As traditional global growth engines falter and market multiples remain compressed across many developed economies, a wave of reforms – from financial system liberalisation to robust governance improvements – is transforming developing economies. Markets that once lagged global indices are now demonstrating credible steps towards transparency and competitiveness – unlocking compelling value for investors.

Against this backdrop, South Korea and South Africa stand out for their ongoing reform momentum, deepening capital markets and rerating potential.

South Korea

The Redwheel Emerging Markets Equity strategy maintains a marginal overweight in Korea at 10.9% [1], mirroring the MSCI Emerging Markets index, but concentrated in high-conviction areas, including semiconductors, banks, industrials, and ecommerce. Performance year to date supports this thesis, with the MSCI Korea Index surging 44.8% in USD terms, led by capital goods and industrials (+82.8%), financials (+53%), and Information Technology (+46%), and supported by a 5.3% appreciation of the South Korean won [2].

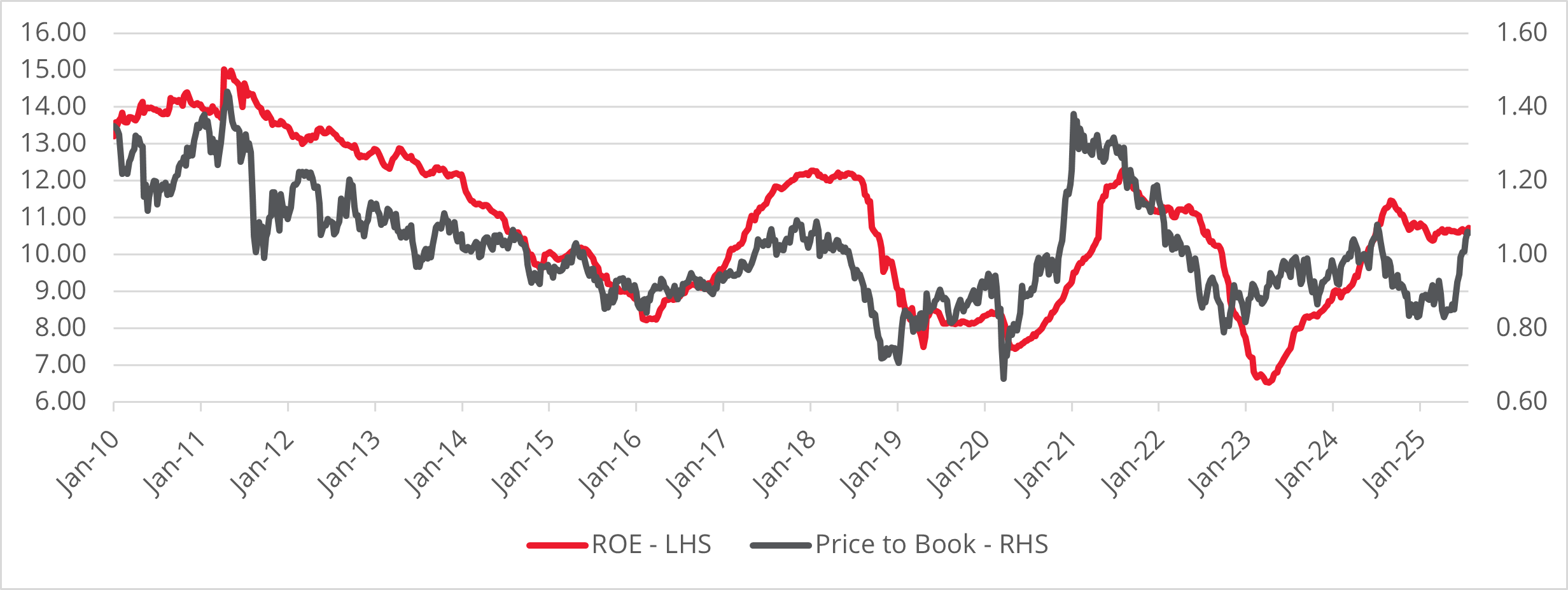

However, despite the rally year-to-date, valuations remain below historical averages with the MSCI Korea index trading at 1x price to book (P/B) for 11% return on equity (ROE) [3]. The team believes that the new prime minister’s target of driving the KOSPI index from 3072 (as of 30 June) to 5000 [4] is achievable in light of an ambitious reform program to improve equity market returns.

Chart 1: MSCI Korea index – Price to book vs return on equity

Corporate reform: Unlocking shareholder value

Korea has historically lagged in corporate governance standards compared to developed market peers. The “Corporate Value-up” program, now in its second year, aims to improve transparency, capital efficiency, and minority shareholder rights in a bid to encourage greater domestic retail participation and foreign capital flows, ultimately reducing the “Korea discount.”

A notable policy shift involves the treatment of share buybacks. Historically, companies repurchased shares and kept them as treasury stock, often for non-commercial purposes beneficial to controlling shareholders. Recent regulatory changes aim to ensure surplus capital is returned to shareholders more efficiently – either through outright cancellation of treasury shares or redistribution via dividends.

Share buybacks and cancellations typically drive earnings multiple expansion as outstanding share count is reduced relative to earnings. It is estimated that treasury shares account for a significant percentage (4%) of corporate share counts on average [5]. Share cancellations would therefore have a material impact on valuations across the country index while preventing management from using treasury shares for non-economic purposes.

Another important policy reform concerns dividend tax reduction. The draft dividend tax reduction law improves the attractiveness of dividend income and aims to cultivate a more stable and engaged investor base in South Korea’s equity market.

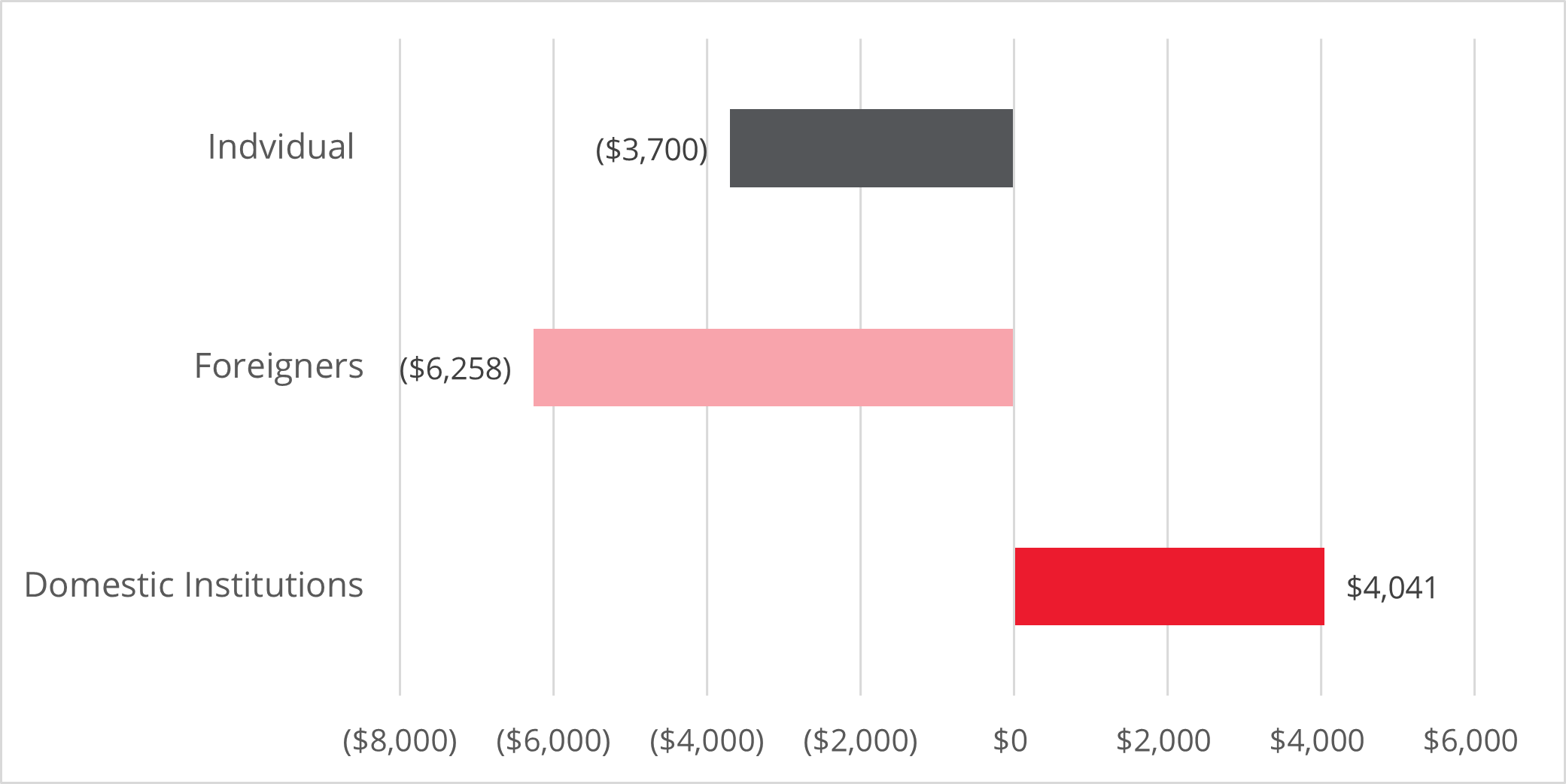

Recent flows highlight a favourable domestic reception to the reforms. The rally year-to-date was driven largely by domestic institutional flows even though foreign investors were net sellers.

Chart 2: Korea investor flows, 2025 YTD (USD millions)

Samsung Electronics: Leading reform and setting the benchmark

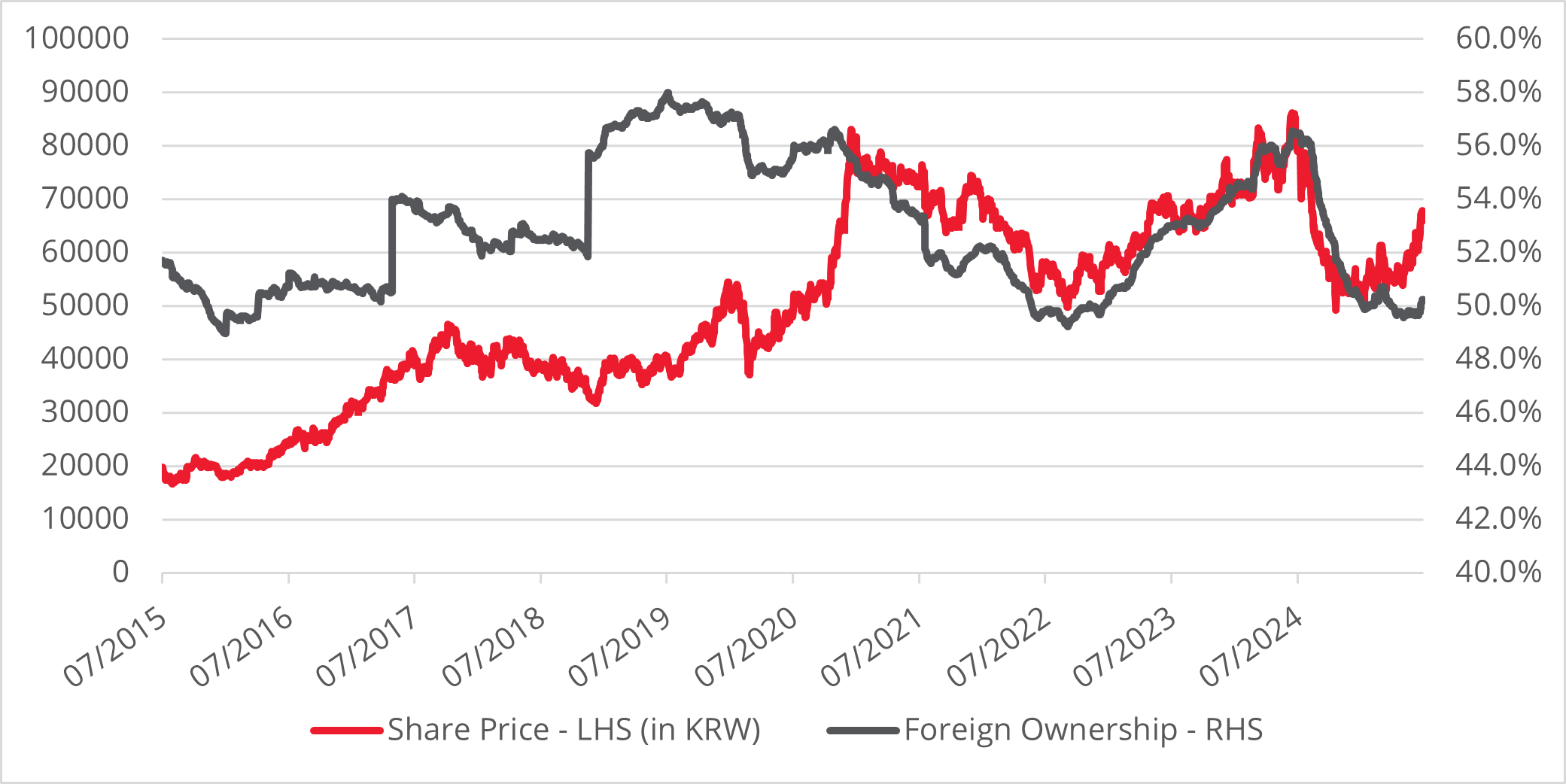

Samsung Electronics stands at the forefront of South Korea’s corporate reform. The first to introduce buybacks in Korea, Samsung has bought back shares worth KRW20 trillion since 2015 and increased dividends on a steady basis since then [6]. As the new dividend tax regime takes effect, this could increase further.

Despite a robust net cash position [7] and strong increases in the price of memory [8], the stock trades on a low multiple of 11x 2025E P/E (a 20% discount to global semiconductors) even after its 23% rally to mid-year.] Both domestic and foreign investors remain underweight [8] but, as the largest stock in the index (22.3% [10]), a change in sentiment will be essential to drive a country rerating.

Chart 3: Samsung Electronics – price vs foreign ownership

Banks: Deep value and dividend upside

Korean banks currently offer some of the most attractive value opportunities globally. Despite robust earnings and improving ROE, the sector trades at just 0.6x P/B: a steep discount versus international peers [11]. Moreover, Korea remains one of the last major markets where banks trade below book value, while similar cycles of revaluation in Europe and Japan have already seen bank multiples converge towards or above book [10]. If Korean banks rerate towards book value, the team believes that stocks could see up to 50% additional upside.

The dividend outlook for the sector remains exceptional. Leading banks are aggressively returning capital to shareholders, with expected average dividend yields exceeding 7% and payout ratios as low as 26% – 30% [10].

Finally, stock cancellations could provide another tailwind for both flows and valuations: recent announcements from the top four banks indicate that cancellations could amount to USD2.5bn in 2025 [12].

South Africa

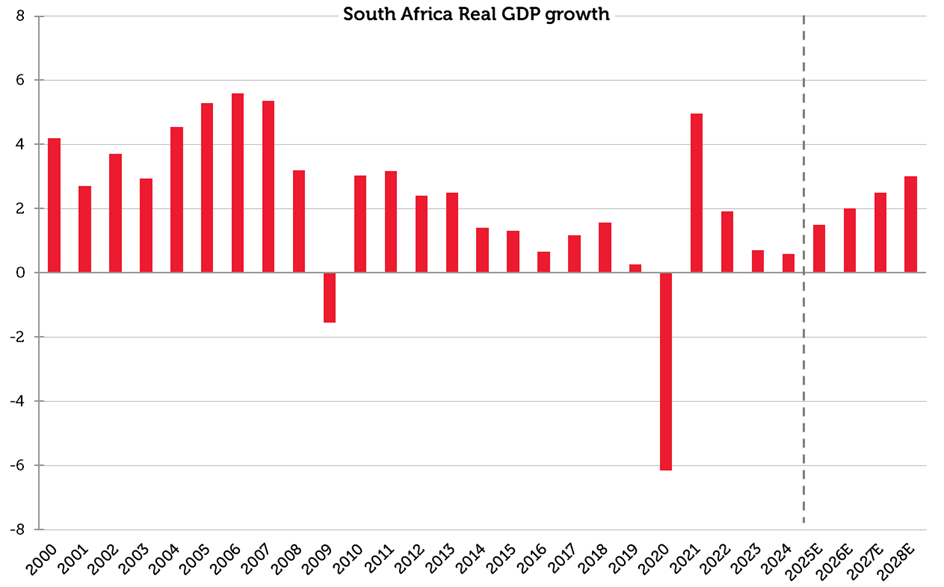

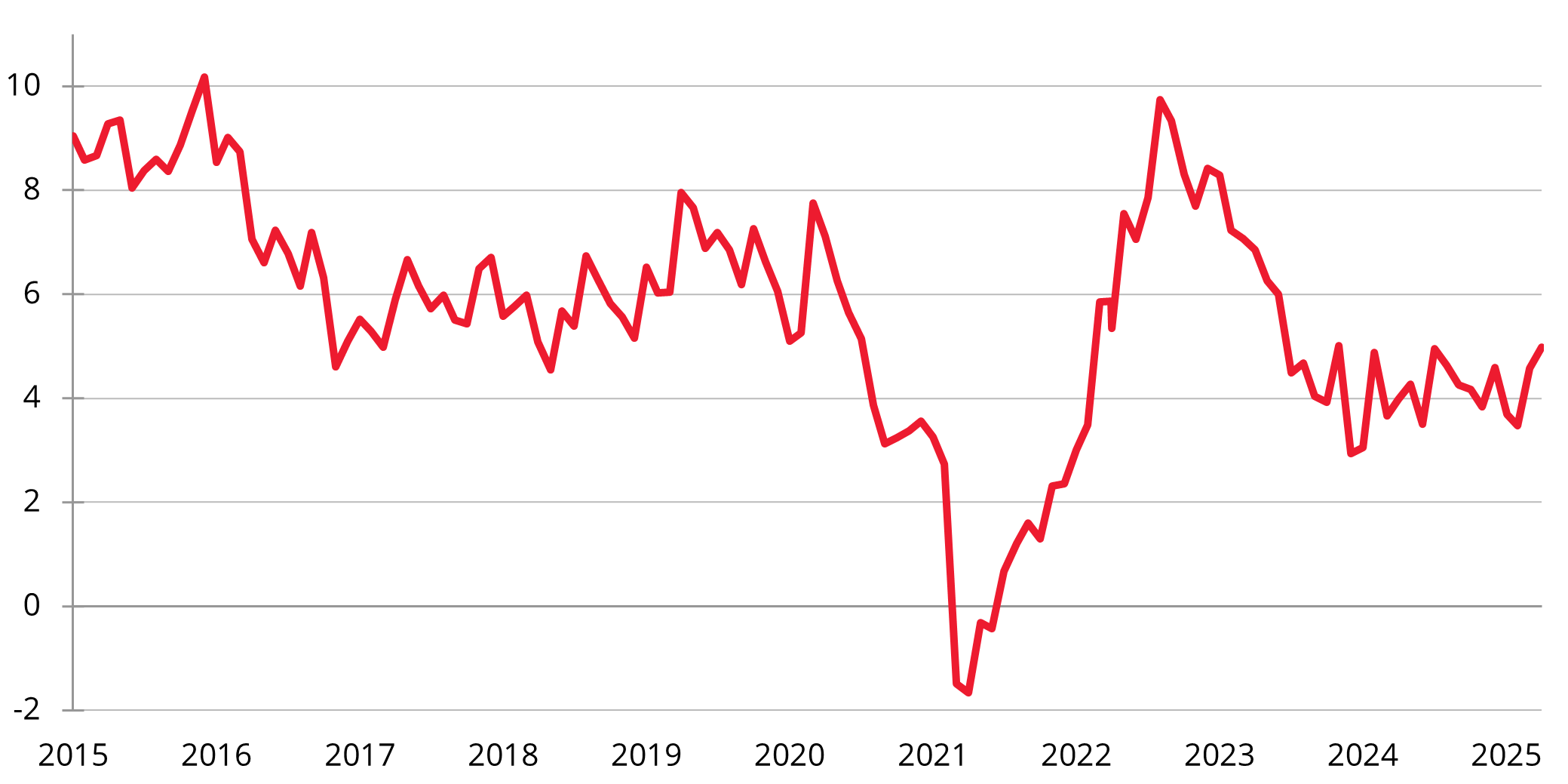

The team continues to reflect a strong conviction in South Africa, maintaining an overweight portfolio allocation of 10.5%, substantially higher than the MSCI Emerging Markets index weighting (2.9%).[13] After a decade of sluggish growth, there are clear signs of GDP acceleration on the horizon – see chart 4, supported by falling inflation and interest rates. South African CPI has fallen from 8% post pandemic to 2.8% at the end of May [14].

Chart 4: South Africa – Real GDP growth (%)

The MSCI South Africa valuation has de-rated by around 45% [15] since its last upcycle in 2015, and valuations now look very attractive, despite climbing over 30% in the first half of the year [16], propelled by USD weakness and robust metals prices. The MSCI South Africa index is trading at a 20% discount relative to the MSCI EM index on a historical long-term average basis [15].

A key factor in this improving outlook is the emergence of a more business-friendly government following the May 2024 elections. The Government of National Unity has publicly pledged to eradicate corruption and inefficiency. Addressing neglected infrastructure is high on the political agenda, setting the stage for a structural rebound in economic performance and investor confidence. It also aims to restore the operational reliability of Eskom, the national electric utility, which should drive a continued recovery in electricity production, supporting industry and mining.

Platinum group metals and gold: price tailwinds

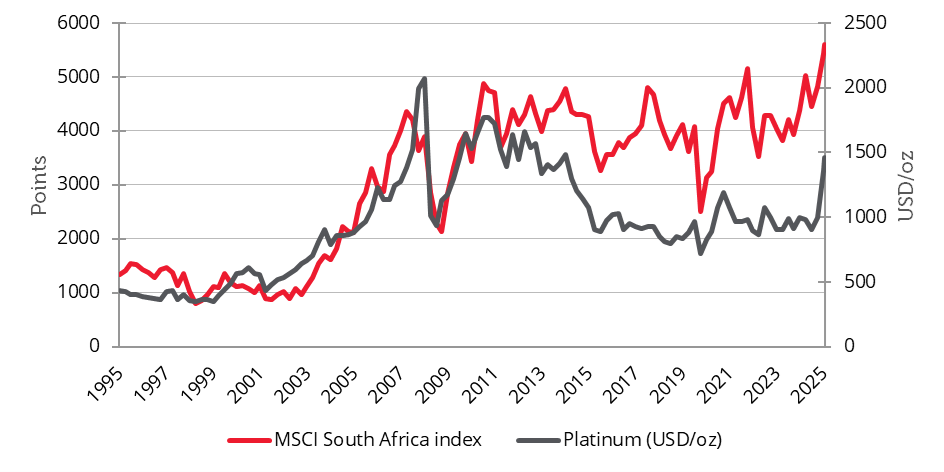

South Africa also benefits from a positive pricing environment for precious metals. The country is the world’s largest producer of platinum group metals (PGMs), commanding a 45% share of global output.[17] Higher prices and tightening supply—driven by underinvestment, stricter Chinese auto-catalyst regulations, and growing platinum jewellery use—are reinforcing the prospects of leading local producers such as Impala Platinum and Valterra Platinum. The chart below highlights the strong influence of PGM prices on South African valuations.

Chart 5: MSCI South Africa index stock vs Platinum price per ounce

Gold also shines on the back of a weakening US dollar and global trade tensions, further boosting earnings for portfolio holdings like Gold Fields and AngloGold Ashanti. [18] These firms benefit not just from current price trends but also from successful mine development projects across Africa.

Telecoms: Driving financial inclusion through mobile money

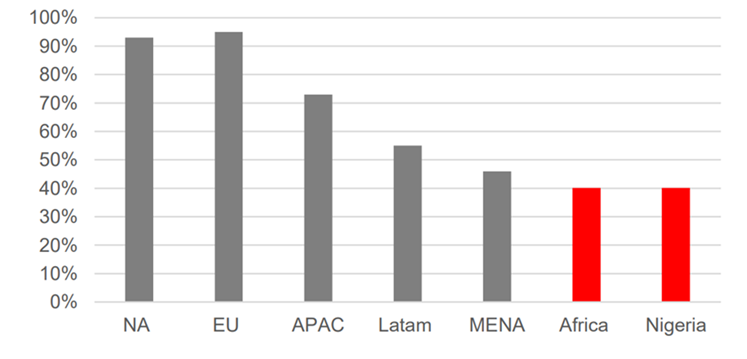

The team’s holding in MTN, the largest telecom company in Africa, climbed 69% in USD terms to mid-year. Banking penetration in Africa remains very low – see Chart 6, and the team is seeing a strong trend of industry leapfrogging, as telecom operators drive financial inclusion through mobile money transfers that are substituting cash payments. MTN’s fintech division accounts for a rising share of group revenues [19] and the team expects the company to deliver strong growth from its high margin, highly scalable mobile money platform.

Chart 6: Traditional banking penetration

Financial sector: Private sector credit growth

Against an improving economic backdrop, the team expects domestic banks to benefit from stronger loan growth (see Chart 7) over the coming year, translating into double-digit earnings growth as interest rates decline and corporate capex recovers. The team’s two South African banking holdings are Capitec and Standard Bank. Capitec has proven to be a disruptive force in the financial sector by delivering highly competitive products to under-served market segments. Standard Bank, the largest bank in Africa, stands to gain from increased corporate investment and the wider upturn in the commodity cycle.

Chart 7: South Africa credit extension to private sector (YoY %)

Reform as a rerating catalyst

Both South Korea and South Africa exemplify the investment case for frontier and next generation emerging markets at a time when reform and restructuring serve as powerful rerating catalysts. In South Korea, the convergence of regulatory enhancements, buyback transparency, and deep-value banking stocks points to meaningful rerating potential. In South Africa, the new coalition government signals an encouraging break from the past, with a pragmatic focus on addressing long-standing impediments to growth and investor confidence.

With disciplined, index-agnostic portfolios and a focus on growth at a reasonable price, the team believes that it is well positioned to capture potential upside from both earnings recovery and currency appreciation.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

[1] Redwheel, 28 July 2025

[2] Bloomberg, 31 July 2025

[3] Bloomberg, 24 July 2025

[5] UBS report, 9 July 2025

[6] Bloomberg, 23 July 2025

[8] DRAMExchange.com, 22 July 2025

[9] Bloomberg, 24 July 2025

[10] Bloomberg, 30 July 2025

[11] Bloomberg consensus estimates, 24 July 2025

[12] Company announcements: KB Financial (24.07.25); Shinhan Financial (25.07.25); Hana Financial (25.07.25); Woori Financial (25.07.25)

[13] Bloomberg, 30 June 2025

[14] Bloomberg, 31 May 2025

[15] Bloomberg, 23 July 2025

[16] Bloomberg, 31 July 2025

[17] Bloomberg, 23 July 2025

[18] Bloomberg, 23 July 2025

[19] Company report for quarter ending 31 March 2025