Here’s looking at you, kid

The winter holidays are a time for many different family traditions, but one that seems to be most widespread is using the time off to settle down to a movie – often, a cultural classic. In my case, this year’s film was the romantic icon Casablanca, in which our hero, Rick – played by an ice-cool Humphrey Bogart – is thrust into a wartime intrigue, and forced to confront the sudden arrival of his long-lost love, Ilsa, the role which catapulted Ingrid Bergman to new heights of stardom.

Watching it again, I was struck by a theme that seems to flow through the story: the importance of being in the right place, at the right time, and making the right decisions. For those unfamiliar with the story – and a modest spoiler alert here – Rick just happens to run the bar where all the shady deals in town get done, and as such just happens to be slipped two Letters of Transit, worth their weight in gold to refugees desperate to escape the clutches of the Nazis. By pure coincidence, after obtaining the letters, the former love of his life Ilsa shows up with her husband in urgent need of someone to help them flee from the regime; Gestapo officers arrive in short order seeking to bring the two into custody.

Baffled by this sudden series of events, Bogart’s character memorably laments at the coincidence of it all:

“Of all the gin joints in all the towns in all the world, she walks into mine”

Ultimately, Rick is at the right place in the right time to help Ilsa flee to a better life, and must find within himself the fortitude to seize his opportunity to come to her aid, even if it means he will never see her again.

Whilst the tears of other viewers were flowing at the passion of it all, my thoughts, as they often do, turned to investing: as we have noted before, all forms of art hold an important lesson for the shrewd investor, and, to my mind, Casablanca is no exception. The message that the effortlessly smooth Humphry Bogart relays to investors is that, when one finds oneself fortuitously in the right place at the right time, one must act decisively to take advantage of the opportunity – and prevaricate at your peril.

It’s a small world, after all

From where we sit, the right place and the right time align today in one area in particular: small companies, especially cheap small companies (in light of our general investment philosophy, the emphasis on buying things cheap should hopefully come as no surprise to our regular readers).

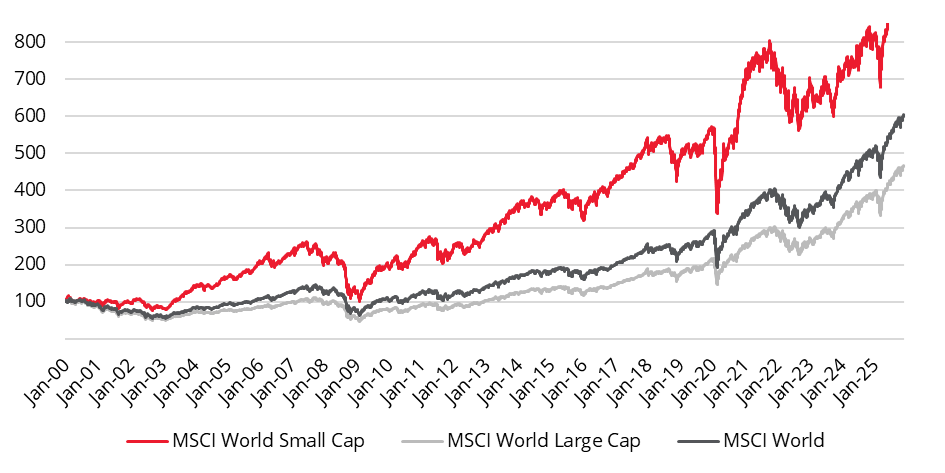

For starters, as a rule, small companies – which, using the MSCI World Small Cap index as a guide, are typically those companies smaller than ~$20bn in market capitalisation [1] – are a great place to look for long-term investing outperformance: for any given long-term time horizon, an investment in a small cap index will likely have beaten an investment made at the same time in larger companies, or indeed in the market in general. For example, $100 invested in the MSCI World Small Cap Index in 2000 would have been worth $951 at the end of 2025 – an annualised return of 9.1% – compared with $599 for the MSCI World, and just $463 for the MSCI World Large Cap index (annualised returns of 7.2% and 6.1%, respectively):

Chart 1: MSCI World Small Cap vs MSCI World and MSCI World Large Cap – long-term performance

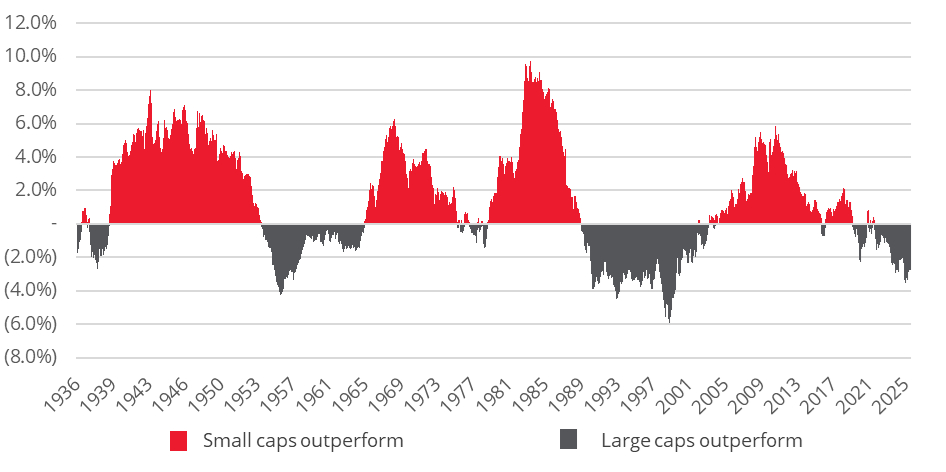

Whilst this is certainly a soothing backdrop for the small company enthusiast, what stands out to us today is the recent underperformance of small cap companies when compared with larger companies, a gap which, when one looks to history, appears to be highly anomalous, and potentially profitable.

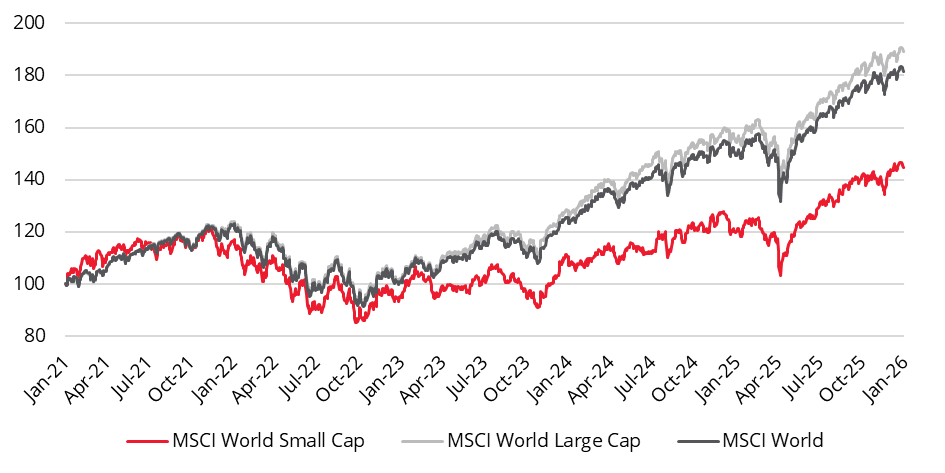

Take, for example the most recent five years of performance of both small and large companies from across the world, as shown below by the figures for the MSCI World Small Cap and MSCI World Large Cap, respectively. In a reversal of the long-term trend, large companies have hugely outperformed small companies since 2021, pushing up global markets as they become more and more concentrated, led by a handful of massive companies, and leaving smaller companies in the dust.

Chart 2: MSCI World Small Cap vs MSCI World and MSCI World Large Cap – 5-year performance

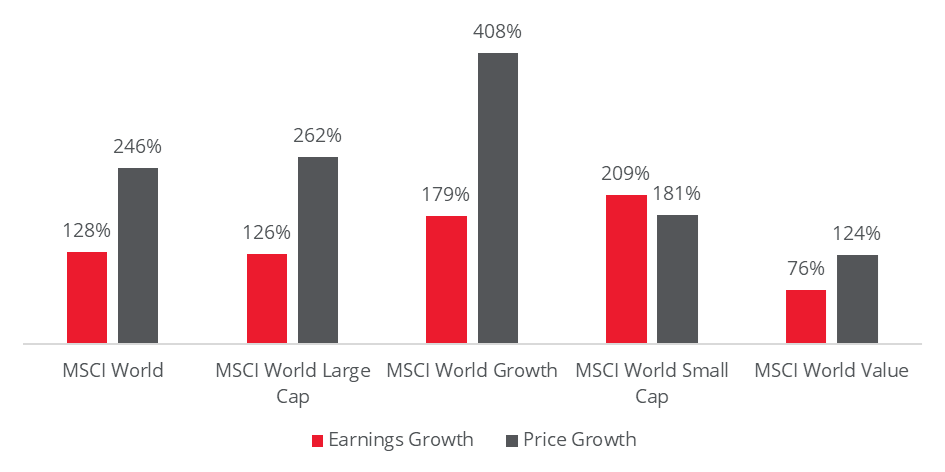

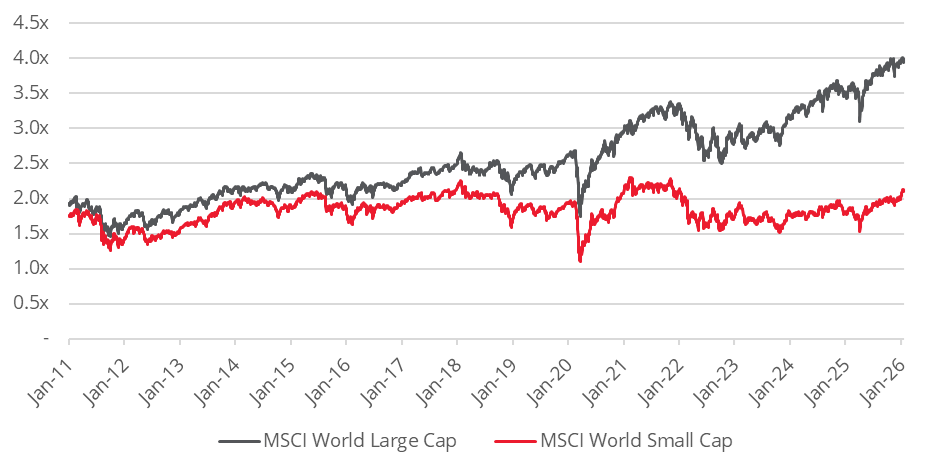

Whilst it might appear that the recent outperformance of large cap companies is driven by the exceptional earnings growth achieved by today’s leading tech giants, a closer look demonstrates that the aggregate earnings growth of large cap companies has been perfectly comparable to their smaller counterparts: from 2010 – 2025, MSCI World Large Cap companies have seen earnings grow by 126%, whilst the MSCI World Small Cap companies have grown their earnings by 209% over the same period – see Chart 3.

Despite this, the basket of larger companies will cost you 262% more than in 2010, compared with only 181% more for the smaller companies – much more in line with the improvement in earnings.

Chart 3: MSCI World Small Cap vs key global indices – relative earnings growth, 2010 – 2025

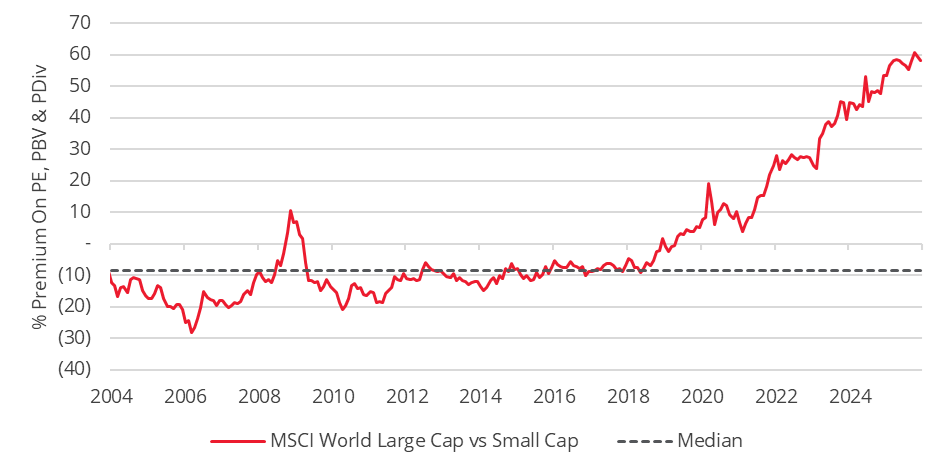

What this shows is that the large cap outperformance is simply a function of an expansion of valuation: investors have been willing to pay higher and higher prices for each $1 of earnings for large companies in the last five years, implying ever greater expectations that their futures will look as rosy as their past. An important corollary of this fact is that the returns from this valuation expansion are finite, and are at risk of unwinding: having a company go from 15x earnings to 30x earnings – with no change in income – does double your investment, but it would be imprudent to assume, on the back of an initial doubling, that your investment will double again. Indeed, continuing to own the same company at 30x runs the very real risk that you in fact end up on a round trip back to 15x – and are no better off than when you started.

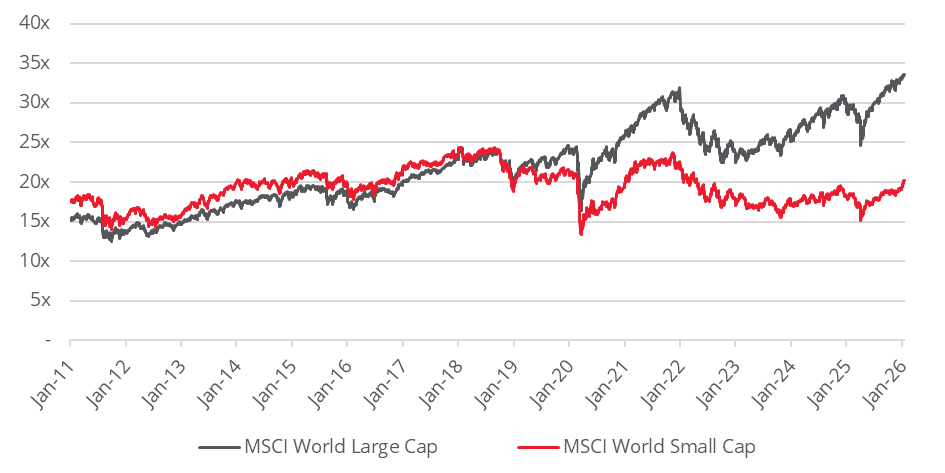

Alternatively, to make the valuation difference more explicit, we can chart simple valuation metrics, based on the fundamental earnings power and value embedded in each type of company. Again, what is clear is that larger companies, whilst certainly admirable and making great strides in business growth, are benefitting hugely of late from investors simply being willing to pay up for their earnings:

Chart 4a: MSCI World Small Cap vs Large Cap – CAPE, 2010 – 2025

Chart 4b: MSCI World Small Cap vs Large Cap – P/B, 2010 – 2025

Chart 4c: MSCI World Large Cap vs Small Cap – % premium on P/E, PBV and PDvd

For us, this translates into opportunity. Not only is the small cap pond an excellent one in which to fish – given the long-run trend of superior performance – but it is being discounted today by investors whose eyes and wallets are glued to the very largest players, making it likely to be a wonderful place to find inexpensive companies with the potential for highly attractive returns. Looking back through history, we can be comforted that in similar periods, where large cap returns have outstripped those from their smaller brethren, the subsequent returns for the investor willing to take the plunge and buy cheap small cap companies have been material:

Chart 5: Small Cap vs Large Cap – relative trailing 10yr annualised return

The key, therefore, is to realise that we may just be in the right place at the right time – and to strike whilst the iron is hot.

Double discounts

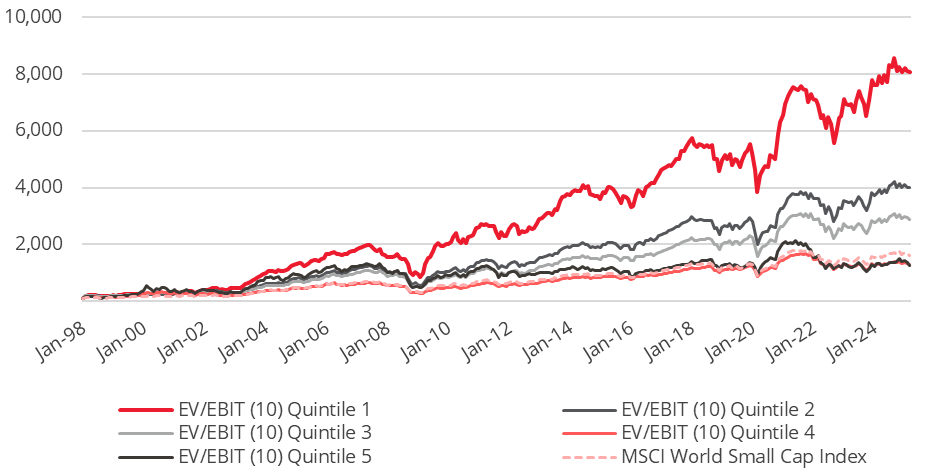

As well as feeling giddy at today’s opportunity set from buying small companies, investors should recall the return potential of value investing, the practice of buying companies with the widest discounts to intrinsic business value. Over time, this approach has tended to deliver persistent outperformance compared with owning more expensive companies, and this phenomenon – the bedrock of the value investing approach, and our investment philosophy – is similarly found in small companies:

Chart 6: MSCI World Small Cap by valuation quintile – performance

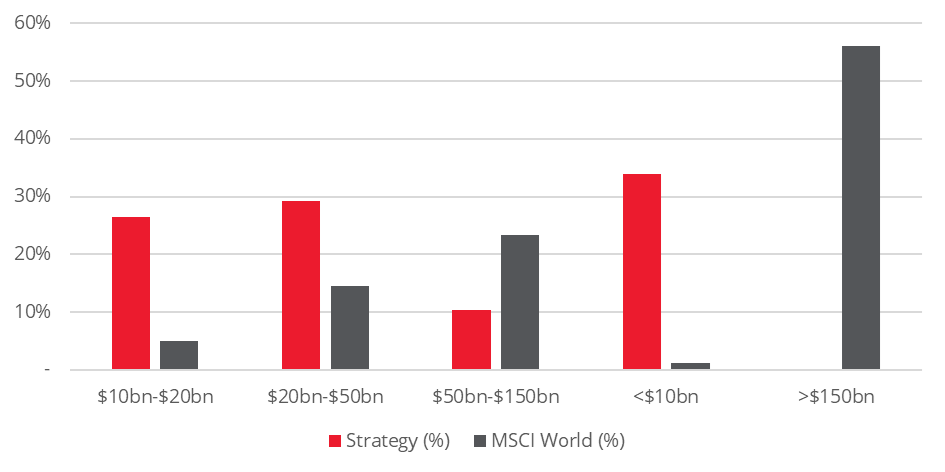

As a result, as disciplined value investors able to buy small cap companies, today we feel like children in a chocolate factory. The environment is ripe with opportunities for the discerning investor in small companies – opportunities that we are actively seeking to take. And as you’d expect, our money is very much where our mouth is: in our Global Intrinsic Value fund [2], we have 30% of our investments in companies smaller than $10bn in size (compared with 1% for the MSCI World), and a full 62% in companies smaller than $20bn (MSCI World: 6%) [2]. This is not something arrived at from some top-down plan, but instead merely a function of our fundamental, bottom-up approach: we go where we feel the value is to be had, and today – as our positioning can attest – we feel that there is more value on offer in small and medium sized companies:

Chart 7: Redwheel Global Intrinsic Value Strategy vs MSCI World – positioning by market cap

Indeed, so compelled are we by small cap’s prospects that we have recently launched a new, dedicated fund – the Redwheel Global Small Cap Value fund [4] – to apply our seasoned value investing disciplined to small companies in a focussed and unconstrained way. Of course, adding in a plug for our new fund makes these observations admittedly entirely self-serving – but it does not make them wrong. We see clear value today in smaller companies across the world, are invested accordingly, and intend to capitalise on that value.

Mindful of the imperative to seize the rewards of being in the right place at the right time, we are reminded of Rick’s iconic line at the end of Casablanca:

“If that plane leaves the ground and you’re not with him, you’ll regret it. Maybe not today. Maybe not tomorrow, but soon, and for the rest of your life”

As the small cap plane heads down the tarmac, we intend to be on it – and in the cheap seats.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

References

[1] Formally, the MSCI World Small Cap Index includes the smallest c.14% of each country’s companies, adjusted for their free float

[2] This is a marketing communication. Please refer to the Fund’s Prospectus and KID/KIID before making any investment decisions.

[3] Portfolio holdings are subject to change at any time without notice. This information should not be construed as a recommendation to purchase or sell any security.

[4] This is a marketing communication. Please refer to the Fund’s Prospectus and KID/KIID before making any investment decisions.