As global equity income investors, our job is to purchase good businesses when they are troubled by an investment controversy. If this controversy – a period of heightened uncertainty around a company’s outlook – is simply temporary, then one is able to purchase a quality business with a premium dividend yield on a valuation basis that offers a margin of safety.

Sometimes, two similar businesses can enter our universe at the same time. And sometimes, doing the work on one of these companies can result in discovering the other.

This is the case with Anta Sports.

The controversy reveals the opportunity

Quality companies enter our universe when they yield at least 25% more than the market. To assess whether their yield advantage is likely to persist with a margin of safety, it is essential to identify and understand the prevailing controversy—why the market is sceptical, and whether such scepticism is temporary or more enduring.

We organise our universe into five buckets of controversy, each reflecting a distinct dynamic influencing short-term sentiment and long-term value. The ‘Profit Transformation’ bucket, for example, focuses on cyclical stocks where earnings profiles are undergoing significant change, often mispriced due to mean-reverting pressures, providing fertile ground to capture durable yield at attractive valuations.

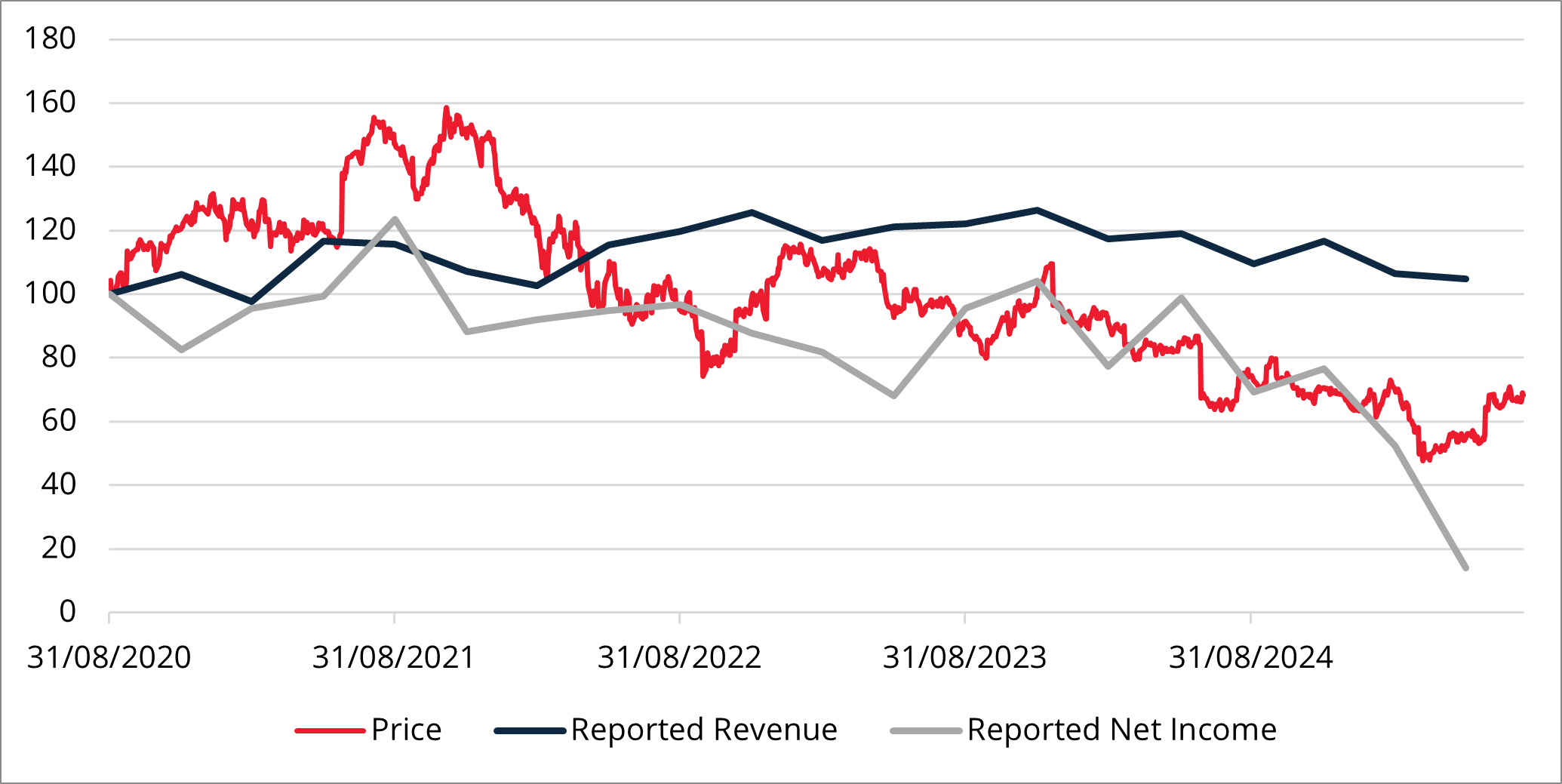

Within this bucket, sportswear businesses have been under pressure as the pandemic-induced boost to sales has waned. The headline-grabbing stock for this dynamic has been Nike. From the peak in November 2021, the shares fell 60% to end December 2024 [1].

Whilst exploring the controversy surrounded Nike – poor management, ceding of key dominance in specific sports, lack of true innovation, failure move to a direct-to-consumer model – another company began to stand out: Anta Sports.

Anta Sports vs Nike

Founded in 1991, Anta Sports is a Chinese sports equipment conglomerate. Its brands include Anta, Fila, Descente, Jack Wolfskin, as well as the brands of Finnish subsidiary Amer, which include Arc’teryx, Salomon and Peak Performance amongst others. It is the largest sportwear company in China (larger than Nike), with sales of c.$10bn [2] in a market where spend on sportswear apparel is half that of the world average and a third of USA levels [3].

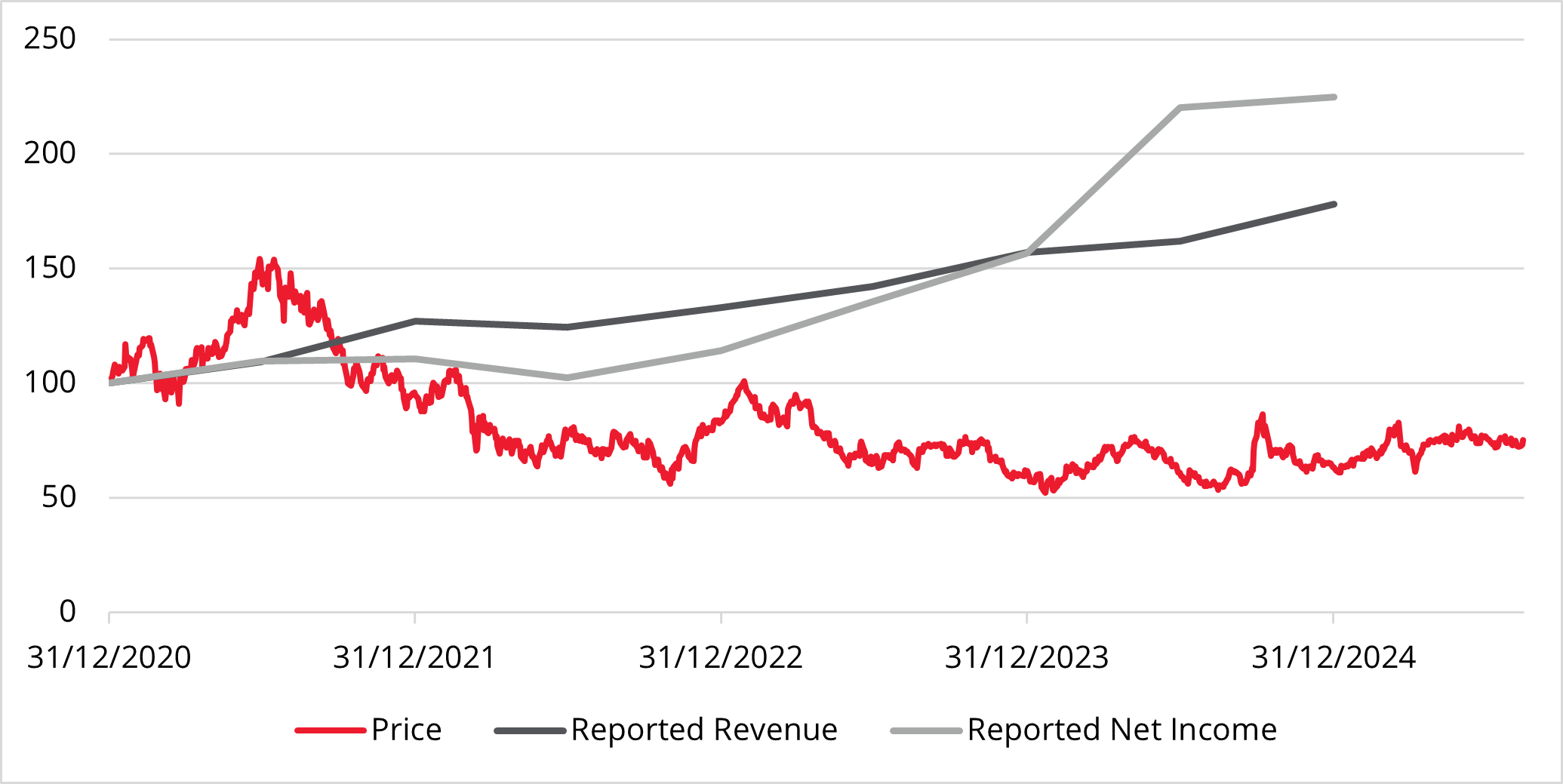

From a peak in June 2021 to a low in January 2024, Anta’s shares fell 66% against a backdrop of a significant, indiscriminate derating across Chinese equities. The controversy was clear. China’s failure to rebound from the pandemic, a collapsing property market and deteriorating consumer confidence all pointed to concerns over future growth for the Chinese economy, and consumer discretionary items such as sportswear in particular.

Yet, since 2021, Anta has grown its revenue 44% and its net income 63% to the end of December 2024, with a significant contribution from Fila, driving around 40% of sales and net income [4]. (Who’d of thought Fila would have been so popular again!) Therefore, the stock has experienced a meaningful derating to a price/earnings (p/e) multiple of 17x on December 2025 estimates, which is over 1 standard deviation below its 10-year historic average p/e. Free cashflow yield stands at 6.7% with a small net cash position, yielding 2.6%.

Chart 1: Anta Sports – share price, reported revenue and net income

Compare this to Nike, which has seen its revenue grow 4% and its net income fall 45% from 2021 to 31 May 2025 [5]. In other words, Nike has not derated much at all, supported by persistent broad-based investor conviction in the US exceptionalism narrative. It currently sits on a p/e of 44x, a free cashflow yield of 2.6% with a small net debt position, yielding 2.3%.

Chart 2: Nike – share price, reported revenue and net income

A probabilistic assessment of future performance

Our process is to assess the range of outcomes for the prevailing controversy, to determine if it is permanent and thus a trap to avoid, or if temporary. If the latter, we then ask if today’s valuation offers a favourable asymmetric risk return profile.

We believe a turnaround in Chinese consumer confidence has a higher probability than Nike quickly and cheaply turning itself around. The valuation asymmetry is therefore better with Anta in our view, given the difference in starting valuations, as well as the broader rerating potential for Chinese equities and ongoing momentum-driven overvaluation in US markets.

This is an example of the process at work. It precludes investing in overvalued areas of the market where certainty is most prevalent rather than uncertainty. This approach protects the strategy from finding itself investing in overcrowded, expensive areas, such as certain parts of the US stock market, namely technology and the Magnificent Seven.

The Profit Transformation bucket is about mean reversion of cycles, whether that be profit cycles or valuation cycles. As Anta have demonstrated with the Fila brand, mean reversion still holds if things are not permanently broken. With a strong track record and plenty of structural growth to be achieved in its marketplace, the team chose to invest in Anta.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

Sources:

[1] Source for all stock price and investment multiples: Bloomberg, Redwheel as of 11 August 2025 unless otherwise stated

[2] Anta Sports, 2024 annual report

[3] Bernstein, China consumer report, 13 February 2025

[4] Anta Sports, 2024 annual report

[5] Nike, 2025 annual report