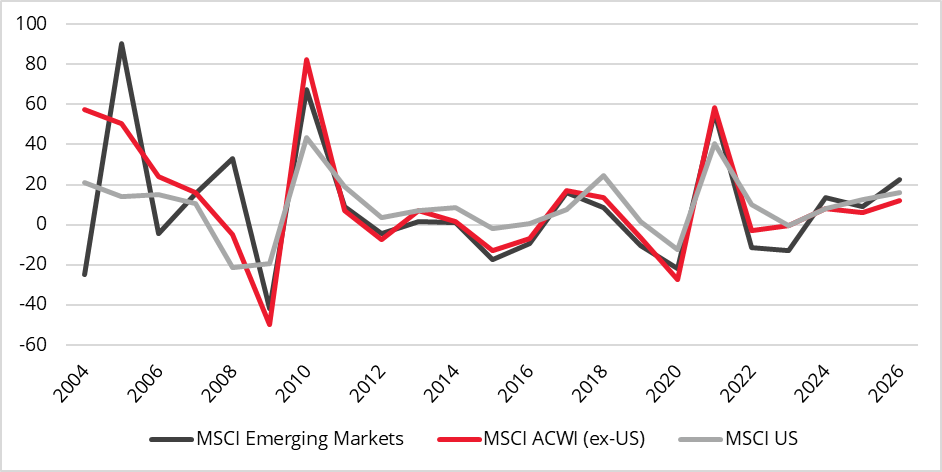

2025 marked the first year that emerging markets outperformed the US since 2017. Long-term believers in non-US markets hope this will mark a new period of outperformance to match the near decade-long streak in the first decade of the millennium, when emerging markets (EM) outperformed every year except for 2008, the year of the Global Financial Crisis.

In the 2000s, EM performance was fuelled by higher commodities’ prices and a lower US dollar. Today, similar conditions prevail, reinforced by falling rates, compelling valuations, reform momentum and shifting capital flows.

Currencies and valuations are a tailwind for international markets

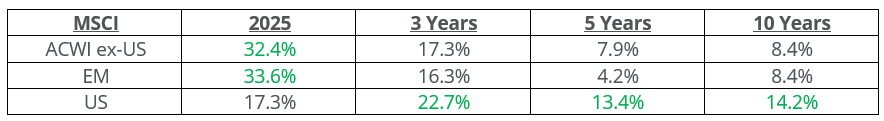

Global equities all traded at similar price-to-book valuation multiples in the late 2000s, but from 2010 onwards, US valuations began to expand and now exceed 5 times book value, a level not seen since the peak of the technology-driven bull market in the late 1990s.

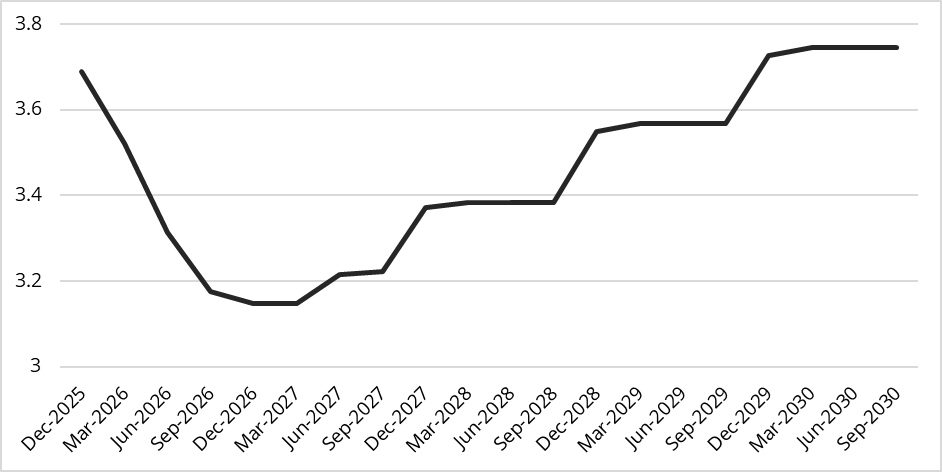

Chart 1:Price to book (x)

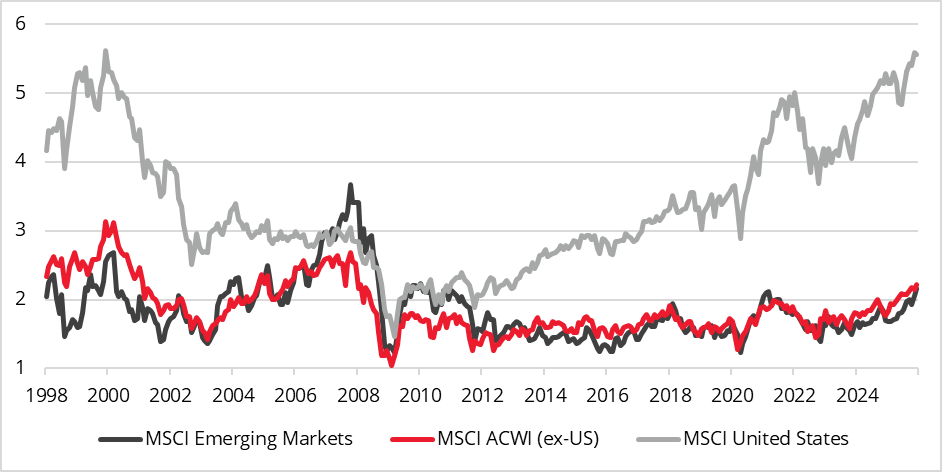

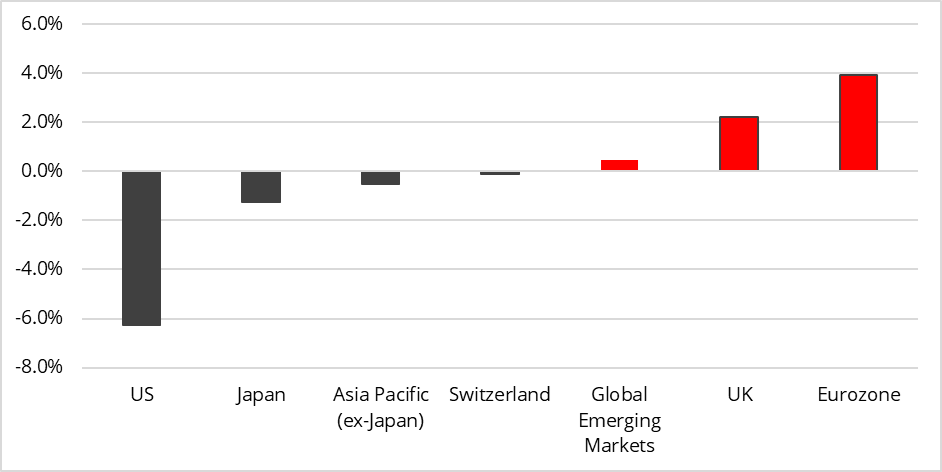

While US equities depend upon earnings growth and maintaining premium valuations, international equities have strong return potential from a re-rating of valuations to close the gap with the US, and currency appreciation against the US dollar. Markets outside the US began to narrow the valuation gap in 2025.

Chart 2: 2025 Decomposition of returns (%)

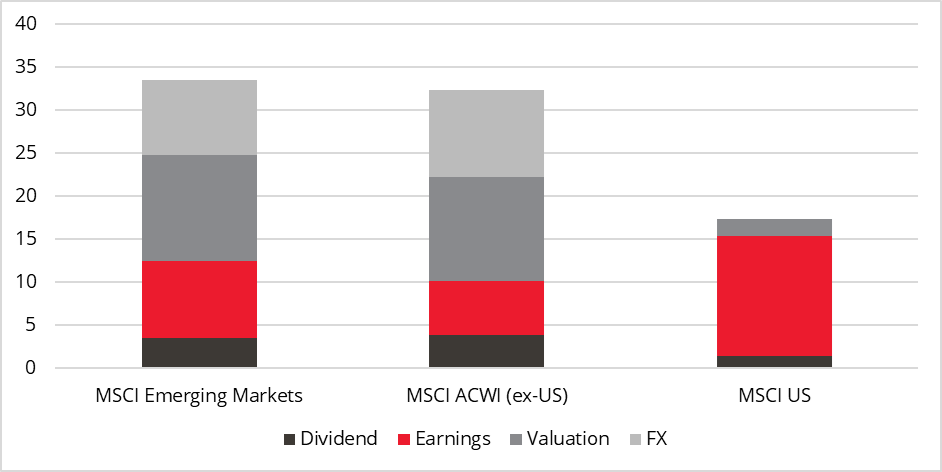

As valuations have expanded, corporate earnings must now grow to sustain higher multiples. Earnings outside the US, although more volatile, are improving and match the growth rate of the US market through 2026.

Chart 3: EPS growth (%)

What could push international markets higher in 2026?

We believe that interest rates will be the most important economic driver of global equity performance in 2026, and the US Federal Reserve sets the pace. The easing cycle that began in late 2024 resumed in late 2025 and is expected to continue in 2026. Fed funds futures indicate that the Federal Reserve will cut the policy rate twice more in 2026, reaching a level of 3.00% – 3.25% by year end

Chart 4: Fed funds futures (implied yield)

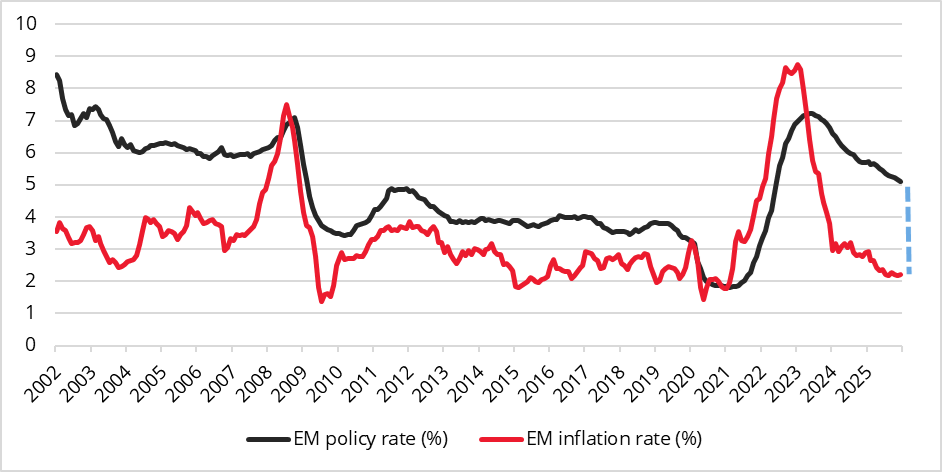

Looser US monetary policy will also permit EM central banks to lower interest rates, which are currently very tight given how rapidly inflation has decreased. Less restrictive monetary policy not only boosts growth but also helps equity valuations to continue their upwards re-rating.

Chart 5: EM policy rates v. inflation (%)

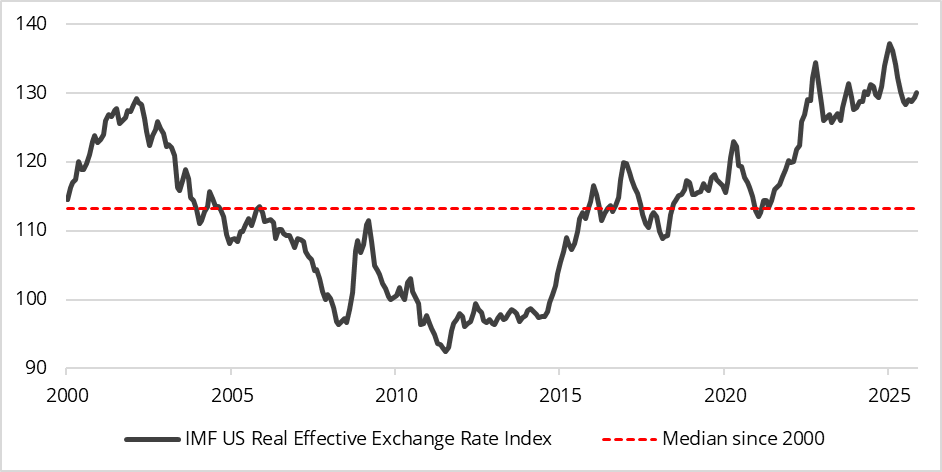

The same factors that pushed the US dollar lower in 2025 should still be present in 2026. The main cause of dollar weakness has been larger US fiscal deficits and government indebtedness without a plan for fiscal consolidation, which caused Moody’s to downgrade the US credit rating in 2025, following Fitch in 2023 and S&P in 2011. Markets have also shown concern over erratic US economic and trade policy, as well as the potential to weaken the independence of key institutions such as the Federal Reserve that have been viewed as guardians of American financial stability. International currencies have started to strengthen, but the US dollar still looks expensive in real terms.

Chart 6: US dollar looks expensive to the median real exchange rate

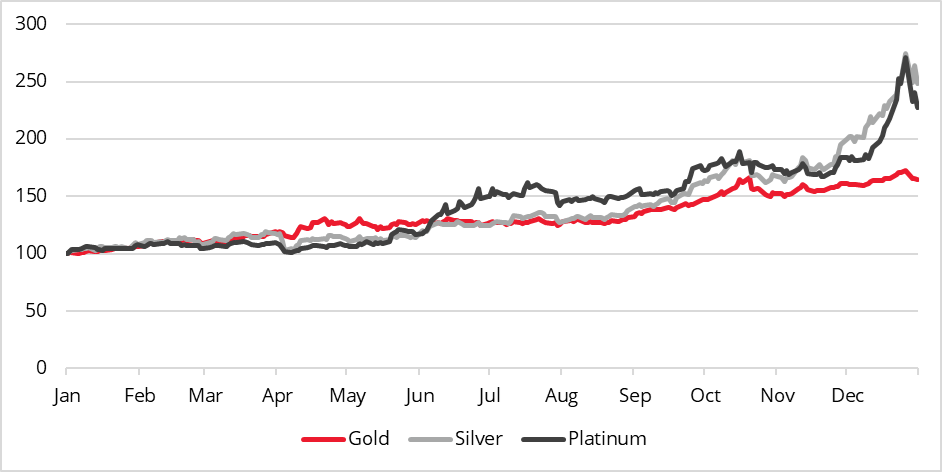

Precious and base metals have also been part of the dollar debasement trend and higher prices have benefited countries such as South Africa [1] and sectors such as materials. Although gold might have captured most of the headlines, platinum and silver have performed even more strongly. Other industrial metals including copper and aluminium should also benefit from growing demand for renewable energy and data centres, as well as demand from the defence industry [2] as NATO members increase their military spending.

Chart 7: 2025 Precious metal performance (normalized to 100)

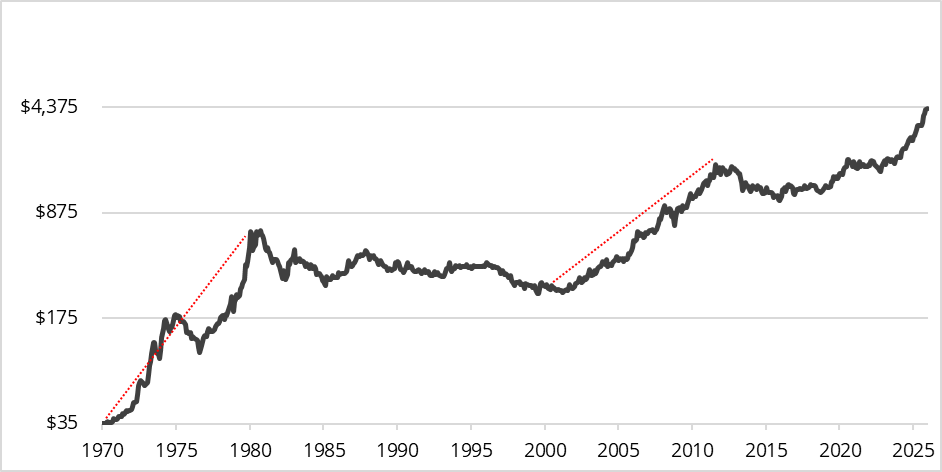

Although gold and precious metals have surged in 2025, their price performance is not unique by historical standards. From the termination of convertibility of the USD into gold in August 1971 at $41 per ounce to the peak of $850 in January 1980, gold rose 20-fold over 8 ½ years, a return of over 40% per annum. Similarly, gold climbed nearly 8 times from its 1999 low of $253 per ounce in the ‘dot.com’ boom to the cycle high of $1,900 in 2011, a compound annual return of about 20%. Therefore, the annualized increase of 45% since the start of 2024 is not extraordinary by historical standards and could keep going for several years, albeit at a less dramatic rate.

Chart 8: Price of gold (log scale, USD, monthly close)

Idiosyncratic opportunities abound

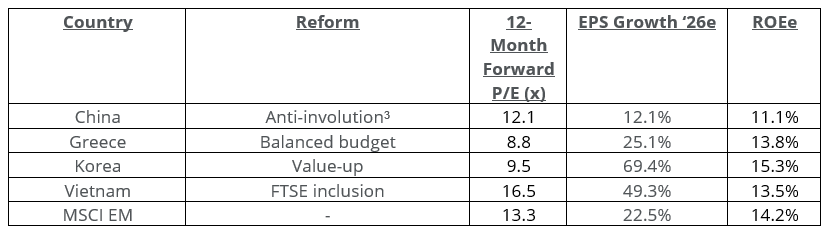

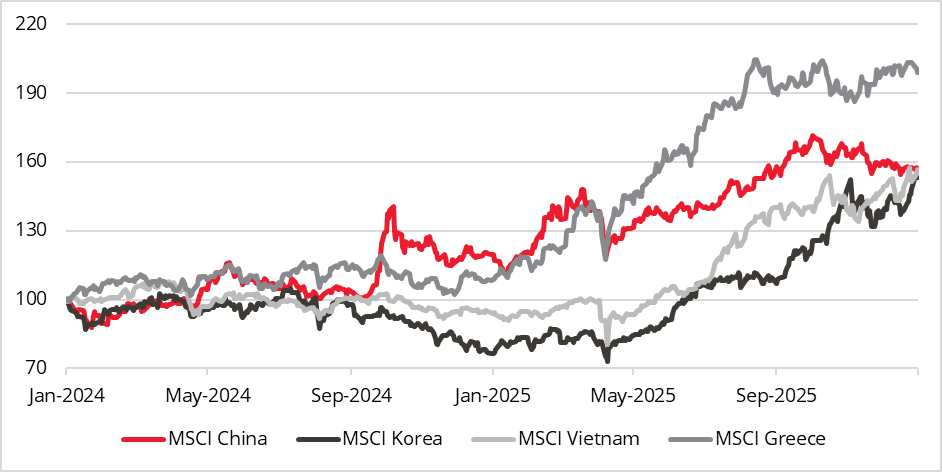

International markets are not a homogenous asset class, and there are many investment opportunities that arise independently of global themes, especially around reform and restructuring. The intention of economic reform is to lower the cost of capital, improve the return, attract investment, boost growth and raise equity valuations.

When reform and restructuring programmes work, they often lead to strong returns.

Chart 9: Reform & restructuring: Return by country (normalized to 100)

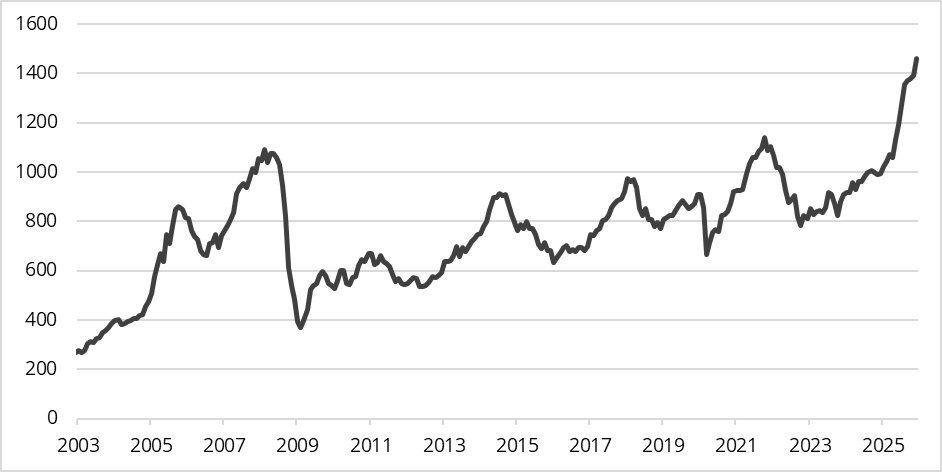

This theme has also produced strong returns in frontier markets, where Kenya, Nigeria, Pakistan and Sri Lanka have all pursued economic orthodoxy after crises, and the MSCI Frontier Markets Index hit new highs throughout the second half of 2025.

Chart 10: MSCI Frontier Markets Index

Investors are increasing exposure to emerging markets at the expense of the US

We estimate that investors committed approximately $45bn to passive ETFs in 2025, but have raised their allocations to emerging markets very slightly.

Chart 11: Active weight by region

The trend of allocating away from US equities is likely to continue, not only because of its high valuation but also because of its over-representation in global equity indices.

The correction of the imbalances in equity indices, in favour of emerging and international markets at the expense of the US, is a long-term structural feature that is likely to be corrected gradually.

Chart 12: Top 5 MSCI ACWI Index country weights (%)

Chart 13: Top 10 countries by global GDP contribution (%)

The next chapter

The conditions that powered the last emerging market super cycle – cheaper currencies, firmer commodities and a relative growth advantage – are re‑emerging. We expect long-term allocators to look increasingly beyond the US towards markets that offer diversification, lower valuations and increased exposure to manufacturing industries underpinned by structural growth tailwinds. In our view, 2026 could prove to be the next chapter in a longer cycle of international equity leadership.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

References

[1] See ‘Harnessing reform as a catalyst for growth: South Korea and South Africa’, Redwheel, August 2025

[2] See ‘Europe’s defence resurgence: Mapping the opportunities’, Redwheel, October 2025

[3] See ‘Ending the race to the bottom: China’s anti-involution reforms explained’, Redwheel, November 2025