Part 2: Pod shops

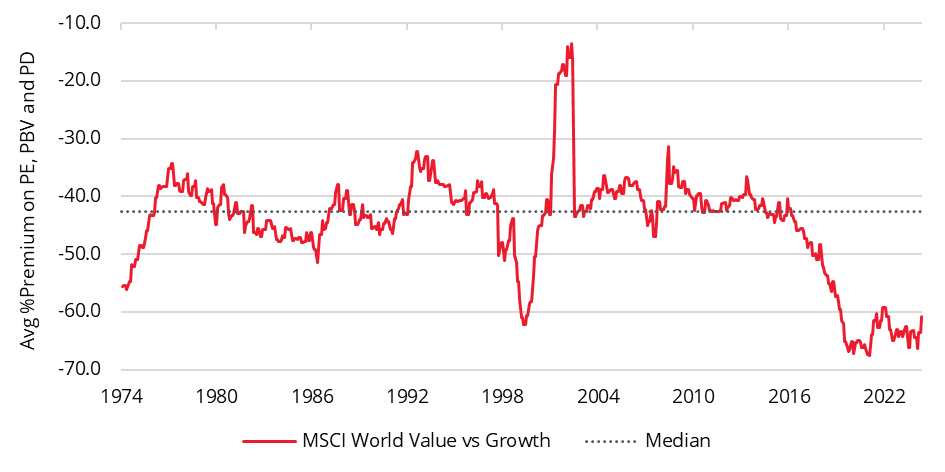

This is the second in a series of notes that explores the increase in the number of market participants who are ‘valuation agnostic’, and how their influence might explain why the gap between the cheapest and most expensive stocks is close to its widest level for fifty years – see Chart 1. We discuss how this produces both challenges and opportunities for long-term investors such as us who focus on fundamentals and valuation.

Chart 1: MSCI World value vs growth, average valuation premium

In the first part here, we looked at how the enormous growth in passive investing – in particular, market capitalisation-weighted passive investing – has potentially increased the number of stocks that are incorrectly priced. We now turn to the growth of multi-manager hedge funds, commonly known as ‘pod shops’, and the impact they have had on market pricing.

What exactly is a ‘pod shop’?

Pod shops operate as platforms that allocate capital to many independent portfolio managers or ‘pods’, each running their own strategies, often with a sector or event-driven focus. The parent fund typically enforces strict risk controls, including tight stop-loss limits, intraday risk monitoring, and a mandate for market neutrality, meaning that the aggregate exposure to market direction (beta) is minimised, allowing the parent fund to gear up the strategies. This structure is designed to deliver consistent, low volatility returns regardless of broader market moves, a feature that has made pod shops especially attractive to institutional investors seeking stable performance in a low-return world.

The incentive structure within pod shops further shapes their market impact: portfolio managers are rewarded for short-term, risk-adjusted performance, with capital allocations and compensation closely tied to recent results. Many pod shops even penalise managers for holding positions longer than a set period (often 30 days), pushing them towards rapid turnover and event-driven trading. This creates a powerful incentive for pods to focus on catalyst events – such as earnings releases, guidance updates, analyst estimate revisions, and regulatory news – that can move stock prices in the short term.

How influential are they?

The scale of pod shops is unprecedented. The two largest firms are Citadel, which has $65 billion of assets under management (AUM), and Millennium, which has $73 billion[1]. Citadel has a headcount of around 3,000 employees, less than half of which are investment professionals, whilst Millennium has over 6,000 employees, around half of which are investment professionals[2]. The collective headcount of pod shops has tripled since 2015, further underscoring their rapid recent growth[3].

Since part of their strategy is to leverage their assets, their influence is magnified beyond what their AUM would imply. Data from the Office of Financial Research (OFR) illustrates that the gross leverage of multi-strategy funds including pod shops has risen from 4x a decade ago to 12x today, while their net leverage has risen from 2x to around 4.5x today[4]. This, combined with the fact that many of their strategies have high turnover and tight risk controls, means that they have an outsized influence in the market, and it is estimated that they now account for over 30% of US equity trading volume[5]. This concentration of capital and trading activity means that pod shops are often the marginal price-setters in the stocks they trade, with their flows and reactions shaping intraday and event-driven volatility.

Impact on valuations

Pod shops are uniquely positioned to respond rapidly to earnings announcements and other corporate events. Their structure of multiple independent teams, each with sector or event expertise armed with sophisticated data and analytics, allows them to process new information and adjust positions within minutes or seconds of a news release. The parent platform’s risk controls and capital allocation processes further incentivise rapid repositioning, as pods that are slow to react risk underperforming their peers and losing capital allocations. This has led to a market environment where the response to earnings surprises is both faster and more violent than in the past. Stocks that beat expectations can see immediate, sharp rallies as pods pile in, while those that disappoint can experience precipitous drops as pods race to exit or short the name. The effect is particularly pronounced in the most liquid, widely followed stocks where pod shop activity is most concentrated.

Challenges and opportunities for long-term, fundamental-driven investors

The very short investment time horizon of pod shops means that valuation is almost completely irrelevant to them, and their focus is instead on momentum and trend. Long-term investors such as us are often shocked when a company that we own plummets on a small quarterly earnings miss despite the fact that it was already trading on a very low valuation, and we believe that this almost certainly reflects the influence of the pod shops. This sense of frustration that we feel was echoed in a recent blog by US value investor Harris Kupperman[6]:

“In my realm of value investing, I’m genuinely amazed at how these pods will short high-quality, rapidly growing businesses at under five times cash flow—just because the next quarter will be weak. I don’t understand how that strategy makes money, except during highly truncated bear-raids, yet the pods keep playing at it as they fixate on short-term rates of change. Then right after the negative print, they often accelerate their short selling, pressuring the stock in the pre-market and further spooking the longs. They want to take a bad quarter and stampede things, so that they can cover. Even then, sometimes they don’t cover until the data stops inflecting negatively. Then they cover en masse.”[7]

If, like us, you believe that in the long term, share prices will be driven by fundamentals and move towards intrinsic value, the influence of the pod shops creates an opportunity. As share prices are being driven further away from the true underlying value of the business, this should, all other things being equal, increase future returns for valuation-oriented investors who take advantage of such dislocations to buy shares.

The momentum-oriented, valuation-agnostic approach of the pod shops provides us with an opportunity to buy good companies at very low valuations which is, of course, the very essence of value investing. The recent flurry of takeovers and the surge in share buybacks that we have observed recently suggests that we may have reached the lower limit on valuations, which is the cue for other market participants to step in and take advantage of the valuation anomaly. This dynamic may presage a better environment for value investing in general.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

Sources:

[1] Corporate websites. April, 2025

[2] Rupak’s Substack. April, 2025

[4] Rupak’s Substack. April, 2025

[6] Harris Kupperman is the founder of Praetorian Capital Management LLC, an investment manager focused on using inflecting trends to guide stock selection and event-driven strategies. Mr. Kupperman is also the author of Praetorian Capital’s public blog, Kuppy’s Korner

[7] ‘Know Your Enemy’ 3 March, 2024