There is an abundance of literature that explores the merits of growth and value investing. In recent years, it is well known that exceptionally low interest rates and breakthroughs in technologies like cloud computing and generative AI have driven a strong bias toward growth stocks. With central banks maintaining highly accommodative policies and effectively removing investment hurdles, investors were pushed out on the risk curve prioritizing long-term potential over near-term returns.

The strong market performance of growth assets triggered a feedback loop between investors’ perceptions and economic reality, consolidating the prevailing trend and strengthening the conviction around the merits of Growth in a self-reinforcing cycle.

Although the technological contributions of these new businesses are immense, we argue that the current momentum and the market concentration around these tech companies are making it harder for investors to allocate capital effectively while aiming to balance risk and return in their pursuit of alpha. In this highly polarized market, we think that value investing offers a way to benefit from a benign economic backdrop while maintaining solid upside potential should the tech sector experience a correction.

Market concentration and risk-adjusted returns

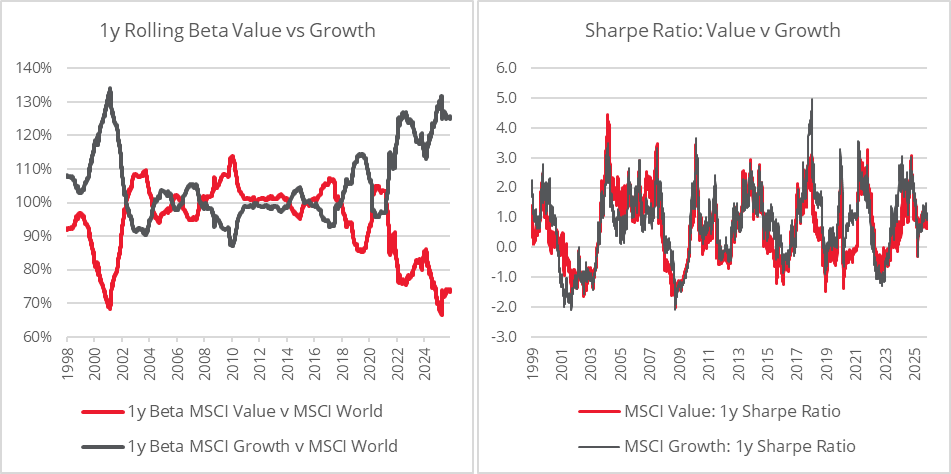

The strong performance of growth stocks has concentrated market returns in a few names and themes, increasing their sensitivity and volatility. In optimistic, disruption-free environments typical of early tech adoption, these stocks were able to convert higher risk into strong gains. However, with a higher beta, these stocks are now more exposed to market volatility and the challenges that come with premium valuations and expectations. Meanwhile, value stocks, though lagging in performance, have delivered comparable risk-adjusted returns due to lower volatility and weaker market correlation.

Charts 1a and 1b: Value vs Growth – 1-year rolling beta and risk-adjusted performance

Liquidity, rates and the mispricing of risk

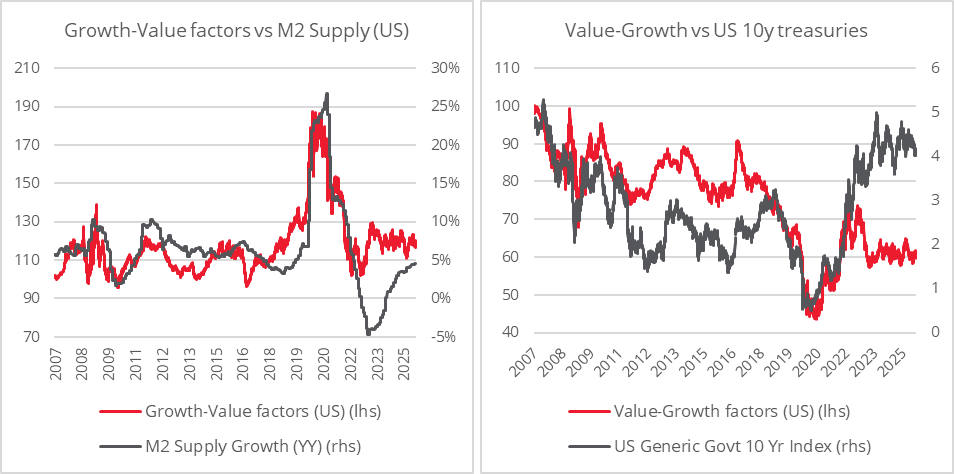

In recent years, the challenge for capital allocators has been to balance stock selection with benchmarks heavily influenced by a few dominant firms, while navigating monetary policies that have actively encouraged mispricing of risk and expectations.

For years, central banks have conveniently held interest rates at zero, citing low inflation as a reason to continue aggressive quantitative easing programmes and keep injecting liquidity into the financial systems. Leaving aside debates about the feasibility of precisely measuring true inflation during one of the most innovative and technologically transformative time in history, we now recognize that the market has been saturated with liquidity for years. M2 supply alone increased more than 6% per annum from 2009 to 2024, a striking number considering that US Treasuries, both 10y and 30y, are paying less than 5% today[1].

Years of ample liquidity and near-zero interest rates suppressed risk costs and hurdle rates, favouring Growth and risk-taking. In a normalised setting with a benign economic growth outlook and positive rates, value stocks should regain strength, as Value has historically withstood higher discount rates that act like gravity on asset prices.

Charts 2a and 2b: The effects of liquidity and rates

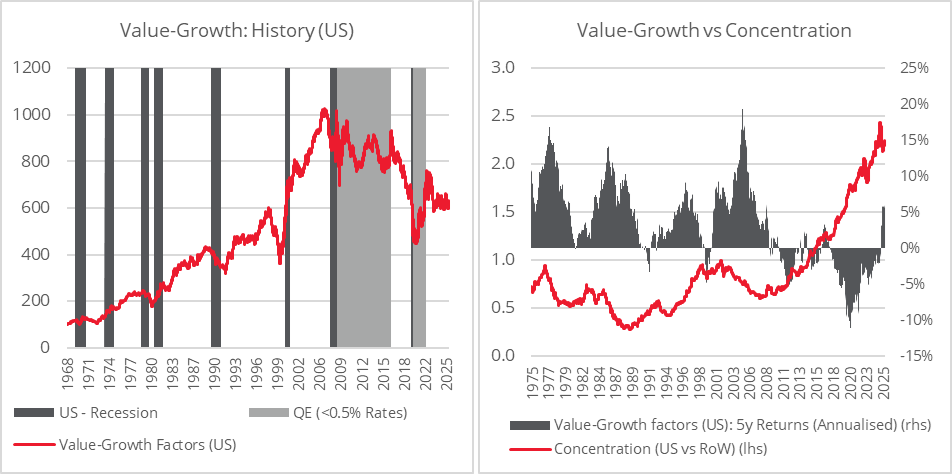

Value through the cycle: Recession and recovery

Conversely, what would be the outcome for Value in a recessionary environment?

Although every recession is unique (who would have expected that the US would be so deep in the cycle today with less than 5% unemployment, around 6% deficit/GDP and dovish central banks? [2]), history shows that value stocks tend to outperform growth stocks during post-recession recoveries. What sets the current cycle apart is the extreme market concentration in a few dominant companies. Over the past 50 years, such concentration has exceeded one standard deviation above average only three times: during the Nifty Fifty era, the Dot-com boom, and today. Historically, value stocks have delivered their strongest returns during the phases of market de-concentration.

In this scenario, Value stands out as likely to deliver stronger results than Growth across the equity landscape

Charts 3a and 3b: Value performance during periods of recovery and de-concentration

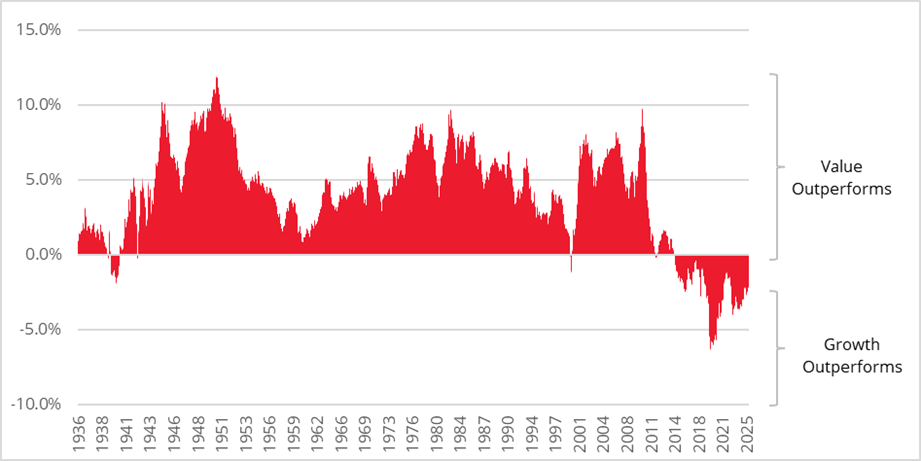

An attractive entry point for Value

We view the current risk-reward profile for Value equities as highly attractive. Value offers exposure to the equity returns typical in a benign macro environment (historically outperforming Growth in such regimes) while simultaneously providing an embedded call option on any normalisation of monetary policies and tech-driven euphoria.

It is well documented that markets have reached record highs across numerous metrics. Although shifting away from strategies that have succeeded over the past decade and exploring alternative options may appear risky to many, we argue that a highly attractive opportunity is emerging in Value for investors willing to adopt a longer-term perspective.

Chart 4: Value – Growth factors (US) – 10-year trailing returns

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.