness of this diverse collection of individual businesses, across our three themes of commodities, travel & tourism, and new factories of the world, makes us confident in the long-term outlook for the Redwheel Next Generation Emerging Markets strategy. By 2050, will the next economic surprise be Kenya, Indonesia or Vietnam? It is certainly an investment path worth exploring.

Key information:

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.