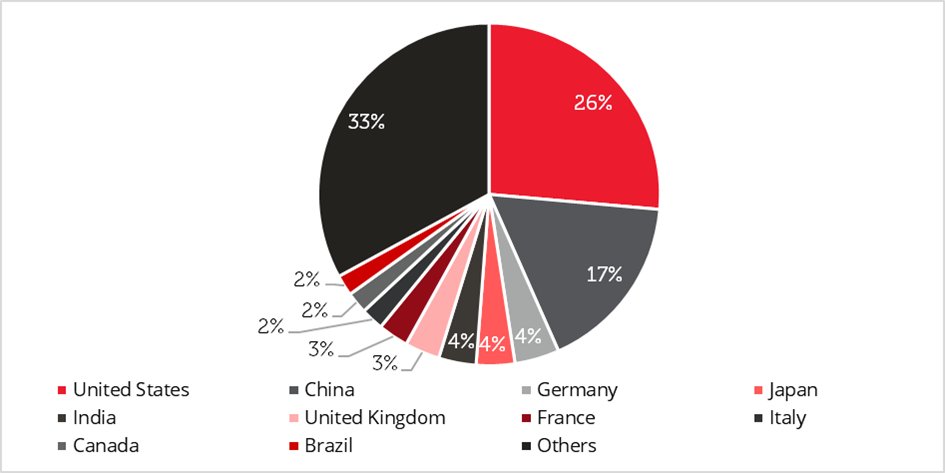

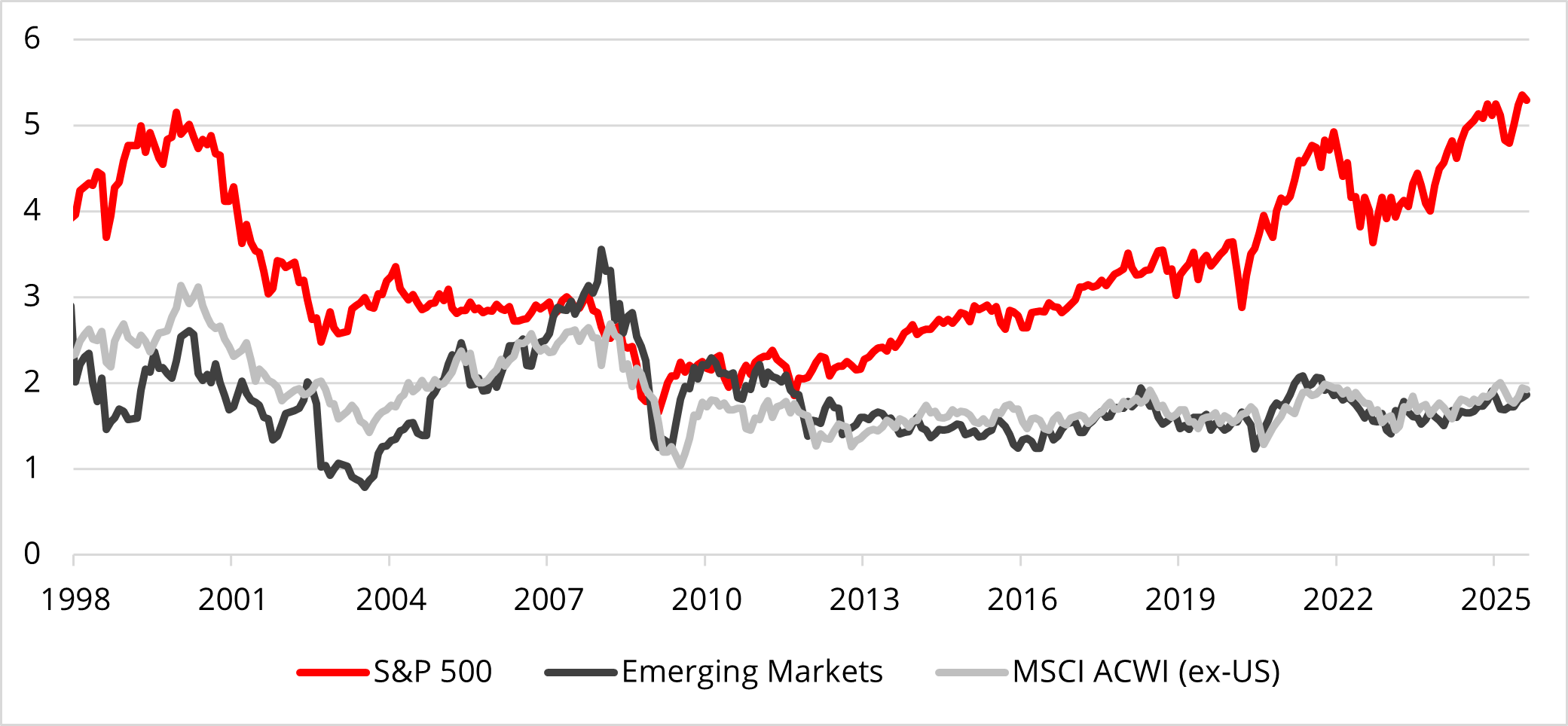

After years of US market dominance, equities outside of the US have begun to outperform in 2025. Although the S&P 500 Index has been the best performing equity index for over 20 years, it has lagged other regional indices by a wide margin in the year to the end of August 2025.

This remarkable shift in market leadership raises questions about the pivotal forces driving international outperformance, whether the rotation is durable, and how investors should respond.

There are many reasons to believe that the recent shift in relative performance is structural, and that the dramatic shift in US economic, foreign and trade policies will drive continued outperformance in international markets.

The US market is too big and too expensive

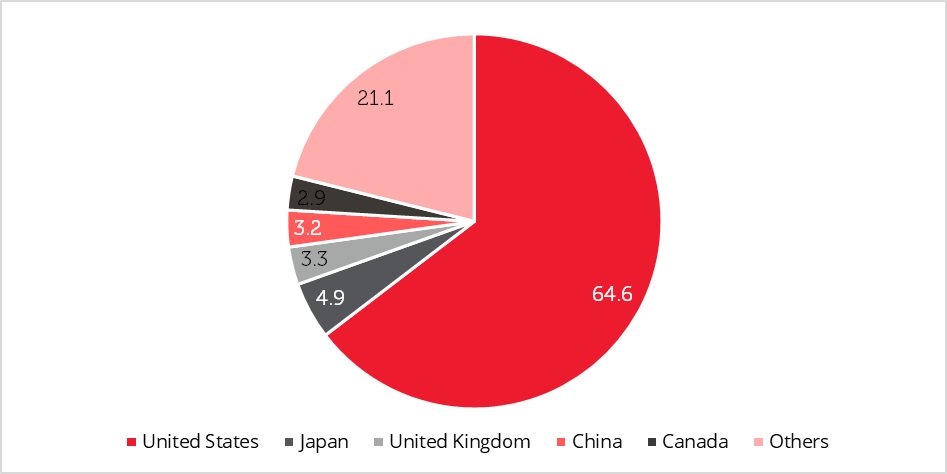

First, the US market has reached a disproportionately large share of global market capitalization compared to its economic output and its population.

The MSCI US Index accounts for nearly two-thirds of global market capitalization, while generating just over one-quarter of global economic output.

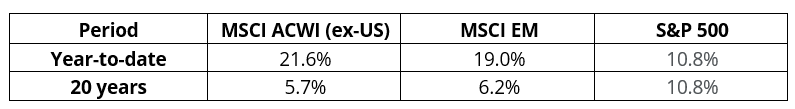

Chart 2: Top 10 countries by global GDP contribution (%)

The weight of the US in the MSCI All Country World Index has increased by nearly 10 percentage points in the past 10 years [1], reducing the importance of significant countries and regions such as Japan, the UK, Europe and emerging markets.

The US market reached this scale as valuations increased substantially since early-2009 on enthusiasm for a new wave of technological advances promised by the ‘FAANGs’, the ‘Magnificent 7’ and companies at the forefront of AI development and adoption. These company groupings are comparable to the ‘4 Horsemen’ of the late 1990s (Microsoft, Intel, Cisco, and Dell), which drove the market to similarly stretched valuation levels. The parabolic gains of the ‘4 Horsemen’ eventually reversed in 2000 at the conclusion of the ‘dot-com’ bubble. Over the following decade, all four companies underperformed key regional indices, including the S&P 500, MSCI ACWI (ex-US) and MSCI Emerging Markets indices1.

Chart 3: Price to book value

A valuation of around 5.5 times book value marked the peak valuation and the conclusion of US equity market outperformance in early-2000. Developed (ex-US) and emerging markets significantly outperformed their US counterpart over the next decade. As of today, the US market has returned to comparable levels, yet the valuation disparity between US and international equities exceeds that observed at the peak of the ‘dot-com’ boom.

Catalysts for international and emerging market outperformance

Currency

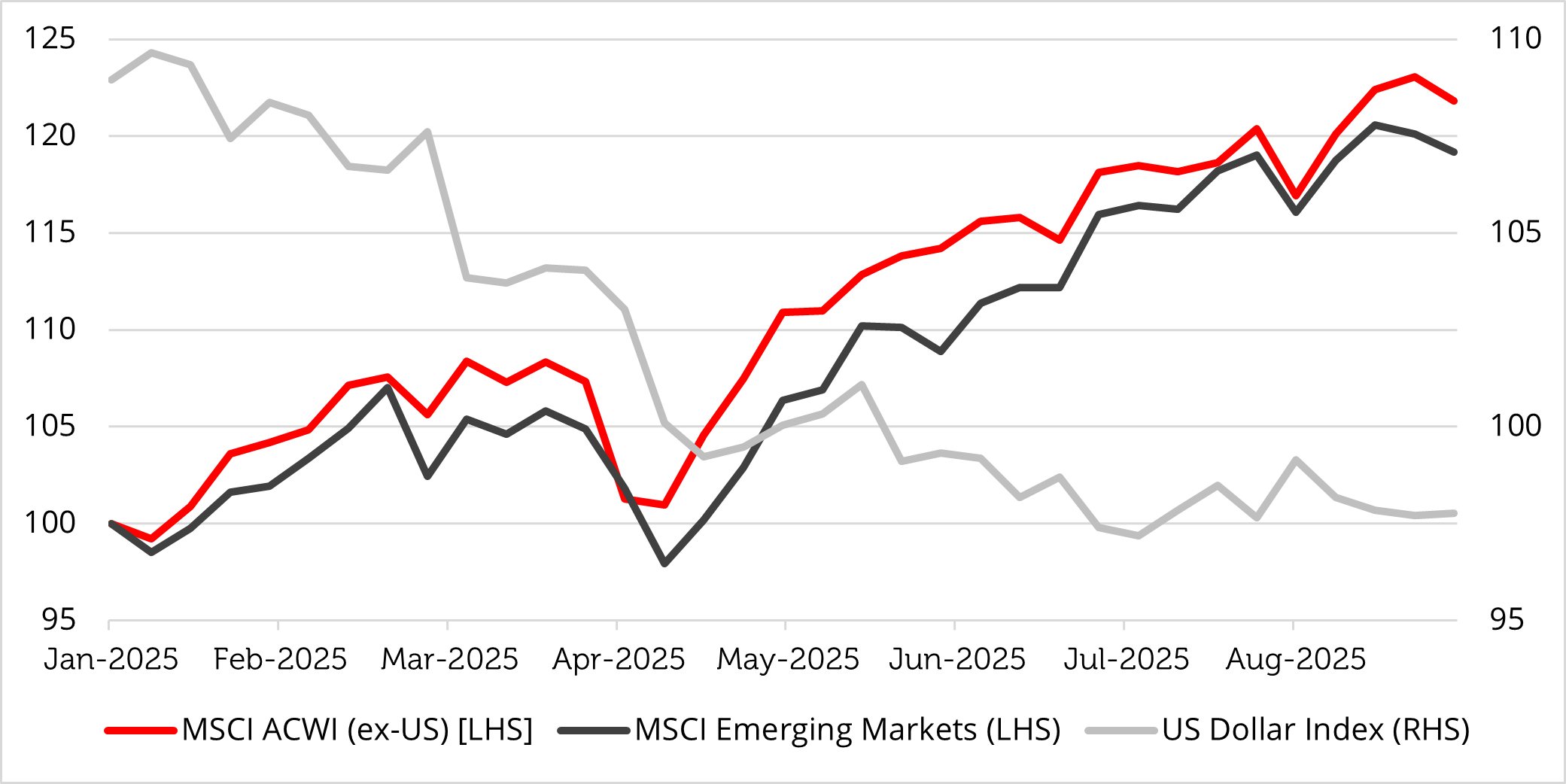

Aside from valuation, the stars are aligning for secular outperformance as many other factors have started to favour emerging and international markets. The most significant change so far in 2025 has been the weakening of the US dollar against nearly all other developed and emerging market currencies.

Chart 4: Performance of the MSCI ACWI (ex-US) and MSCI Emerging Markets Index (normalized to 100) v. US Dollar Index

Economic and Trade Policy

First, American trade tariffs are the equivalent of Brexit, whereby America cuts its trade with the rest of the world by curtailing imports and therefore reduces its potential growth rate. Second, the passage of the One Big Beautiful Bill Act (OBBA) led to a downgrade by Moody’s of the US credit rating as continuous fiscal deficits add to the public debt incurred fighting the Global Financial Crisis in 2008 and the COVID-19 pandemic in 2020. The high burden of government debt would normally be controlled through counter-cyclical fiscal consolidation during a period of economic growth, but OBBA is pro-cyclical and expansionary.

Finally, President Trump has tested the independence of American institutions, such as the Federal Reserve and the Bureau of Labour Statistics, that are trusted by foreign investors to help safeguard the consistency and predictability of economic policy and therefore the value of portfolio investments.

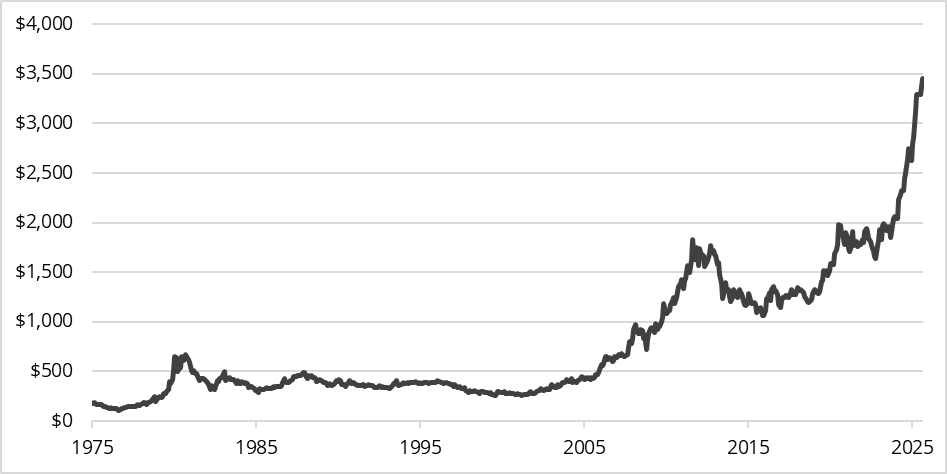

Gold can foreshadow inflation and a rotation to international equities

Waning trust in the dollar as a haven is reflected in the rising price of gold, which has reached a record in 2025.

Chart 5: Price of gold (USD / Oz)

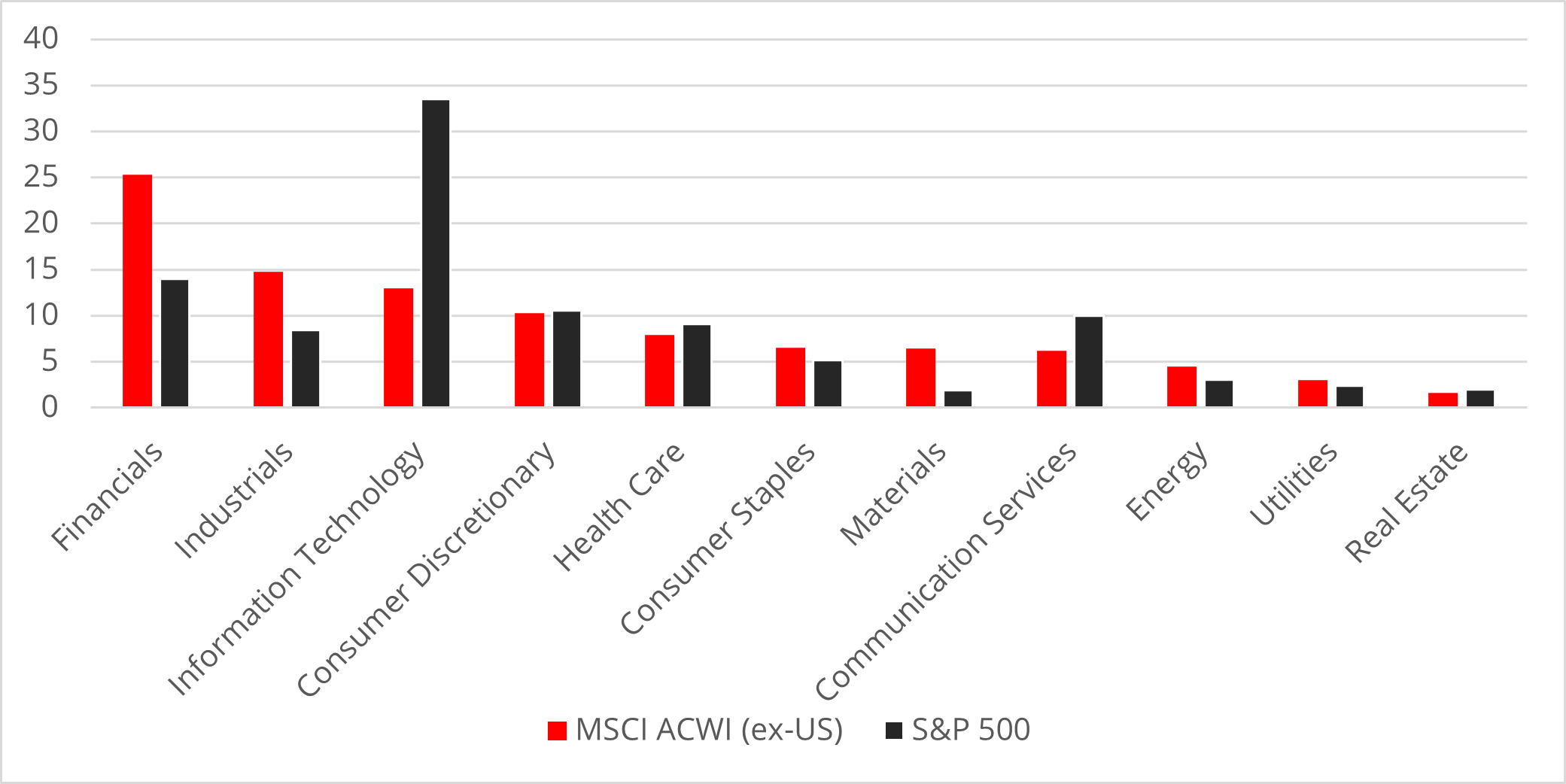

The rise of gold indicates the possibility of higher inflation and sovereign credit risk than has been experienced since the Global Financial Crisis, and hence a potential rotation from the US to international and emerging markets. Large capitalization growth stocks, particularly in the technology sector that is synonymous with the growth style, dominate the US equity market. On the other hand, international markets have much greater weighting in the financials and industrials sectors, which typically perform better with a weaker dollar, higher inflation and a steeper yield curve.

Chart 6: S&P 500 and MSCI ACWI (ex-US) sector weights (%)

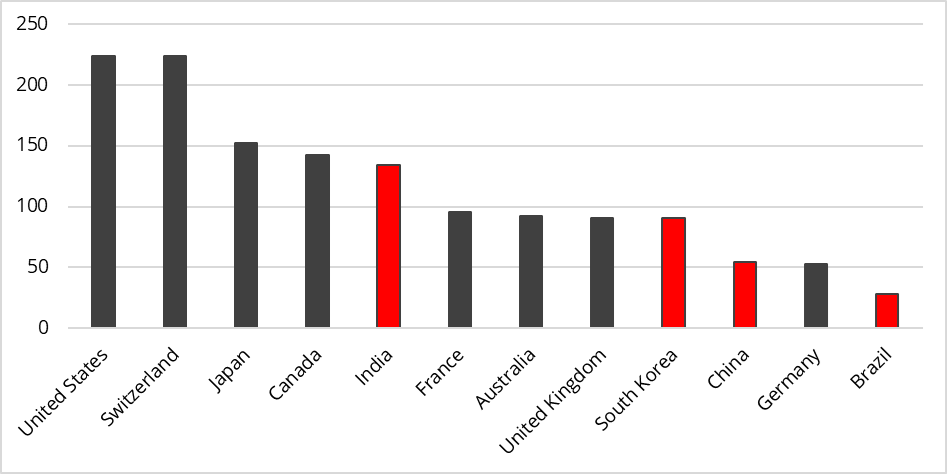

Markets outside the US are under-capitalized and under-owned

The inexorable rise in the valuation of the US market has led to an increase in the ratio of market capitalization to GDP, the ‘Buffett Indicator’, to over 200%. Mr. Buffett made many substantial investments in companies including Bank of America, Burlington Northern, Dow Chemical and Goldman Sachs between 2008 and 2011 when the total US market capitalization was below 100% of GDP [2]. Many emerging market and European countries are still capitalized below 100% of GDP, suggesting room for expansion of stock market valuations outside the US.

Chart 7: Market cap to GDP (%)

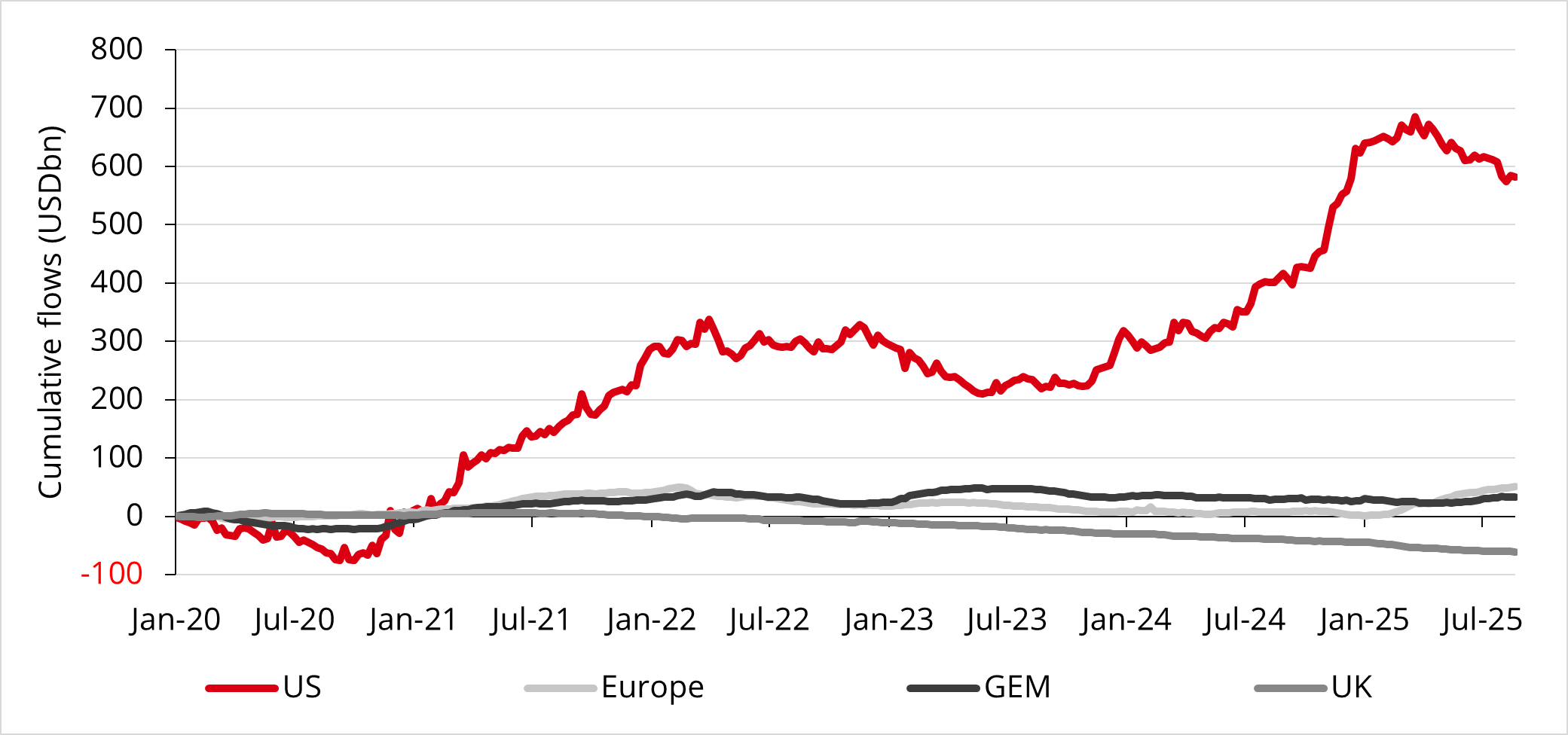

In addition, ACWI ex-US markets tend to be under-owned by institutional investors in the United States. The performance of the US market has attracted portfolio investment at the expense of other regions, and a reversal of this trend could have a significant impact given their relatively small size compared to the US. Flows into the US equity market seem to have peaked in early 2025.

Chart 8: Regional equity fund flows (USD bn)

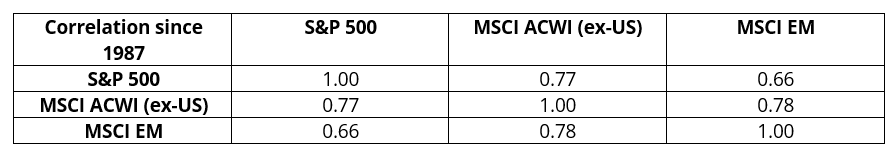

Diversification is the key to portfolio construction

Within the MSCI ACWI universe, a neutral or overweight position in the US is the metaphorical equivalent of putting all the eggs in one basket. Given the number of countries and listed stocks denominated in currencies other than the USD, higher allocations than benchmark weights to regions outside the US have the potential to improve risk-adjusted returns.

Source:

[1] Bloomberg

[2] Bloomberg

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.