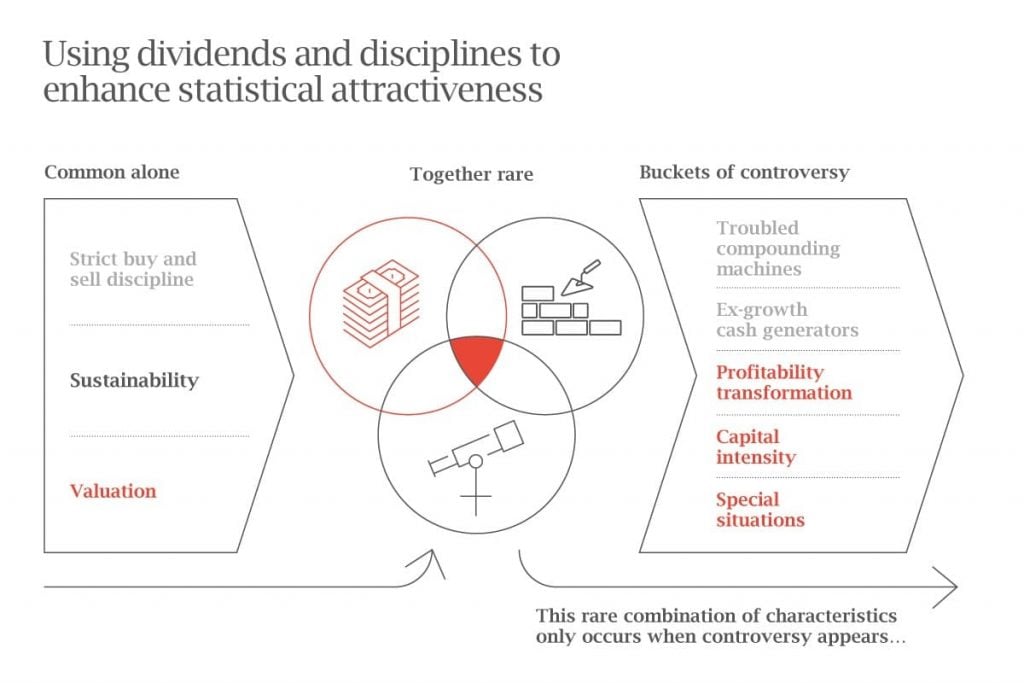

The three requisite features of every investment we make are: a premium yield; dividend sustainability; and a valuation margin of safety. These are relatively easy to find individually but, in combination they are rare and typically only occur when a company is surrounded by some form of risk or controversy.

Profitability transformation

The stock market consensus has a preference for extrapolation – observing a trend and projecting its continuation into the future. The market struggles to forecast moments of inflection, where a company’s profits take a turn in a new direction, either up or down. The presence of controversy makes it even more likely that the market will fail to anticipate a positive change of fortune.

Companies in this bucket, therefore, tend to be exposed to some form of cycle but it can include any business that has the potential for a positive profit inflection. Cyclical businesses can often be misleading – if they are delivering healthy profits and dividends, we are inclined to be cautious because we know that, at some stage, the cycle will turn. Conversely, a more sensible starting point for us is to look for companies that are delivering depressed profitability within a historic cycle of peaks and troughs.

Calling the turning point of a cycle is notoriously difficult, but our focus on the sustainability of the dividend guides us towards companies that have robust cashflows even at the trough of the cycle. A cost advantage over competitors helps in this regard, as does a clean balance sheet with limited debt. Where we find these characteristics, the emphasis of our research moves towards what is priced into the stock. If the market is discounting an improbably extended down-cycle, the asymmetry of future returns is likely to work in our favour. The length of the down-cycle and the path of the subsequent recovery are typical sources of controversy in this bucket. Sometimes this has specific ramifications for a particular business; other times, an entire industry may be implicated.

Case study: Samsung – memory improvement

Samsung has a dominant market share in memory. It is an industry leader, being a consistent early adopter of new technologies. Management is long-term in focus and its long-serving former chairman is viewed as responsible for transforming the company away from its reputation for cheap electrical goods to the global technology powerhouse that we see today.

Nevertheless, Samsung remains a business that has historically seen high cyclical swings in profitability, albeit its diversified business model (handsets, displays, consumer electronics as well as memory) has meant that returns are less volatile than peers.

Refuting the controversy

After a period of strong profitable growth, Samsung saw a sharp fall in profits in 2019, which weighed on its share price and valuation. In the middle of 2019, few analysts were predicting a rapid recovery, with consensus forecasts for 2021 profits still 20% below the 2018 peak.

Our analysis revealed a business that had always enjoyed decent returns even at the trough of the cycle. Meanwhile, the capital cycle looked like it was shortening, with rising capital intensity slowing the pace of industry capacity growth, which meant the next up cycle was likely to arrive sooner rather than later. That lack of additional capacity, coupled with robust underlying demand for memory, led us to anticipate a period of super-normal profits during the next cycle.

Repeating patterns

We have seen many companies who are able to suffer the cyclical downturn in their industry, only to come out stronger afterwards, such as CRH in building materials and Adecco in staffing. Further, the book Capital Returns by Marathon Asset Management and Edward Chancellor teaches many lessons on investing through the cycle. The analogue semiconductor industry, TSMC and the scotch whisky industry all demonstrate how rising capital intensity can underpin returns.

Capital intensity

Companies with high returns (for us, best measured by Return on Invested Capital, or ROIC for short) attract most of our attention, but lower ROIC companies can also provide opportunity. More capital-intensive industries, such as property, insurance and utilities, rarely make high enough returns to put them in buckets one or two, but they can still be of interest if returns still comfortably exceed the cost of capital and there is a reason to believe that these returns are highly durable. Of particular interest are such franchises that also have the prospect for steadily compounding growth. A utility business with a revenue stream underpinned by regulation, for example, maybe a candidate for inclusion in this bucket, but we may also include unregulated companies that have demonstrated historic resilience through a strong franchise and culture.

These are less glamorous than high ROIC businesses, but this means they are often overlooked by other investors. This is an obvious starting point for potential valuation opportunities. When combined with a controversy that we can effectively neutralise with evidence, lower ROIC business can start to look very appealing.

This bucket of controversy has some overlap with buckets one and two, despite the different ROIC characteristics. However, it requires a separate category because capital intensive businesses require a different set of questions to be answered during the research process. Debt levels are often higher, so these opportunities require particular work to test the durability of revenues and cashflows, to mitigate the financial risk that comes with leverage. Similarly, operational leverage is high and small changes to a company’s fortunes can meaningfully undermine its cashflows.

Case study: Eversource

Refuting the controversy

Looking beyond the setbacks, our analysis focused on underlying need for all three projects which had not diminished. New England requires significant additional energy infrastructure to secure its current needs, with even more required to fulfil its climate change aspirations. While there remained significant uncertainties over two of the projects, management had shown themselves capable of finding additional growth opportunities to keep asset growth compounding at a steady 5-6% per annum.

The proposed takeover of Connecticut Water looked sensible to us as a good fit for the recently acquired Aquarion Water. But hostile bids rarely win in the utility sector, so we ascribed a low probability that Eversource would succeed. Meanwhile, its base utility business was ticking over nicely, with good regulatory deals from its two largest subsidiaries being secured to underpin future growth and returns and reinforcing its management team’s reputation for managing positive political and regulatory outcomes.

The combination of a strong historic track record, regulated returns comfortably ahead of its cost of equity and solid long-term growth prospects, led us to a positive view of Eversource, which remains a position in the strategy’s portfolio.

Repeating patterns

Special situations

Lastly, the special situations bucket typically contains companies with complicated conglomerate structures and complex issues surrounded by uncertainty.

Often the valuation aspect of the investment thesis here will rely on a sum of the parts methodology. The controversy will typically relate to one segment of a business, but it will influence the market’s perception of the entirety. This may lead to other assets becoming underappreciated and the opportunity for hidden value to ultimately be realised.

The complexity associated with special situations can bring additional risk, so our research work needs to be tested against robust downside scenarios, and a slightly different set of questions needs to be addressed. For example, we must assess management’s ability to address the under-valuation of certain assets and build confidence in the remaining value of the business, should the worst-case scenario for the troubled division prevail.

Case study: Bayer

With a healthcare heritage, Bayer’s management has pursued a diversifying strategy in recent years, buying Merck’s consumer health business in 2015 and the crop science business, Monsanto in 2016. As a result of these acquisitions, its balance sheet held considerable debt and, more recently, the ESG threat of genetically modified crops and glyphosate, along with the associated litigation (through its ownership of the weedkiller brand, Roundup) has hung over the business.

Refuting the controversy

After a period of material share price weakness, we became interested in Bayer as a special situation opportunity in 2018. The stock market had rushed to price in a worst-case litigation scenario, even though glyphosate retained the full support of government regulators. Considerable uncertainty existed over the likely duration of the litigation process, with the risk of negative trial verdicts along the way.

Nevertheless, our analysis indicated that further share price downside would likely be limited even in the event of the worst-case litigation scenario prevailing. Meanwhile, considerable upside potential would exist should we see an up-cycle in agriculture, success within the pharmaceutical pipeline or a turnaround in the underperforming consumer health division.

With the benefit of hindsight, it is clear that we have been early in forming this view. However, the flags by which we have monitored Bayer’s operational progress have permitted us to retain a positive view. Indeed, much of the original investment thesis remains in place and there are strong signs of an agricultural upcycle which could last for many years should the recent trends in China’s self-sufficiency in grains prove structural.

Repeating patterns

We have seen various repeating patterns where the market has rushed to price in a worst-case scenario for litigation outcomes, most recently at Qualcomm and, further back, across the tobacco and healthcare industries and within banking.

Conclusion

The RWC Global Equity Income strategy normally has approximately one-third of its portfolio assigned to the three buckets explained above. Currently, 30% of the portfolio is allocated to it. All three of the case studies detailed above are currently held by the strategy, alongside other compelling new ideas such Tapestry (Profitability transformation), Brixmor Properties (Capital intensity) and Exelon (Special situations). Across all five buckets of controversy, our investment disciplines repeatedly deliver quality at a reasonable yield.

Collectively, we are confident that our track record of identifying and investing in businesses that are currently experiencing some form of temporary controversy that the market has incorrectly perceived as permanent, can generate good long-term returns for our investors.

Unless otherwise stated, all opinions within this document are those of the Global Equity Income team, as at 4th May 2021.