Global defence spending has surged in recent years amid escalating regional conflicts, driving a strong rally in Emerging Markets Aerospace Defence stocks – see Chart 1. This is particularly evident in Europe, where countries are embarking on a multi-year rearmament cycle in response to shifting geopolitical realities.

With member states committing to ambitious spending targets, the region stands at the forefront of security investment and industrial growth. We believe these trends are reshaping defence, infrastructure, and economic landscapes across the bloc, creating significant long-term opportunities for investors.

Chart 1: MSCI Emerging Markets Aerospace & Defence Index

European defence spending has only just begun

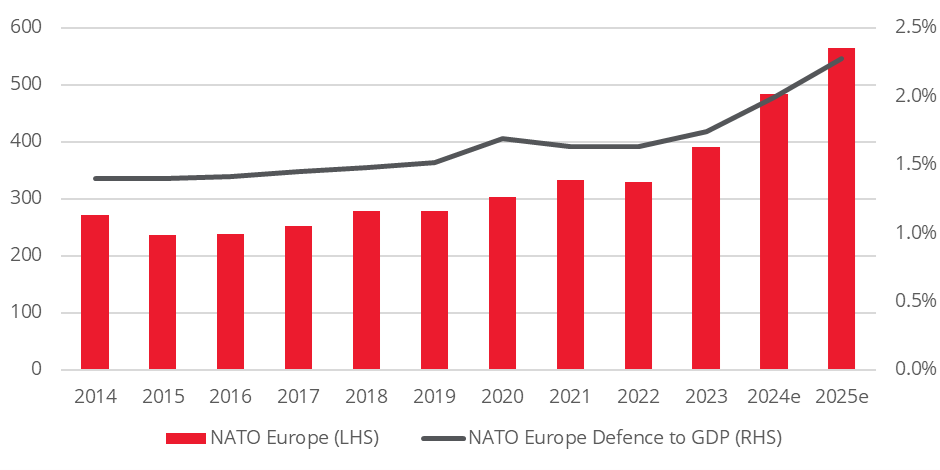

European defence spending is still in the early stages of a long-term resurgence, in our view, driven by increased tensions with Russia and strategic focus on reducing military dependence on the US. NATO forecasts its European member states to spend $564bn on defence expenditures in 2025 representing 17% year-on-year growth (at current prices and exchange rates) [1].

Chart 2: European core defence spending – $bn current prices/FX

Further increases in defence spending are likely. At the Hague Summit earlier this year, NATO members committed to a target of spending 5% of GDP annually on defence and related security expenditure, such as hard infrastructure, with at least 3.5% of GDP in core defence expenditure [2]. This compares to European NATO members’ expected outlay of 2.3% of GDP in 2025 in aggregate – see Chart 2.

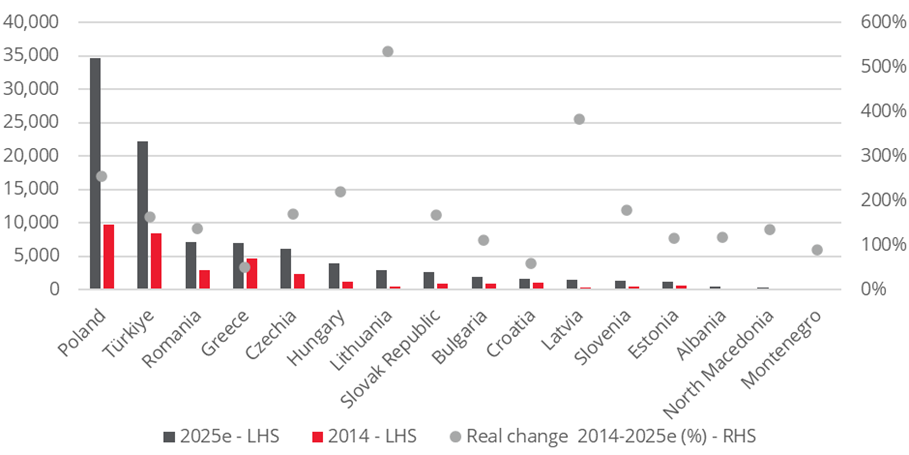

A decade of defence spending in CEE

While the Russian invasion of Ukraine has been a catalyst for increased defence expenditure over the last three years, the trend has been particularly established among Central and Eastern Europe (CEE) countries located closer to NATO’s eastern flank for over a decade. Since the 2014 annexation of Crimea, spending in various CEE countries has increased sharply – in many cases in the order of 100-200% in real terms. Lithuania, for example, is expected to see a real terms increase in defence spending this year of over 500% compared to 2014 – see Chart 3.

Chart 3: CEE defence spending – $m in 2021 real terms

Poland has been a bellwether for CEE defence spending. In absolute terms, Poland is expected to be the 5th largest spender in NATO this year and spend the highest proportion of all members of its GDP on defence at 4.5% [3].

Beneficiaries and investment opportunities

Many of the direct beneficiary defence contractors in the CEE region are not listed in public markets but are instead either state-owned or privately held. Press reports suggested that Czech defence firm CSG is seeking a valuation of €30bn in a potential IPO in 2026 [4]. Despite the lack of direct investment opportunities for now, we expect the fiscal impulse from higher defence spending positively to benefit the real economies in the region. For example, the European Commission estimates that an increase of defence spending by 1.5% of GDP in the EU would result in a 0.5% boost to GDP by 2028 [5].

Much of the initial equipment spending boost in the CEE region is likely to be spent on imports to meet urgent timelines. South Korean industry players have been a substantial beneficiary with over $20bn of land equipment and aircraft exports to Poland over the last three years [6]. Redwheel has a position in Embraer, a Brazilian-headquartered civil and defence aircraft manufacturer [7]. Embraer has also sold its C-390 military transport aircraft to Lithuania, Czech Republic and Slovakia, among other European NATO members, with further opportunities to expand exports.

At the same time, buoyant spending in the region has attracted increased FDI from larger international players, as well as partnerships with local players, as countries seek to rebuild domestic military manufacturing capabilities over time. For example, UK defence contractor BAE Systems has partnered with Poland’s state-owned PGZ group [8] to establish a new artillery ammunition facility in Poland, which is expected to create hundreds of skilled jobs. German defence manufacturer Rheinmetall has announced several investments in the CEE region including Latvia, Bulgaria, Romania, Hungary and Lithuania. In Bulgaria, Rheinmetall will make a joint investment with the government of over €1bn in gunpowder and artillery shells factories [9].

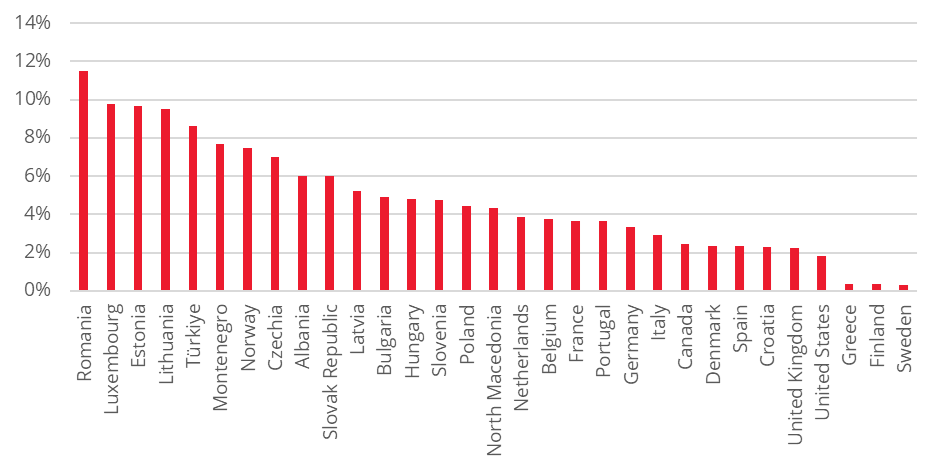

Infrastructure investment and security resilience

The current war in the Ukraine has also highlighted how traditional infrastructure investments are also important to enhance security resilience. The need to reinforce roads, bridges and transport networks to allow transport of typically heavy military equipment and vehicles is one example. NATO’s 5% defence investment target stipulates at least 3.5% of GDP on core defence requirements. It also allows for up to 1.5% of GDP annually on investments to “protect critical infrastructure, defend networks, ensure civil preparedness and resilience, innovate, and strengthen the defence industrial base” [10]. German cement manufacturer Heidelberg Materials has highlighted that higher defence spending in Europe supports a €20-40bn annual increase in investment on concrete infrastructure annually, such as shelters, barracks and warehouses [11]. Budimex, Poland’s largest construction and engineering construction company, has disclosed it has won almost 2bn PLN (c$550m) from military contracts since 2022 [12].

Increasing commodity demand

Chart 4: Infrastructure % of total defence expending – 2024e

In December 2024, recognising the strategic importance of materials supply, NATO published a list of critical raw materials important for maintaining its defence readiness and technological edge. This includes platinum, which is a key component in aircraft engines, optical systems and fuel cells for submarines and drones.

NATO defence critical raw materials

1. Aluminium

2. Beryllium

3. Cobalt

4. Gallium

5. Germanium

6. Graphite

7. Lithium

8. Manganese

9. Platinum

10. Rare Earth Elements

11. Titanium

12. Tungsten

Source: NATO, December 2024

Broader defence demand for PGMs is relatively inelastic relative to their base metal substitute, given the focus on performance and reliability. Redwheel is currently overweight Materials, including exposure across both the base metals space, such as copper, and PGMs.

German infrastructure stimulus

Beyond higher defence spending, CEE is also poised to be a beneficiary of German infrastructure stimulus. In March 2025, Germany’s government approved a €500bn special fund to be spent on infrastructure projects over the next 12 years. The average annual investment is roughly equivalent to 1% of German GDP [14]. Potential areas for infrastructure spending include decarbonisation (e.g. building renovation, heating and energy infrastructure), transport and housing.

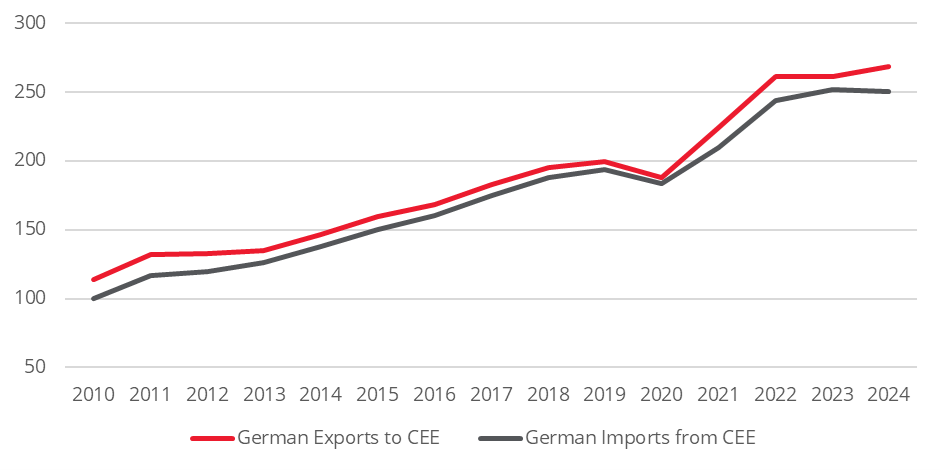

As a key trading partner of Germany, CEE countries will likely benefit from stronger German economic growth. Trade between Germany and CEE has risen steadily over the last 15 years. According to KPMG, the 2024 estimated trade volume between Germany and CEE of €519 billion exceeded the combined trade volume of Germany with the US (€256 billion) and China (€248 billion) at €504 billion [15].

Chart 5: Foreign trade between Germany and CEE (€billion)

CEE companies can also directly benefit through cross-border collaboration and demand for construction materials, engineering and skilled labour. Poland’s Budimex is active in Germany, which represents 3% of its total sales [16], including civil engineering projects such as bridge construction. The emphasis on energy infrastructure within Germany’s stimulus package can also benefit Czech energy company CEZ Group, which generates around 9% of its revenue in the country [17]. CEZ has extensive investments in Germany including onshore wind, B2B energy services as well as solar and battery storage projects.

Economic tailwinds and emerging industrial opportunities

Europe has emerged as a focal point for increased defence and infrastructure investment, driven by evolving security challenges and ambitious but necessary NATO commitments. For investors, this surge is creating new opportunities for manufacturing industry and stimulus for regional economies. We believe continued spending is likely to increase growth, improve physical infrastructure, and better prepare for ongoing geopolitical uncertainties.

Sources:

[1] NATO, August 2025

[2] NATO, June 2025

[3] NATO, August 2025

[4] Bloomberg, August 2025

[5] European Commission, May 2025

[7] Portfolio holdings are subject to change at any time without notice. This information should not be construed as a recommendation to purchase or sell any security.

[8] BAE Systems, September 2025

[10] NATO, August 2025

[11] Heidelberg Materials, May 2025

[13] Goldman Sachs, August 2025

[14] Bloomberg

[15] German-Central and Eastern European Business Outlook 2025

[16] Company financials, year-end 2024

[17] Company financials, year-end 2024

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.