Part 3: Retail traders

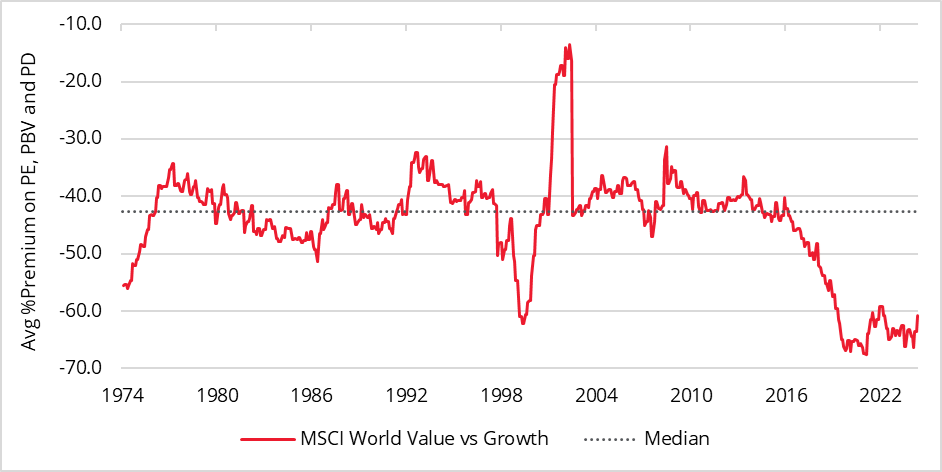

This is the third in a series of notes that explores the increase in the number of market participants who are ‘valuation agnostic’, and how their influence might explain why the gap between the cheapest and most expensive stocks is close to its widest level for fifty years – see Chart 1.

Chart 1: MSCI World value vs growth, average valuation premium

In Part 1 we examined how passive investing had created mispricing of securities whilst in Part 2 we looked at how pod shops had amplified this. In Part 3 we look at the impact of retail traders and discuss how this produces both challenges and opportunities for long-term investors such as us who focus on fundamentals and valuation.

Day trading by retail investors has grown in recent years

The proliferation of retail day trading, epitomised by platforms like Robinhood and the Reddit WallStreetBets phenomenon (see the Appendix), represents a fundamental transformation in market microstructure that extends far beyond cyclical increases in retail participation. Day trading in the US stock market has seen a significant increase in recent years, particularly during the COVID-19 pandemic. The magnitude of retail trading expansion since 2020 represents an unprecedented structural shift in market participation that extends well beyond historical precedents. By 2021, retail investors comprised 25% of total equities trading volume, nearly double the percentage reported a decade prior [1]—a transformation that occurred with remarkable velocity.

The concentration effect within this expansion reveals critical insights into market structure evolution. Nvidia alone has attracted nearly $4 billion in daily retail trading volume, representing 13.4% of all retail dollars traded despite being the most popular stock by value for only 64% of trading days [2]. This concentration phenomenon has reached unprecedented absolute magnitudes. Tesla’s previous capture of nearly 30% of all retail value traded in February 2023 provides comparative context, having maintained distinction as the most traded retail stock for 678 days (48% of the period) since January 2019, averaging 8.6% of retail dollar volume daily2.

Several factors have contributed to this trend:

1. Increased accessibility: Online trading platforms and apps have made it easier for individuals to participate in day trading. Companies like Robinhood have lowered the barriers to entry by offering commission-free trades.

2. Market volatility: The pandemic created a highly volatile market, which attracted day traders looking to capitalise on rapid price movements.

3. Stimulus checks: Government stimulus checks provided many individuals with extra funds, some of which were invested in the stock market.

4. Social media influence: Platforms like Reddit, particularly the subreddit r/WallStreetBets, have played a significant role in encouraging retail investors to engage in day trading.

5. Technological advancements: The rise of algorithmic trading and advanced trading tools has also made day trading more appealing and accessible.

The impact of the growth in retail day traders

This structural shift has materially impacted corporate valuations through concentrated flows, algorithmic amplification, and the emergence of non-fundamental price drivers that challenge traditional arbitrage mechanisms.

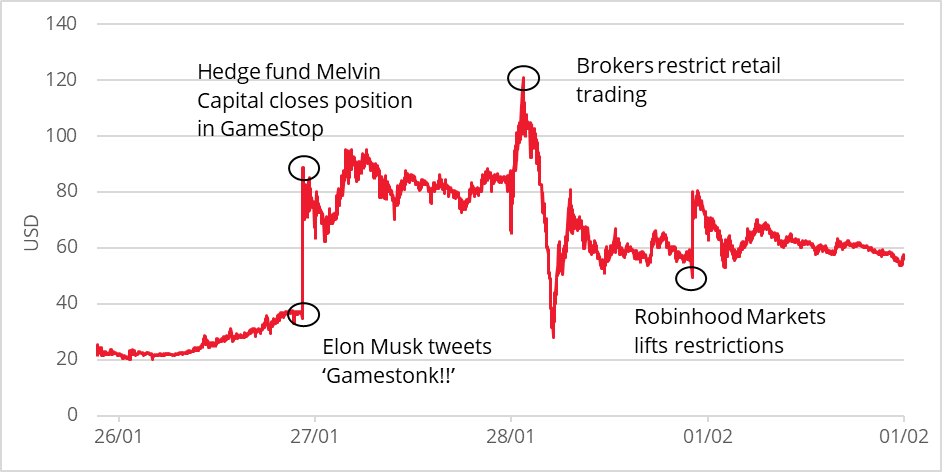

The GameStop episode of January 2021 served as an inflection point that exposed latent vulnerabilities in market structure while demonstrating the capacity for coordinated retail activity to overwhelm institutional safeguards.

On 27 January, 2021, GameStop opened 143% above its previous close and then climbed, closing 10% above its opening price [3]. 28 January saw even greater levels of volatility. GameStop opened down, roughly 25% on the previous day’s close, before shooting higher, rallying 82% in about 30 minutes and then plummeting 77% a couple of hours later. From there, it jumped 150% before sliding back to close – wait for it – 25% off its open, 60% off its high but 75% off its low. The following day, it opened almost 100% higher again.

Chart 2: GameStop Price Action, 26 January – 1 February 2021

However, the implications extend beyond individual security volatility to encompass systemic changes in price discovery, market concentration, and the intersection of technology platforms with financial infrastructure that require comprehensive analysis for market participants and policymakers.

The impact on long-term fundamental value investors

The impact that the volatility caused by retail traders crowding into the same stock is perhaps best demonstrated by the fact that the highly respected hedge fund Melvin Capital required a $2.75 billion bailout from Citadel and Point72 following losses that occurred from a short position in GameStop [4]. As with pod shops, the fact that these retails traders now represent a sizeable amount of daily liquidity and that they tend to concentrate their bets into the same stocks means they can have a huge impact on share prices. The fact that they are not investing with any informed view of the underlying value or fundamentals means that share prices can move both far above and far below the intrinsic value of the business.

This presents a challenge for long-term value investors as a stock that has been bought at what appeared to be a very low valuation can be driven even lower by retail traders who are mostly focused on price momentum. This can lead to short-term volatility which is uncomfortable for investors – but it can also create opportunities for greater long-run returns since share prices may be driven even further below the intrinsic value of the business.

As we argued in our previous blogs, any change to the market structure that creates a mispricing of securities should increase the opportunity set for those whose investment approach is based around long-term fundamentals and valuation.

Appendix: What is WallStreetBets?

The WallStreetBets phenomenon refers to the impact of the subreddit r/wallstreetbets on the stock market. This community, known for its irreverent humour and high-risk trading strategies, gained significant attention in early 2021 during the GameStop short squeeze. Here are some key points:

1. Origins and culture: Founded in 2012, WallStreetBets initially focused on discussing high-risk trading strategies. It quickly evolved into a community that celebrates unconventional investment approaches, often using colourful jargon and memes

2. Meme stocks: The subreddit became famous for driving up the prices of heavily shorted stocks like GameStop and AMC Entertainment through coordinated buying efforts, leading to dramatic short squeezes

3. Impact on the market: The collective actions of WallStreetBets members can significantly impact stock prices, often causing substantial market disruptions and increased regulatory scrutiny

4. Community dynamics: Members often embrace high-risk, high-reward gambles, symbolised by terms like «diamond hands» (holding assets through extreme volatility) and «YOLO» (you only live once)

5. Broader implications: The phenomenon has highlighted the power of retail investors and the influence of social media on financial markets, challenging traditional Wall Street practices

Sources:

[1] The Retail Investor Report, August 2023

[3] Bloomberg

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.