Why patient-centric health care companies are proving resilient

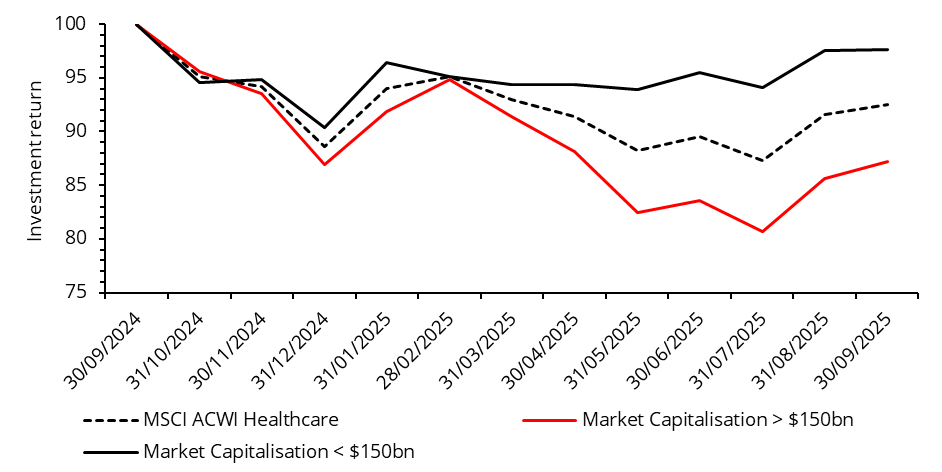

As we have discussed in our most recent article – Health care: A once-in-a-decade valuation opportunity? – the MSCI ACWI Health Care Index has underperformed the wider market over the past year. In the year to the end of September 2025, the Index declined by 7.5% (in US Dollar terms) [1], led by the 17 largest companies (market capitalisation greater than $150bn). We find this fascinating since it is the reverse of the dynamic seen in wider equity markets, where returns have been driven by only the top handful of companies.

The Index consists of around 300 companies, but the 17 largest companies account for about 50% of the total Index weighting[2]. The performance of these stocks has been exceptionally poor, falling 13% in aggregate over the past 12 months – and 20% at its nadir – dragging down the Index as a whole, while the remaining 285 Index constituents performed better (see Chart 1).

And while returns have still been negative, those 285 companies have been more resilient amid a storm of bad news, including political headwinds, tariffs, DOGE-led disruption at US government agencies, such as the US Food and Drug Administration, and higher US interest rates.

Chart 1: Poor performance of the MSCI ACWI Health Care Index has been led by the largest 17 constituents (> $150bn)

We think the lessons for investors are two-fold. Firstly, market participants that buy passive exposure to health care risk being overly concentrated in a small number of large companies. Secondly, health care is a highly diverse sector and significantly differentiated investment returns compared to the benchmark are possible, but we believe this requires an investment approach that diverges from the crowd.

The poor performance from health care’s ‘Not so magnificent 17’

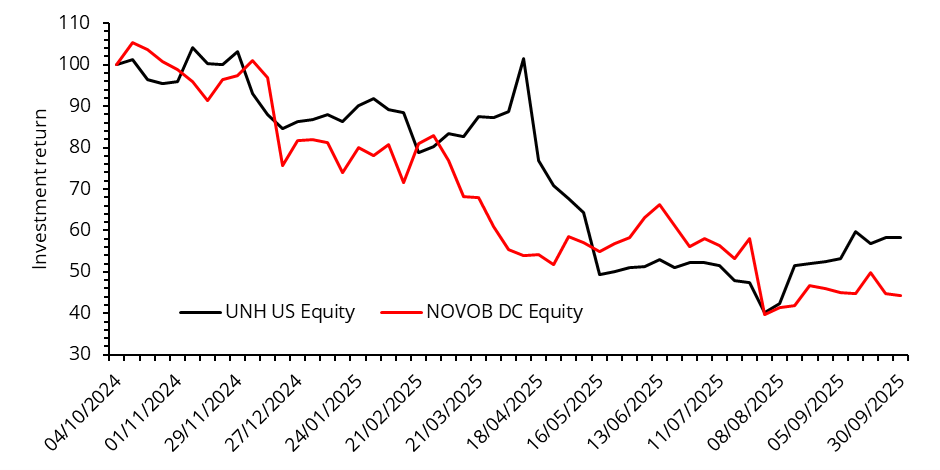

Health care’s ‘Not so magnificent 17’ has included some high-profile blow ups. Novo Nordisk’s stock lost more than 55% of its value in the year to September 2025 (see Chart 2) as branded and generic competition to its obesity drugs led to profit warnings and downgraded expectations. Similarly, United Health fell more than 40% in the same timeframe as the health care insurer’s operations faced a maelstrom of challenges to profitability and investigations into its practices by the US Department of Justice. United Health’s sell off was particularly painful for those investors heeding the widely held view that the stock was insulated from Trump’s tariffs prior to the stock’s implosion.

Chart 2: Share price return of Novo Nordisk and UnitedHealth Group over the past year

In our view, the high-profile nature of these companies and their struggles had the effect of chilling investor sentiment towards the entire sector despite the fact there are many companies delivering significant results.

The patient-focused approach to health care investing

We believe our focus on the most life-changing solutions for patients leads to differentiated stock selection. We simply think if we focus on the most life-changing solutions for patients, then we will identify more commercially successful companies and deliver differentiated performance.

Often, it’s smaller, more nimble companies whose impact on patients’ lives are greatest and clearest. For example, if we invest in a small biotechnology company developing a treatment for lung disease where there is no current pharmaceutical treatment available, then the performance of the stock in the long-term will be largely determined by how well that treatment benefits patients, even if in the short-term macroeconomic sentiment can induce volatility in the stock.

In contrast, the success of a larger pharmaceutical company may be determined by several other factors which are very difficult to predict with confidence: the magnitude of the tariff on Chinese exports to the US is near impossible to forecast yet can have a significant impact on the financial performance of larger pharmaceuticals businesses.

We believe our focus on life-changing solutions naturally pushes us towards smaller, more nimble health care companies. As a result, we have significantly less exposure to large market cap companies compared to the Index and we believe this has helped insulate us from the weaker returns of this group over the past year.

Patient-focused investing in action

Our approach favours companies such as Guardant Health and Insmed [3]. In the 12 months to the end of September 2025, Guardant Health and Insmed are up 97% and 172%, respectively [4]. Guardant Health is a diagnostics company focused on blood-based testing for oncology and Insmed is a biotech company focused on respiratory diseases.

The unifying factor is our belief that both companies have technologies with a profound capability to revolutionise the standard of care for patients. Blood-based testing for oncology has demonstrated the ability to detect cancer progression significantly sooner than traditional monitoring methods [5]. Insmed’s recently approved drug, Brinsupri is the first and only treatment for Non-Cystic Fibrosis Bronchiectasis, which afflicts half a million patients in the US alone [6].

We believe the performance of these companies’ stocks over the last year is more directly tied to their underlying business performance and may explain why we have experienced differentiated returns compared to the ‘Not so magnificent 17’.

Sources:

[1] Bloomberg

[2] Bloomberg

[3] Portfolio holdings are subject to change at any time without notice. This information should not be construed as a recommendation to purchase or sell any security

[4] Bloomberg

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.