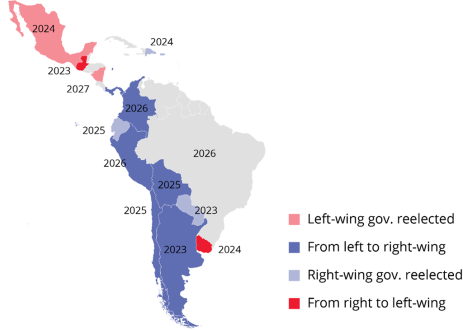

A significant political shift towards economic orthodoxy is underway in Latin America, with electorates choosing right-of-centre governments to try and improve economic conditions in their respective countries. Taken together with falling US rates, a weaker dollar and early signs of a new commodities upswing, these changes suggest that last year’s rally in Latin American equities could mark the start of a more durable re-rating.

Chart 1: Political shifts in Latin America (election years)

In 2026, elections are due in Brazil, Colombia and Peru and the shift to the right is likely to continue except for Brazil, Lula being the left-wing incumbent. In Peru, Lopez Aliaga leads a multi- candidate field.

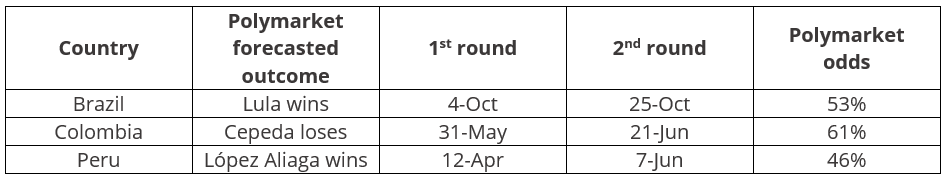

From high real rates to a virtuous circle

The return of a more conservative economic approach that emphasizes fiscal prudence, control of inflation and a relatively limited role for the State should allow high real rates of interest to come down, thereby boosting growth and providing a tailwind to equity market performance. The US Federal Reserve resumed its monetary easing in September 2025 and Latin American central banks are in a position to follow suit; Banco Central do Brasil indicated in its January 2026 meeting that it would begin to reduce its benchmark SELIC rate in March this year. [1]

Chart 2: Latin America policy rates & inflation (%)

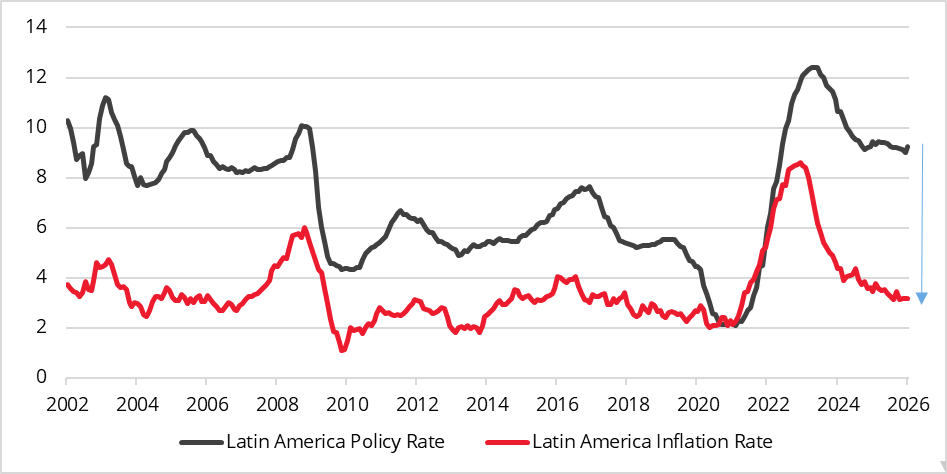

Latin America could be about to enter a virtuous circle. Lower interest rates stimulate non-inflationary growth and engender market confidence, allowing currencies to strengthen further against the US dollar. This trend began when President Trump took office in January 2025 and has become more pronounced as Republicans have implemented dirigiste economic policies with which they have not previously been associated. As investor confidence is waxing in emerging markets while waning in the US, Latin American currencies are among those appreciating against the US dollar. President Trump appeared to validate a weak dollar policy in January when he responded that the value of the dollar was “doing great” to a question about whether the currency had declined too much.[2]

Chart 3: US dollar vs Latin American Currencies Index

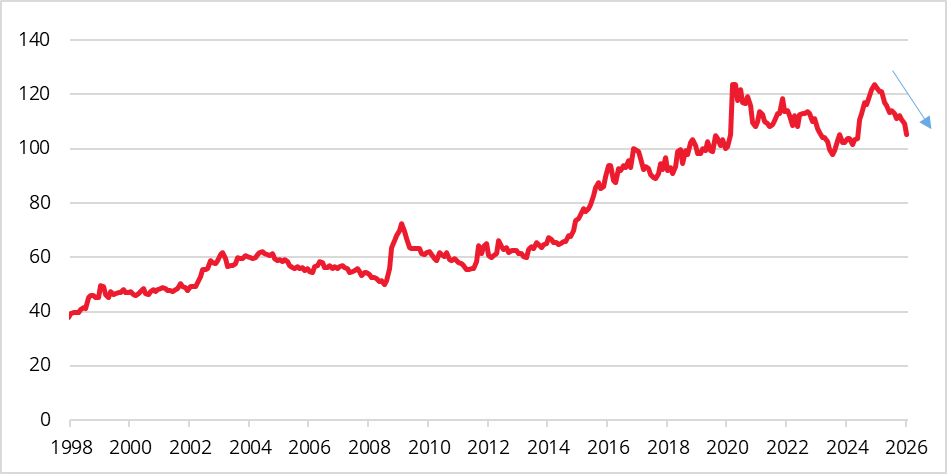

Commodities, earnings and the case for a re‑rating

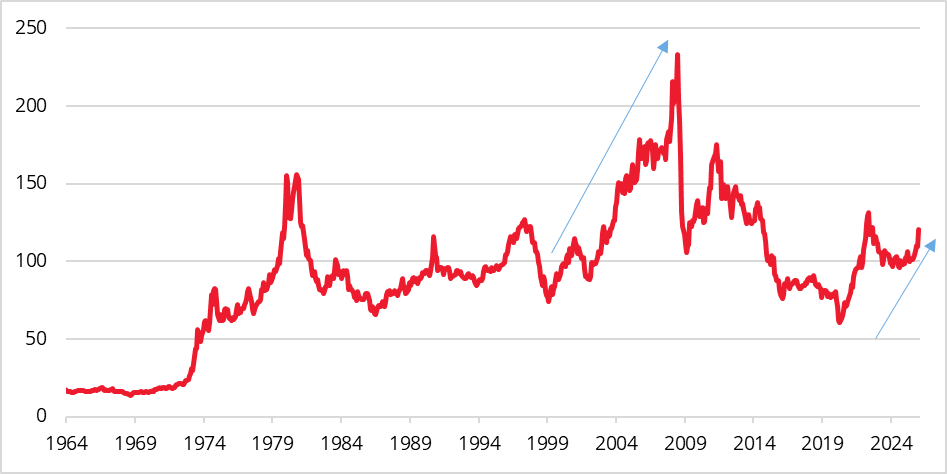

A weak US dollar also contributes to rising commodity prices, as happened in the Super Cycle of the first decade of the millennium. The Bloomberg Commodity Index, which climbed roughly 200% from its trough in 1999 to its peak in 2008, also began to recover strongly in late 2025 – but is still about 50% below its 2008 peak and could rise further.

Chart 4: Bloomberg Commodity Index

The energy and materials sectors are significant weights in the MSCI Latin America Index, accounting for almost 30% of its constituents’ free-float market capitalization;[3] this cyclical exposure is currently acting as a tailwind to Latin American corporate earnings, which have begun to inflect from their trough levels of early 2025.

Chart 5: EM policy rates v. inflation (%)

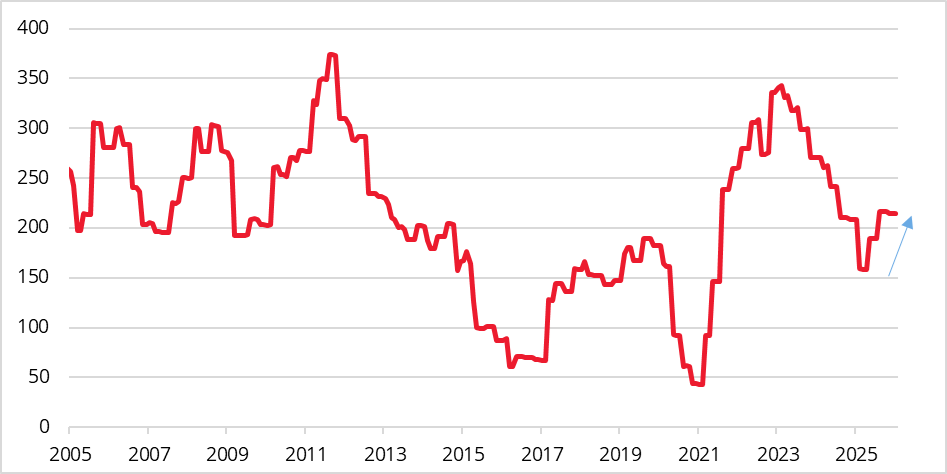

The rebound in corporate earnings and optimism over commodity prices and currencies have fuelled Latin American equity performance, with the index having risen 77% since its trough in January 2025. Nevertheless, the MSCI Latin America Index remains about 40% below its 2008 peak.

Chart 6: MSCI EM Latin America Index

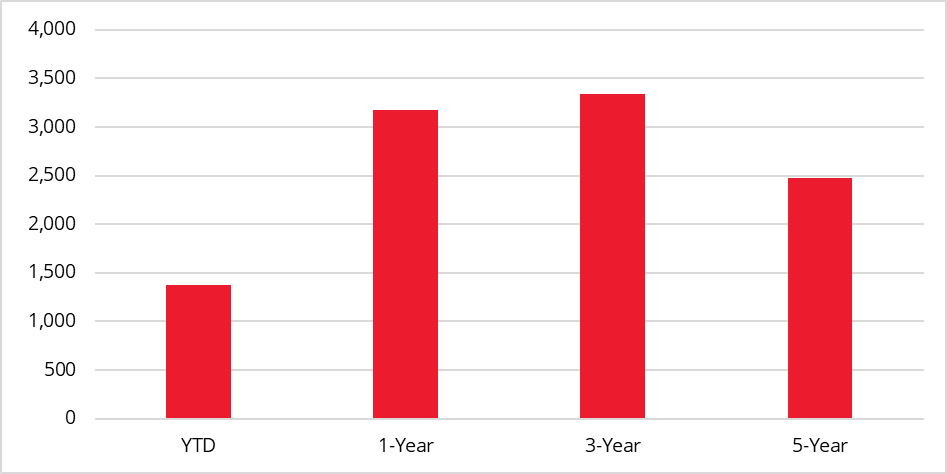

Despite strong performance, Latin American equities are only at long-run average valuations. The 12-month forward P/E multiple of 12.5 times exceeds the extremely low valuation that afflicted Latin America in the early 2020s but is below the levels seen in the teens and has room to expand with earnings growth, improving ROE and lower interest rates. Latin American equity performance has not escaped international investors, with nearly $1.5 bn of subscriptions to Latin American equity ETFs in January 2026 alone, meaning that financial flows to Latin American equities in the past year exceed commitments over the previous five, and demonstrate the return of Latin America to emerging market equity allocations.

Chart 7: Latin America ETF flows (USD, mn)

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

References

[1] Bloomberg, 28 January

[2] Bloomberg, 28 January

[3] Bloomberg, 30 January