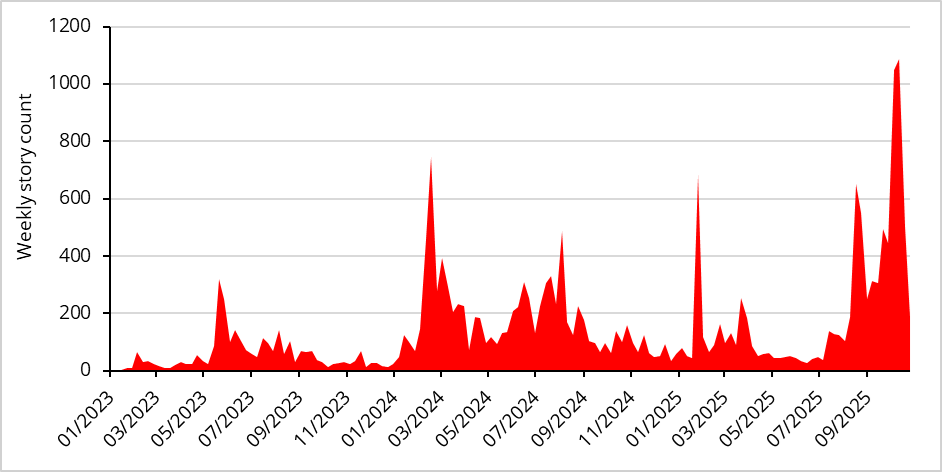

If you pick up a newspaper today, it is likely that you will find an article either proclaiming or disputing the existence of an AI bubble. As Chart 1 shows, in the week commencing the 17 October, 1,100 articles globally included the term ‘AI bubble’.

Chart 1: Articles mentioning ‘AI bubble’

The dizzying valuations and speculative corporate investments in AI are enough to make anyone feel queasy. OpenAI recently committed to spend over a trillion dollars over a five-year period, around 100x its annual recurring revenue[1]. Investors therefore find themselves in a dilemma. While many may still have a pervasive fear of missing out, an increasing number are concerned about investing in a bubble that could pop at any moment and looking for more attractively priced opportunities.

Health care offers the potential for tech-like growth at a far more reasonable price

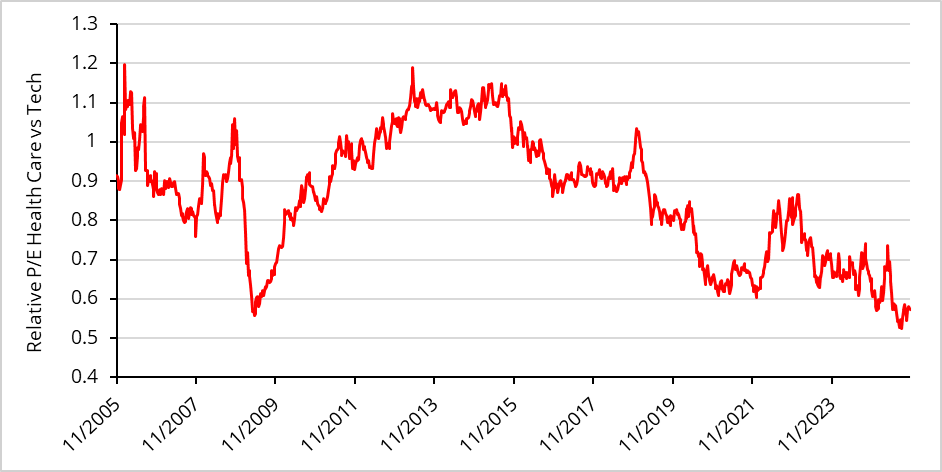

We believe health care offers an attractive combination of significant earnings growth potential and a historic valuation discount. The technology sector is forecast to grow earnings at a 25% compound annual growth rate (CAGR) through to 2027[2]. It may surprise many to realise that health care earnings are not far behind with a forecast 22% CAGR over the same period2. And yet, despite the similar earnings outlook, the health care sector hasn’t traded at such a deep discount to technology stocks since the financial crisis (see Chart 2).

Chart 2: Relative P/E – health care vs tech indices

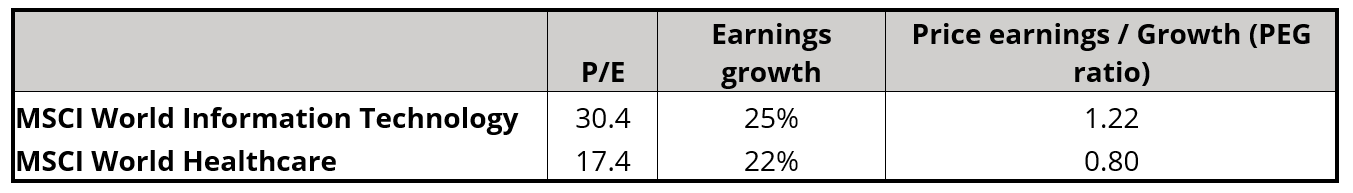

At prevailing prices, the growth potential offered by the tech sector is 50% more expensive than health care – something a price earnings growth (PEG) ratio can tell you – see Table 1.

Table 1: Price earnings growth ratio (PEG) – tech and health care indices

Reasons for the valuation gap appear to be receding

As we noted in July this year and in our more recent discussion of the Not-So-Magnificent-17, a number of factors drove the emergence of the health care sector’s discount, many of which we believe are now moderating.

In particular, the risk of changes to US drug pricing policy was at the forefront of many investors’ minds earlier this year. More recently, a number of pharma companies have made deals with the US administration, potentially taking aggressive drug price reductions off the table while both sides can claim victory.

At the same time, the FDA continues to approve new therapies at pace with 35 new drugs approved this year to date. This is roughly in line with the 38 drugs that had been approved at the same point in 2024, showing that innovation in the sector remains vibrant[3].

Although these updates are specific only to pharma, the increased clarity has had a positive effect on supply chains too. Some tools companies, which provide the technology and services to help bring therapies to market, are seeing a marked increase in activity from their biopharma customers[4]. We believe this could be a leading indicator for upgraded earnings outlooks for that sub-sector.

The case for investing in life-changing solutions becomes compelling

We believe the case for investing in health care is compelling with this more benign political backdrop and significant valuation discount. Within that, we continue to believe that investing in the most life-changing solutions offers the greatest commercial and investment success. We do not know if or when the AI bubble will burst, but we do have a strong conviction that the companies we invest in offer a life-changing impact to the patients they serve. They will continue to do that regardless of the fate of big tech, which makes us confident investing in health care when other sectors have smashed all-time highs.

[1] FT.com, 7 November 2025

[2] Bloomberg, 31 October 2025

[3] Novel Drug Approvals for 2025 | FDA, 7 November 2025

[4] For example, Thermofisher Scientific, Q3 2025 earnings call.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.