The ascendancy of the growth style of investing over the last decade has been unusual in its strength and duration. There are now signs that the winds of change are blowing through global equity markets. Read on to find out how RWC’s Global Equity Income strategy may benefit should the growth headwind become a dividend-investing tailwind.

What if a growth-investing headwind…

Although many factors have contributed to this growth obsession, an enduring period of ultra-low interest rates has undoubtedly been an important engine. Official interest rates reflect the rate at which future cashflows are discounted, so a lower interest rate increases the value of future cashflows from equity investments. In theory, this should increase the current value of all equities, but it tends to favour growth companies, where a greater proportion of current value is deemed to be associated with future cashflows, more than it does those with traditional “value” characteristics, where more of the value is associated with the here and now.

Nevertheless, the longer this dynamic has played out in markets, the more stretched valuations have become among many growth stocks. The long history of financial markets suggests that there must eventually come a point at which the valuation stretch in markets starts to normalise. The valuation altimeters for many of the stocks that most closely personify this growth obsession make for scary reading, and the prospect of a nose-dive cannot be completely ruled out.

In the meantime, however, these conditions have inevitably represented a headwind for any investor unable or unwilling to embrace these stocks and others like them. Our disciplined investment approach means that we will leave them on the table. Our yield discipline prevents us from investing in any stock unless it yields more than 25% above the global average. That immediately screens these growth stocks which, as a result of their seemingly unstoppable share price performance, offer very little in terms of dividend yield, out of our investable universe. Irrespective of this distinctive yield criteria, however, our broader investment disciplines would prevent us from participating, given the substantial valuation risk that these stocks now entail.

Make no mistake, though – we do like some growth characteristics. We love to invest in quality businesses that can deliver long-term growth in earnings and cashflows. Just not at any price. It is the price that has become the problem for many stocks, not the concept of sustainable growth. Our entire investment process is designed to identify and invest in quality companies that can deliver growth at a time when they are not priced for growth. Each stock must deliver a premium yield, dividend sustainability and a valuation margin of safety. That is why we call it “Quality at a Reasonable Yield”.

We believe this disciplined process is robust and repeatable, and it has delivered outperformance over the last decade. This is a significant achievement in such a relentlessly adverse investment environment.

…becomes a dividend-investing tailwind?

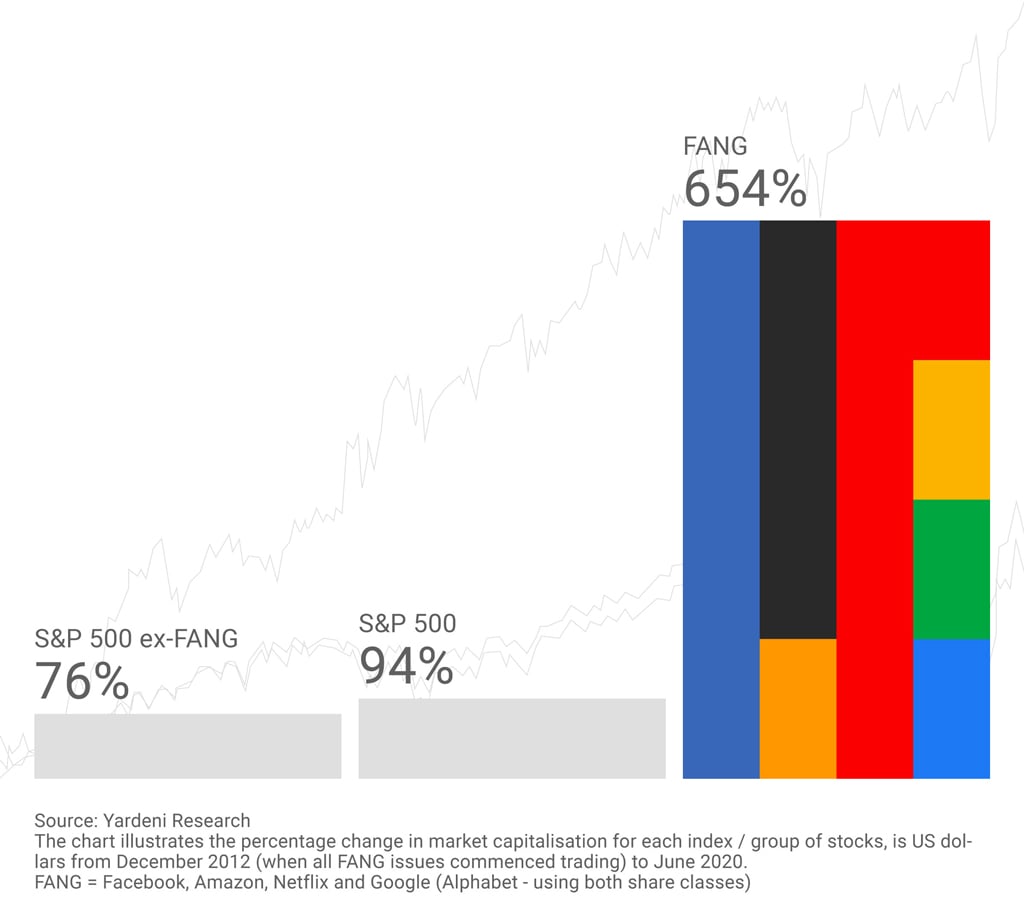

Investors are sounding the alarm bell around the extreme valuations of technology stocks and other parts of the market that display classic ‘growth’ characteristics. Many people believe we are in bubble territory and are questioning the elevated share prices in parts of the market that have driven returns in recent years. For example, valuations of some of the big US technology companies have reached almost 10x sales. The combined market capitalisation of the five largest US stocks is equivalent to the third largest country in the world, with only the US and China’s GDP greater. The assumptions on future growth that will be required to enable investors to make a positive return from here are extraordinary. In fact, we would argue, they are basically impossible.

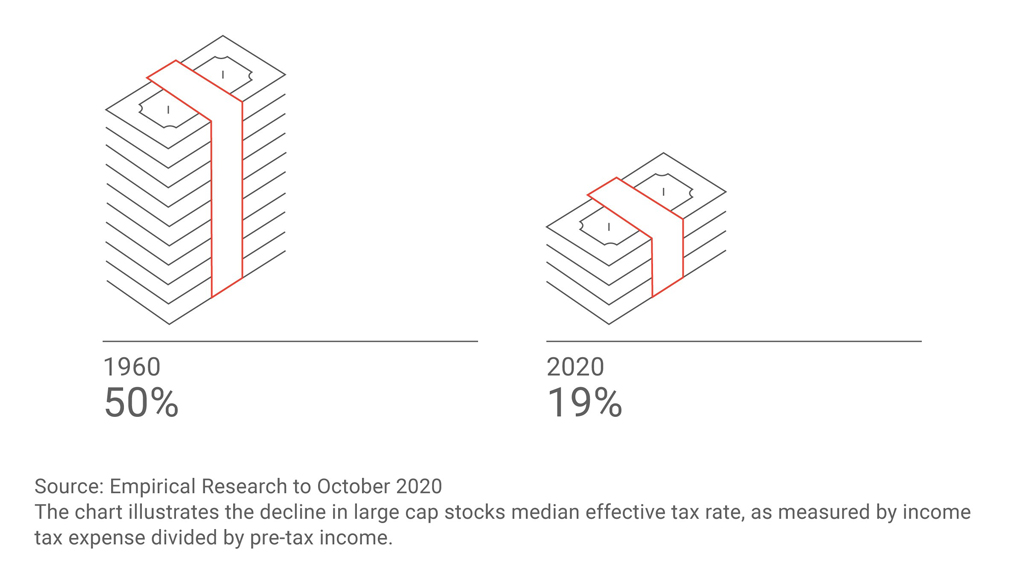

Certainly, they are not priced for anything to go wrong, which is interesting given that governments the world over are wrestling with how to raise taxes to pay for some of the extraordinary stimulus spent and promised. Corporation tax for the largest companies has fallen from 50% in the 1960s to below 20% today, and many of the largest technology companies pay 10% or less. It doesn’t seem inconceivable that corporates will be forced to pay a share of the costs of dealing with the pandemic, especially those that have benefited from it.

The wind beneath our wings

As a reminder, therefore, a wide body of evidence demonstrates that the power of compounding a sustainable dividend has been a successful investment strategy for more than a century. We believe that this will prove to be a more enduring force in equity markets than the current infatuation for over-paying for growth characteristics.

If we are to see a tailwind for dividend-based strategies, the next ten years will look markedly different to the decade that has just passed. The flight path therefore looks encouraging for our strategy. Similar to an eastward bound aeroplane flying across the Atlantic towards Europe, a tailwind in markets should allow disciplined dividend-based strategies to deliver their investors to successful destinations even faster.

Chocks away…

The term “RWC” may include any one or more RWC branded entities including RWC Partners Limited and RWC Asset Management LLP, each of which is authorised and regulated by the UK Financial Conduct Authority and, in the case of RWC Asset Management LLP, the US Securities and Exchange Commission; RWC Asset Advisors (US) LLC, which is registered with the US Securities and Exchange Commission; and RWC Singapore (Pte) Limited, which is licensed as a Licensed Fund Management Company by the Monetary Authority of Singapore.

RWC may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. RWC seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by RWC are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

This document has been prepared for general information purposes only and has not been delivered for registration in any jurisdiction nor has its content been reviewed or approved by any regulatory authority in any jurisdiction. The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by RWC; or (iv) an offer to enter into any other transaction whatsoever (each a “Transaction”). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party.

RWC uses information from third party vendors, such as statistical and other data, that it believes to be reliable. However, the accuracy of this data, which may be used to calculate results or otherwise compile data that finds its way over time into RWC research data stored on its systems, is not guaranteed. If such information is not accurate, some of the conclusions reached or statements made may be adversely affected. RWC bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction. Any opinion expressed herein, which may be subjective in nature, may not be shared by all directors, officers, employees, or representatives of RWC and may be subject to change without notice. RWC is not liable for any decisions made or actions or inactions taken by you or others based on the contents of this document and neither RWC nor any of its directors, officers, employees, or representatives (including affiliates) accepts any liability whatsoever for any errors and/or omissions or for any direct, indirect, special, incidental, or consequential loss, damages, or expenses of any kind howsoever arising from the use of, or reliance on, any information contained herein.

Information contained in this document should not be viewed as indicative of future results. Past performance of any Transaction is not indicative of future results. The value of investments can go down as well as up. Certain assumptions and forward looking statements may have been made either for modelling purposes, to simplify the presentation and/or calculation of any projections or estimates contained herein and RWC does not represent that that any such assumptions or statements will reflect actual future events or that all assumptions have been considered or stated. Forward-looking statements are inherently uncertain, and changing factors such as those affecting the markets generally, or those affecting particular industries or issuers, may cause results to differ from those discussed. Accordingly, there can be no assurance that estimated returns or projections will be realised or that actual returns or performance results will not materially differ from those estimated herein. Some of the information contained in this document may be aggregated data of Transactions executed by RWC that has been compiled so as not to identify the underlying Transactions of any particular customer.

The information transmitted is intended only for the person or entity to which it has been given and may contain confidential and/or privileged material. In accepting receipt of the information transmitted you agree that you and/or your affiliates, partners, directors, officers and employees, as applicable, will keep all information strictly confidential. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information is prohibited. The information contained herein is confidential and is intended for the exclusive use of the intended recipient(s) to which this document has been provided. Any distribution or reproduction of this document is not authorised and is prohibited without the express written consent of RWC or any of its affiliates.

Changes in rates of exchange may cause the value of such investments to fluctuate. An investor may not be able to get back the amount invested and the loss on realisation may be very high and could result in a substantial or complete loss of the investment. In addition, an investor who realises their investment in a RWC-managed fund after a short period may not realise the amount originally invested as a result of charges made on the issue and/or redemption of such investment. The value of such interests for the purposes of purchases may differ from their value for the purpose of redemptions. No representations or warranties of any kind are intended or should be inferred with respect to the economic return from, or the tax consequences of, an investment in a RWC-managed fund. Current tax levels and reliefs may change. Depending on individual circumstances, this may affect investment returns. Nothing in this document constitutes advice on the merits of buying or selling a particular investment. This document expresses no views as to the suitability or appropriateness of the fund or any other investments described herein to the individual circumstances of any recipient.

AIFMD and Distribution in the European Economic Area (“EEA”)

The Alternative Fund Managers Directive (Directive 2011/61/EU) (“AIFMD”) is a regulatory regime which came into full effect in the EEA on 22 July 2014. RWC Asset Management LLP is an Alternative Investment Fund Manager (an “AIFM”) to certain funds managed by it (each an “AIF”). The AIFM is required to make available to investors certain prescribed information prior to their investment in an AIF. The majority of the prescribed information is contained in the latest Offering Document of the AIF. The remainder of the prescribed information is contained in the relevant AIF’s annual report and accounts. All of the information is provided in accordance with the AIFMD.

In relation to each member state of the EEA (each a “Member State”), this document may only be distributed and shares in a RWC fund (“Shares”) may only be offered and placed to the extent that (a) the relevant RWC fund is permitted to be marketed to professional investors in accordance with the AIFMD (as implemented into the local law/regulation of the relevant Member State); or (b) this document may otherwise be lawfully distributed and the Shares may lawfully offered or placed in that Member State (including at the initiative of the investor).

Information Required for Distribution of Foreign Collective Investment Schemes to Qualified Investors in Switzerland

The representative and paying agent of the RWC-managed funds in Switzerland (the “Representative in Switzerland”) is Société Générale, Paris, Zurich Branch, Talacker 50,

P.O. Box 5070, CH-8021 Zurich. In respect of the units of the RWC-managed funds distributed in Switzerland, the place of performance and jurisdiction is at the registered office of the Representative in Switzerland.