China’s pursuit of anti-involution policies is unlocking new pathways for sustainable, long-term economic growth in more technologically advanced and higher value-added industries. The government is persuading companies to eliminate inefficient operations and supports consolidation to create stronger players, providing robust businesses with the opportunity to thrive in a rationally competitive environment and ultimately guiding China toward President Xi’s goal of a unified national market.

Over-saving and over-investing

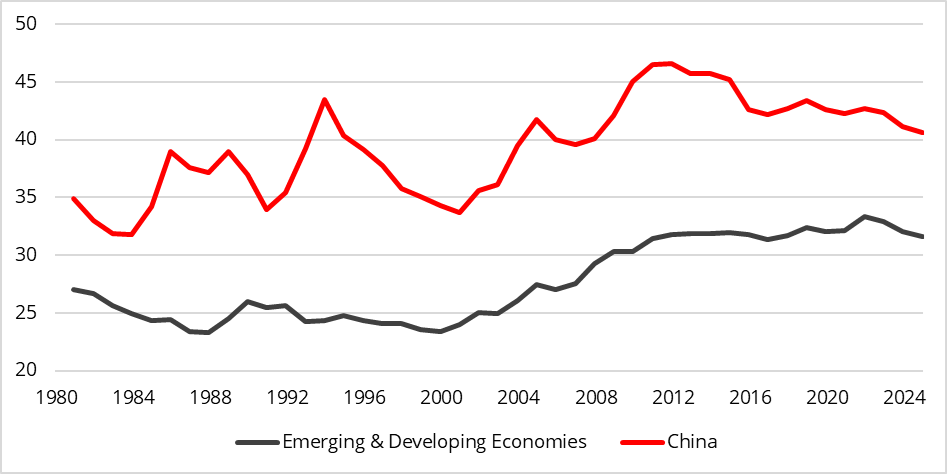

Why are Chinese companies under pressure? China has a higher rate of saving and investment compared to the rest of emerging markets, which has created excess manufacturing capacity.

Chart 1: China investment as a % of GDP

Over-capacity has led to over-production with insufficient domestic demand, which has depressed capacity utilization. US tariffs on Chinese goods also limit access to the world’s largest consumer market, weakening export pricing power.

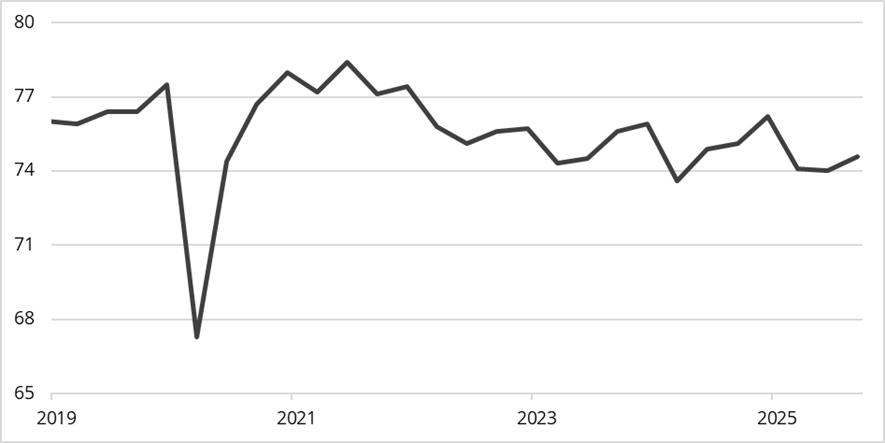

Chart 2: Capacity utilization in China (%)

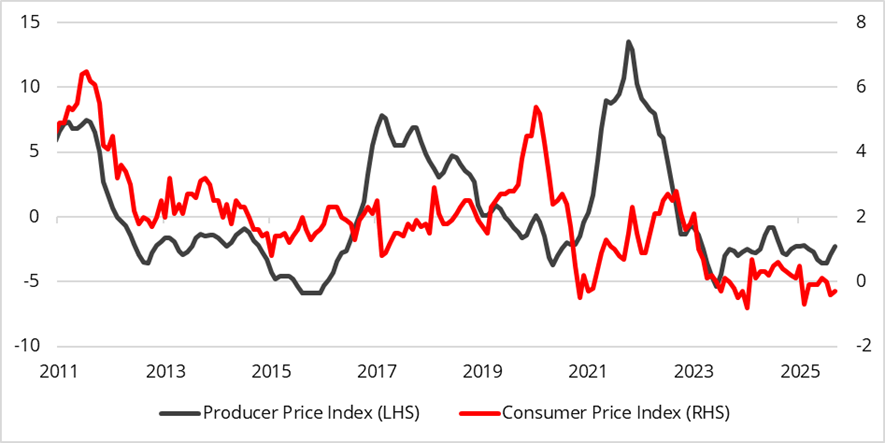

Lower capacity utilization has caused lower growth and persistent disinflation, endangering China’s plan for full employment in high-margin, value-added industries that generate higher wages and better working conditions than the manufacturing industries on which China has relied for economic development up until now.

Chart 3: China producer price index & consumer price index (% change, YoY)

Restoring profitability

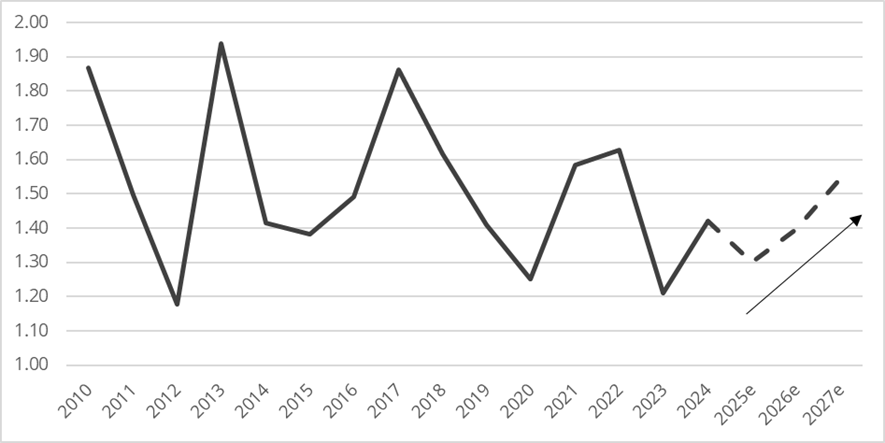

Recognizing the threat of profitless growth, the Central Financial and Economic Affairs Commission (CFEAC) determined to “curb low-price competition, promote the orderly exit of outdated capacity, improve the overall market and foster healthy industrial development” [1] through anti-involution, which consists of economic policies designed to curb excessive competition and remove under-utilized industrial capacity in order to restore profitability and stabilize markets. This initiative resembles the supply side reforms that were undertaken when China experienced deflation in 2015 – 2016, which entailed closing coal mines and cement and steel plants, as well as reducing subsidies for industries with over-capacity. China has repeatedly demonstrated that it does not want to be burdened with zombie companies that might destroy industrial profitability and is attempting to restore the financial health of manufacturing. Rationalizing production should lead to a recovery in profitability for industrial companies.

Chart 4: MSCI China industrials: Earnings per share (USD)

Anti-involution policies will likely involve a combination of production cuts, tighter regulation (including setting pricing floors), mergers and acquisitions, and phasing out capacity for efficiency and environmental reasons. As with the supply-side reforms in 2015 – 2016, the most immediate success is likely to be in state-owned enterprises (SOEs) with outdated capacity in concentrated markets that might be subsidized by the government, but which are unprofitable. It is relatively easy to control capacity, prices and mergers in industries where the government is the controlling shareholder, such as cement, coal and steel. It is more difficult to exercise control in privately-owned or fragmented industries with newly installed capacity, such as photovoltaics (solar) or e-commerce express delivery. However, the Chinese government has been setting price floors and pushing companies to implement price and volume discipline to boost industry margins.

Companies that stand to benefit: Autos and basic materials

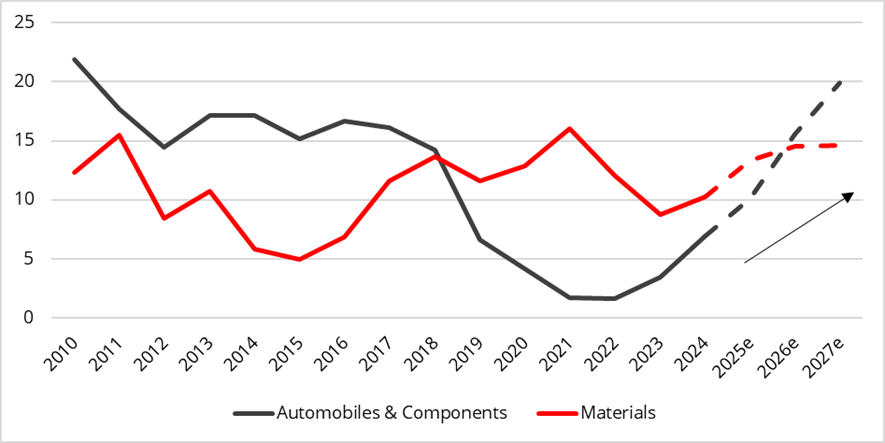

Financial improvement can already be seen in the automotive and materials sectors.

Chart 5: MSCI China automotive and materials: Return on equity (%)

Several Chinese companies in Redwheel equity strategies are potential beneficiaries of anti-involution policies. In the automotive industry, BYD and Nio might start to experience less ferocious price competition, allowing for a possible improvement in profit margins. Autoparts supplier, Ningbo Tuopu, may subsequently feel less intense price pressure from the car companies. Battery maker Contemporary Amperex Technology (CATL) could also benefit for the same reasons [2].

The investment implications of anti-involution

Successful reform and restructuring of strategic industries in China could help sustain the equity rally.

Chart 6: MSCI China net total return index

Even after a gain of 36.4% so far this year, the MSCI China Index is approximately 34% below its high of early 2021 and, on a 12-month forward P/E ratio of 13.9 times, a slight discount to the MSCI Emerging Markets Index with ongoing improvement in corporate fundamentals [3].

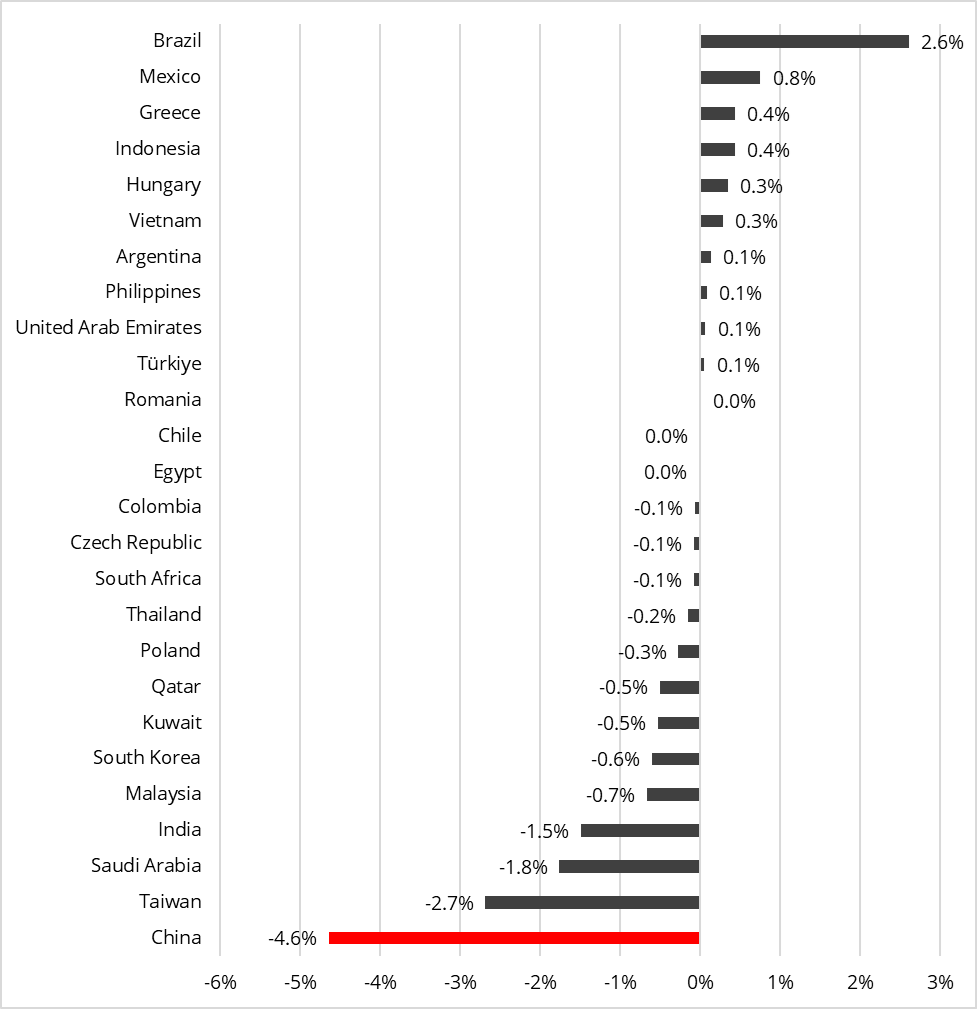

Despite this upside potential, emerging market portfolio managers continue to hold their long-standing underweight to China, currently the largest active underweight in the emerging universe. Any positive effects from ongoing reforms could therefore prompt a significant portfolio rebalancing, adding further support to the rally.

Chart 7: Average weight in global emerging market funds

Sources:

[1] CFEAC, 1 July 2025

[2] Portfolio holdings are subject to change at any time without notice. This information should not be construed as a recommendation to purchase or sell any security.

[3] Bloomberg, 31 October 2025

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.