Just over a year ago, we argued that the post-pandemic market regime—marked by higher interest rates, a broadening of equity markets beyond ‘The Magnificent Seven’ (Mag7) and macro uncertainty —was laying the foundation for a renewed era of performance for balanced convertible strategies. That thesis is no longer theoretical. It is now observable in market returns, improved deal structures and a surge in primary issuance.

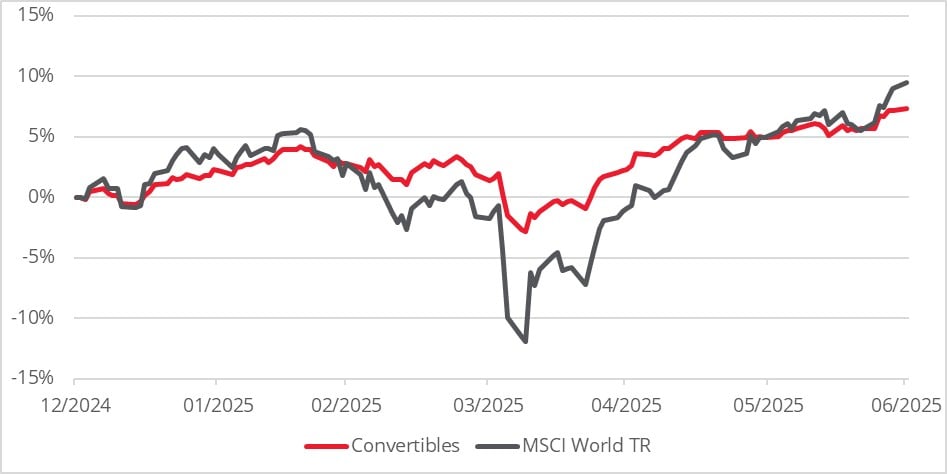

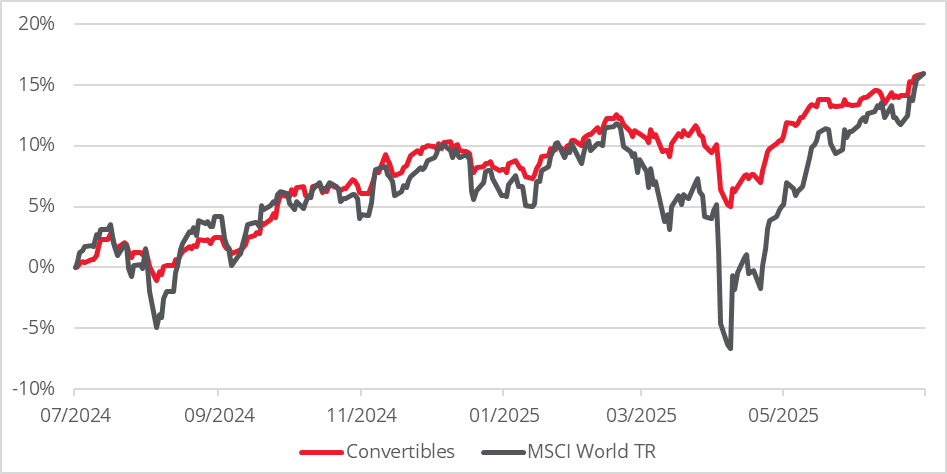

The Refinitiv Global Focus Convertible Bond index, a proxy for balanced convertibles, has delivered +7.3% YTD and +15.9% over the last year as of 30 June 2025, closely matching and even beating the performance of both the MSCI World and global fixed income indices – see charts 1 and 2 below.

This marks a meaningful departure from the muted performance of the last decade—and validates the view that convertibles, especially when approached with a balanced lens, are once again an attractive proposition for fund allocators looking to increase their risk-adjusted return.

Chart 1: Refinitiv Global Focus Hedged Convertible Bond index – YTD performance

Chart 2: Refinitiv Global Focus Hedged Convertible Bond index – 1-year performance

Higher coupons are delivering higher convexity—and better returns

A central theme in our prior outlook was that normalised income would restore the asymmetry at the heart of the asset class. This has now materialised:

– The average coupon for new issuance in 2025 is 2.5%, with a 32% conversion premium[1]. While lower than 2024, this continues to be higher than the average coupons we saw during the pandemic era.

– The investable universe also has many short-dated bonds with less than a year to maturity that offer a very attractive yield to maturity of up to 5%[2].

– These changes are not just cosmetic: they create a more robust downside cushion and enhance convexity, allowing balanced portfolios to more effectively participate in equity upside without sacrificing bond-like protection.

The re-emergence of coupon income has structurally changed the risk/return dynamics for long-only convertible investors—contributing to both absolute returns and relative resilience.

Primary market strength: volume, quality and breadth

The convertible primary market has been a standout in 2025:

– $68bn has priced in H1 alone, with the US and Asia leading in terms of volumes and deal count[3].

– Bank of America forecasts that global convertibles issuance will hit $110–120bn for the year, indicative of a strong H2 for issuance[4].

– Importantly, this isn’t just refinancing. The share of first-time issuers is the highest since 2021, indicating a broadening of the opportunity set and a more diverse issuer base.

This is a structurally supportive development. Issuers are not turning to convertibles out of necessity, but for strategic capital raising. Raising capital via convertible bonds can represent a meaningful saving in interest costs and we believe that the primary market will continue to be strong as nearly 25% of the global convertible market is due to mature in the next 18 months.

Market volatility has returned—and it’s been a tailwind

Over the past year, political, economic, and monetary uncertainty—particularly with Trump administration returning to the forefront—has driven higher realised volatility across equity markets. For convertibles, and especially balanced portfolios, this is constructive.

Convertibles are inherently designed to benefit from two-way markets. The return of volatility restores the value of embedded optionality and reinforces the role of convertibles as dynamic, convex instruments. Balanced convertible funds which look to maintain a balanced delta by selling in strong markets and buying in weaker markets benefit from this additional volatility. This dynamic was largely absent in the recent past as the market moves were very unidirectional and void of volatility leaving balanced funds unable to rebalance delta optimally.

Mag7 still dominant but the field is broadening

The equity market continues to reflect narrow leadership, but the outsized influence of the Mag7 has started to moderate. The outperformance of balanced convertibles this year occurred without material exposure to those names—demonstrating that the asset class is not reliant on mega-cap momentum to deliver results.

Many convertibles instead provide exposure to mid-cap, growth-oriented companies in technology, industrials, and real assets—segments that have been key contributors to 2025 performance. This positions balanced portfolios as effective vehicles for investors seeking equity upside, but with a more diversified and often more idiosyncratic return profile.

Rise of AI and digital currencies

We’ve seen a notable pickup in convertible issuance from companies linked to AI infrastructure, data centers, and digital assets. Roughly 10% of new paper in 2025 falls into these themes[5]—reflecting investor enthusiasm and issuers’ appetite for growth capital and while we recognise the momentum behind these sectors, many of these companies are early-stage. Hence convertibles, by design, may be the most prudent way to access such high-growth narratives. In cases where the underlying credit is good, the convertible structure can offer upside participation while preserving downside protection if the theme ultimately fails to deliver.

A recent good, example of this is the Core Scientific issue which came to market less than a year ago offering a coupon of 3%. The company has been transforming itself from a Crypto miner to an AI data center infrastructure company and since the CB issue the stock is higher by approximately 80% with the CB higher by approximately 70% as the company has become a potential buyout target[6]. At issue, the bond was offering some downside protection, but more importantly the embedded call option offered investors a meaningful way to participate to the upside, had the investment thesis played out.

We see the M&A thematic continue to play out in this sector but also more broadly, with convertible investors traditionally incrementally benefitting more from takeover ratchets embedded in the bonds.

Conclusion: a turning point realised

After a long period of muted performance, the balanced convertible strategy is not only working again—it’s outperforming. Key drivers that have moved in its favour include:

-Income has normalised

-Volatility has returned

-Equity leadership is broadening

-The primary market is expanding

-Risk-managed exposure to high-growth themes

Investors who stayed the course are beginning to reap the rewards. And for those who have remained underweight, the window to reconsider the asset class may still be open—especially as we head into a period of policy divergence, macro uncertainty, and a more discriminating equity market.

In our view, the conditions that initially underpinned our optimism remain in place—and are likely to persist into 2026. Balanced convertibles are once again a relevant and powerful tool for today’s asset allocation challenges.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

[1] Bank of America – Global Convertibles Halftime Report, June 2025

[2] Bloomberg, Redwheel, June 2025

[3] Bloomberg, Redwheel, June 2025

[4] Bank of America – Global Convertibles Halftime Report, June 2025

[5] Bloomberg, Redwheel, June 2025

[6] Bloomberg, Redwheel, June 2025