When equity markets fixate on a single narrative, quality businesses are often unduly punished, creating opportunities for disciplined, value-driven investors. Occasionally, however, entire sectors can fall under the shadow of a controversy, dragging down all, including sector leaders. As patient income investors, we see this as an opportunity to upgrade the quality of our investments and capture premium yields from durable dividends.

The recent turmoil in the IT services sector, driven by concerns around the impact of artificial intelligence, has created exactly this opportunity – enabling the team to own Accenture [1], which we regard as best-in-class.

Recent historical patterns, such as those observed in fast fashion and luxury retail, show that opportunities for long-term outperformance are often forged in these moments of sector-wide repricing.

Why controversy creates opportunity

The Redwheel Global Equity Income Strategy invests in quality global businesses when they offer a premium yield to the market. This is only possible when the business is surrounded by a controversy, a moment of undue market pessimism that creates a valuation margin of safety. If the controversy looks permanent, we avoided it as the decline in the business is invariably too quick to allow for any profitable investment. If it appears temporary, then we regard it as an opportunity.

When a controversy broadens across a whole sector, it pulls all stocks, including market leaders, into the yield universe. The Strategy then has an opportunity to upgrade the quality of the business invested in for the same controversy. This improves the ability of the investment to suffer if the controversy lasts longer than expected and underpins the ability of the company to provide a durable dividend throughout. Recent examples illustrate this process.

Historical example: Inditex and the fast fashion sector

Following the pandemic, a market consensus emerged that the future of fast fashion was purely online, leading to a severe repricing of all traditional retailers.

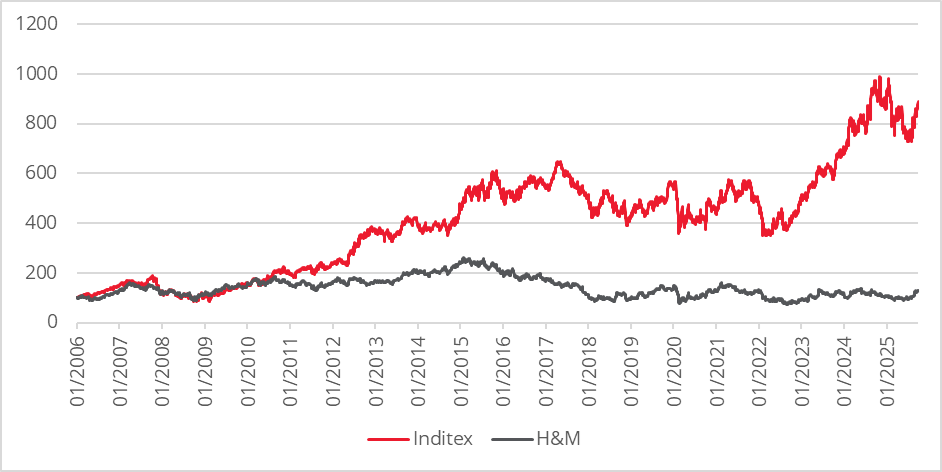

By May 2022, the share price of Industria de Diseño Textil (Inditex) had fallen below its pre-pandemic low [2], presenting an excellent entry point. The team had already established a conviction that the future would be a hybrid model and had initially invested in H&M to play this temporary controversy. The team switched the H&M holding into Inditex, a far higher quality business, to play the same controversy. Chart 1 illustrates how quality can reassert itself once the controversy fades.

Chart 1: Inditex and H&M price returns from 31/01/2006 – indexed to 100 in EUR

Historical example: LVMH and the luxury retail sector

Similarly, by mid‑2024, the market believed that luxury was ‘over’, particularly in China, and the sector derated as if structural growth had vanished. For the first time in 20 years, LVMH entered the Strategy’s yield universe, enabling an upgrade into a best‑in‑class franchise for the same sector controversy. Chart 2 illustrates how LVMH’s stronger, more resilient business model enabled it to suffer controversy better than Kering, a quality peer.

Chart 2: LVHM and Kering price returns from 31/01/2006 – indexed to 100 in EUR

The opportunity today: Accenture and the IT services sector

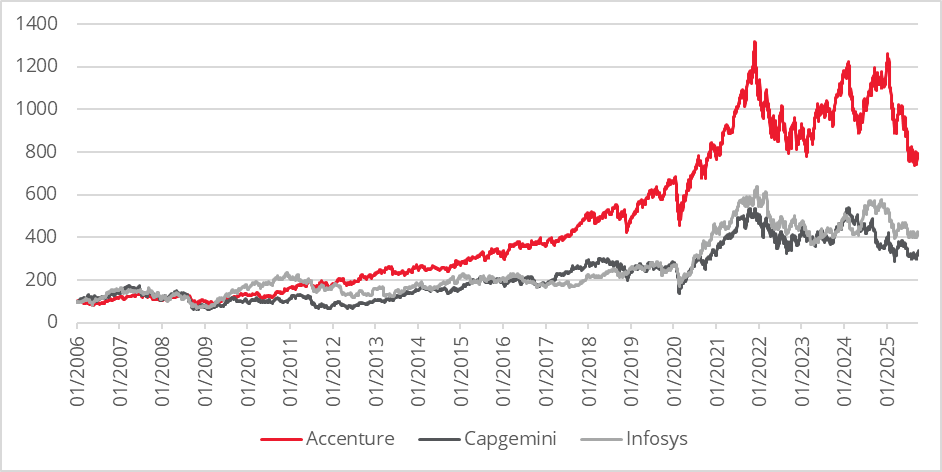

Today, a new chapter of market myopia is unfolding in the IT services sector. The narrative is that Artificial Intelligence will disrupt the entire business model, automating away both maintenance and consulting work, rendering human services obsolete. The entire sector has been repriced, with Accenture, a global leader, falling 40% from February to August 2025 [3]. Chart 3 points to the sector-wide drawdown as well as Accenture’s established leadership.

Chart 3: Accenture, Capgemini and Infosys price returns from 31/01/2006 – indexed to 100 in USD

In our view, this is a repeating pattern that supports our view that it will be temporary. There are numerous instances when technological innovation was seen as disruptive for the IT services industry. Most recently, it was predicted that cloud computing would disintermediate IT services completely; instead, it became more than half of Accenture’s revenue and continues to grow at double‑digit rates. [4]

For us, the key lesson here is that while technological innovation can increase efficiency and productivity and reduce complexity, it simultaneously creates vast new opportunities for IT businesses to add value through complex implementation and integration. The success of an AI implementation hinges on having a fit-for-purpose database, a task that requires deep consulting expertise.

Our conviction is that AI will follow the same pattern, creating more demand for IT services, not less. The market’s current obsession with the AI threat has therefore created a classic investment opportunity. We believe that Accenture is uniquely positioned to provide this new wave of more sophisticated services, turning a perceived threat into an opportunity for growth.

The 40% fall created the rare confluence of quality, yield, and valuation, allowing us to upgrade our holding from Capgemini and Infosys to the higher quality of Accenture, just as we had done in the previous historical examples.

The power of patience

Occasionally, the market’s obsession with a theme can lead to high-quality businesses being thrown out like the proverbial baby in the bathwater. This creates the precise conditions that the Strategy is designed to exploit: the ability to upgrade the quality of its holdings when the market is overreacting.

The investment in Accenture is not a bet on the speed of AI adoption, but a disciplined application of a proven process—a bet on enduring quality, sustainable cash flows, and the power of patience when others are capitulating. The Strategy’s philosophy is simple: good things come to those who wait – and then act with conviction.

Sources:

[1] Portfolio holdings are subject to change at any time without notice. This information should not be construed as a recommendation to purchase or sell any security.

[2] Bloomberg

[3] Bloomberg

[4] Company report and accounts 2025

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.